ICT-IOT

Managed Security Services Market

Managed Security Services Market Size, Share, Growth & Industry Analysis, By Type (Fully managed, Co-managed), By Security (Cloud Security, End-point Security, Network Security, Application Security), By Service, By Vertical, and Regional Analysis, 2021-2031 2024-2031

Pages : 180

Base Year : 2023

Release : December 2024

Report ID: KR1136

Managed Security Services Market Size

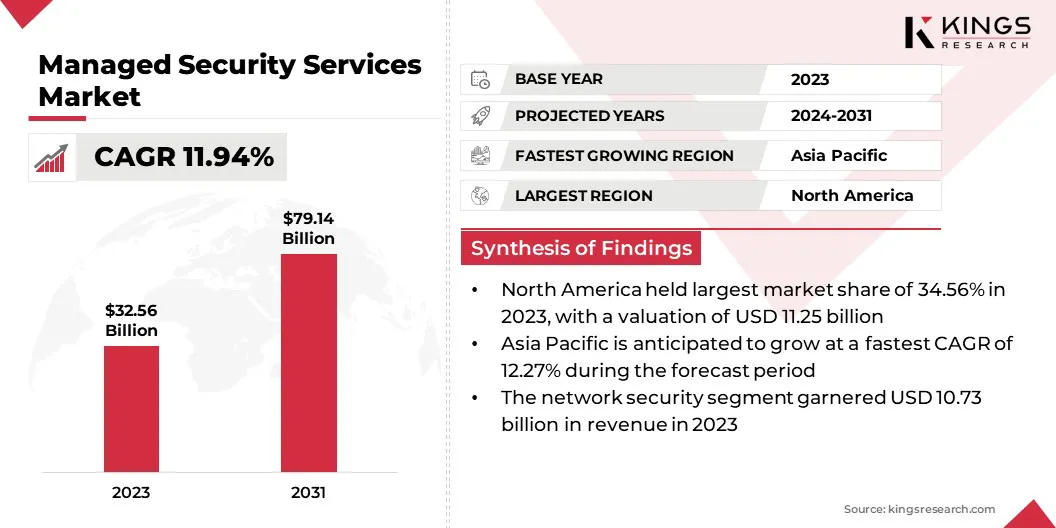

Global Managed Security Services Market size was recorded at USD 32.56 billion in 2023, which is estimated to be valued at USD 35.94 billion in 2024 and is projected to reach USD 79.14 billion by 2031, growing at a CAGR of 11.94% from 2024 to 2031.

Escalating cyber threats and attacks and growing demand for managed detection and response services are augmenting the growth of the market. In the scope of work, the report includes products offered by companies such as Broadcom, Secureworks, Inc., Trustwave Holdings, Inc., AT&T Inc., IBM Corporation, Fortra, LLC, Palo Alto Networks, Lumen Technologies Inc., Fortinet, Inc., Check Point Software Technologies Ltd., and others.

Emerging 5G networks are revolutionizing global connectivity by offering faster speeds, ultra-low latency, and improved network reliability. This technological advancement significantly benefits industries dependent on data-intensive applications, including IoT, autonomous vehicles, and smart cities.

The increased network bandwidth and connectivity of billions of devices have expanded the threat landscape, creating a strong demand for proactive and scalable security solutions. MSS providers can capitalize on this opportunity by offering real-time threat monitoring and AI-powered cybersecurity tools tailored for 5G infrastructure.

- For instance, in February 2023, Atos introduced 5Guard, a security solution for private 5G networks and telecom operators. This solution helps organizations identify risks, secure RAN, MEC, 5G core, and multi-cloud platforms, and develop end-to-end security strategies. It facilitates digital transformation by minimizing risks and protecting critical business assets and data.

Moreover, with edge computing becoming integral to 5G, MSS vendors can focus on developing solutions to secure edge devices and data streams. The deployment of private 5G networks by enterprises creates opportunities for specialized services, including network access control and encryption.

Managed security services (MSS) are outsourced solutions that protect an organization's IT infrastructure, data, and users against cyber threats. MSS providers offer services such as threat detection, vulnerability management, incident response, firewall management, and endpoint protection. These services are delivered through 24/7 security operations centers (SOCs) to ensure continuous protection.

MSS cater to diverse industries, including finance, healthcare, retail, and government, each requiring tailored security measures to address specific compliance and risk profiles. For instance, healthcare providers prioritize data encryption and HIPAA compliance, while financial institutions focus on fraud detection and transaction security.

With the rise of advanced persistent threats (APTs) and sophisticated malware, MSS emphasizes preventive, detective, and corrective security measures. By leveraging advanced technologies such as AI and machine learning, MSS providers enhance their capabilities to predict and mitigate emerging risks. This flexibility and specialization make MSS an essential component of modern cybersecurity strategies for businesses across various sectors.

Analyst Review

The global managed security services market is highly competitive, with key players prioritizing growth and differentiation through strategic innovation. Companies are increasingly focusing on integrating advanced technologies such as artificial intelligence (AI) and machine learning into their service offerings to enhance threat detection and automate responses. These innovations improve efficiency, allowing providers to handle the growing complexity of modern cyber threats.

Another critical strategy is expanding service portfolios to include endpoint protection, cloud security, and compliance management, addressing the evolving needs of diverse industries.

Vendors are further investing heavily in global security operations centers (SOCs) to ensure seamless, real-time monitoring across geographies. Partnerships and acquisitions play a pivotal role in enhancing capabilities and market presence, with companies collaborating with technology leaders to access cutting-edge tools.

- For instance, in November 2024, Trustwave and Cybereason merged to deliver an integrated suite of cybersecurity solutions. The partnership combines managed services, DFIR, and EDR capabilities to address complex cyber risks, expand market reach, and provide enhanced value while maintaining independent operations.

Amid growing demand for personalized solutions, these providers are tailoring services to meet specific industry needs, solidifying their role as indispensable partners in enterprise cybersecurity.

Managed Security Services Market Growth Factors

The rise in cyber threats and attacks is fostering the growth of the managed security services market. Cybercriminals are leveraging sophisticated techniques, including ransomware-as-a-service, zero-day vulnerabilities, and social engineering, to target organizations of all sizes and across industries. These attacks result in significant financial losses, disrupt operations, and damage reputations, prompting businesses to seek comprehensive security solutions.

The proliferation of IoT devices and cloud-based infrastructure has expanded the attack surface, creating vulnerabilities in networks, endpoints, and data repositories.

- In July 2024, Check Point Software Technologies reported a 30% YoY increase in global cyberattacks, averaging 1,636 attacks per organization weekly in Q2 2024. Education/Research (3,341 attacks), Government/Military (2,084 attacks), and Healthcare (1,999 attacks) were the top targets, highlighting the growing risks across key industries.

MSS providers play a vital role in addressing this challenge by offering advanced threat intelligence, real-time monitoring, and rapid incident response. Their ability to detect and mitigate threats proactively ensures uninterrupted business continuity.

Furthermore, the rise in regulatory frameworks, such as GDPR and CCPA, has compelled organizations to strengthen their cybersecurity posture. MSS providers can meet compliance requirements while securing operations, highlighting their major role.

The high initial investment costs associated with managed security services pose a significant challenge for businesses, particularly small and medium enterprises (SMEs). Establishing robust cybersecurity measures often requires substantial investments in advanced technologies, infrastructure, and skilled personnel.

For instance, deploying a security operations centers requires significant upfront capital and ongoing operational expenses, which many businesses find prohibitive. This financial barrier can deter organizations from adopting comprehensive managed security solutions, leaving them vulnerable to cyber threats.

However, this challenge can be mitigated by promoting the subscription-based models offered by MSS providers, which distribute costs over time and eliminate the need for large upfront investments.

Additionally, MSS vendors can tailor their offerings to meet the specific needs and budgets of smaller enterprises, making cybersecurity accessible to a broader market segment. Flexible pricing plans, bundled services, and scalable solutions help organizations strengthen their defenses while managing costs effectively.

Managed Security Services Market Trends

The increasing adoption of artificial intelligence (AI) and machine learning (ML) is transforming the managed security services landscape, enabling providers to deliver more efficient and proactive cybersecurity solutions.

AI and ML algorithms are effective at analyzing vast datasets in real-time, identifying patterns, and detecting anomalies that indicate potential cyber threats. These technologies enhance threat intelligence, allowing MSS providers to predict and neutralize attacks before they occur.

For instance, AI-powered tools can rapidly identify zero-day vulnerabilities and recommend preventive measures, while ML models continuously learn from evolving attack vectors to improve accuracy and response times. Furthermore, the integration of AI and ML supports automation in repetitive tasks, such as log analysis and endpoint monitoring, allowing human resources to focus on more strategic activities.

- For instance, in May 2024, Palo Alto Networks launched AI-focused security solutions leveraging Precision AI, a proprietary innovation that combinies ML, DL, and GenAI capabilities. These solutions proactively address AI-generated threats, enabling real-time protection for networks and infrastructure and setting a new standard for enterprise cybersecurity.

As cyber threats grow more sophisticated, AI-driven solutions offer unparalleled agility and precision, making them indispensable for modern MSS offerings.

Segmentation Analysis

The global market has been segmented based on type, security, service, vertical, and geography.

By Type

Based on type, the market has been segmented into fully managed and co-managed. The co-managed segment captured the largest share of 65.15% in 2023, largely attributed to its ability to balance in-house control with external expertise. Co-managed security services allow organizations to retain partial control over their cybersecurity operations while leveraging the specialized skills, tools, and infrastructure of managed security service providers (MSSPs).

This hybrid model is ideal for enterprises with established IT teams that require external support to handle sophisticated cyber threats and manage peak workloads. Furthermore, co-managed solutions offer enhanced flexibility, enabling organizations to customize services to their specific requirements, such as compliance, threat detection, or incident response.

The rising adoption of co-managed services is further fostered by cost-efficiency, allowing businesses to optimize existing security investments without requiring additional infrastructure. Industries with stringent data regulations, such as healthcare and finance, benefit from this model by ensuring compliance while maintaining operational autonomy. This adaptability positions the co-managed security services as the preferred choice for modern enterprises.

By Security

Based on security, the market has been classified into cloud security, end-point security, network security, and application security. The cloud security segment is poised to record a staggering CAGR of 12.64% through the forecast period, reflecting the growing reliance on cloud-based infrastructure and applications across industries.

As businesses increasingly migrate their workloads to cloud environments, the demand for robust security solutions to safeguard sensitive data and systems is rising. Cloud security services include data encryption, access control, identity management, and threat monitoring, tailored to address the unique challenges of cloud ecosystems.

This growth is further fueled by the adoption of hybrid and multi-cloud strategies, which require advanced security tools for consistent protection across diverse platforms. Emerging trends such as edge computing, 5G integration, and serverless architectures increases the complexity of securing cloud environments, highlighting the need for specialized managed security services.

Additionally, the rise of remote work and the proliferation of SaaS applications have increased the importance of securing endpoints and ensuring compliance. MSS providers are well-positioned to cater to these needs, making cloud security a key component.

By Vertical

Based on vertical, the market has been divided into BFSI, government and defense, manufacturing, healthcare, IT and telecommunications, and others. The IT and telecommunications segment garnered the highest revenue in managed security services market of USD 7.56 billion in 2023.

IT and telecom companies, central to global connectivity and digital transformation, are increasingly vulnerable to cyber threats due to the vast amount of data they handle and the complexity of their networks. The proliferation of 5G networks, IoT devices, and edge computing expands the attack surface, underscoring the need for comprehensive security solutions.

Managed security services (MSS) providers offer tailored offerings, including threat monitoring, DDoS protection, and secure SD-WAN, to address these challenges. Moreover, regulatory frameworks and data privacy laws compel telecom providers to invest heavily in compliance-driven security measures.

The sector’s reliance on uninterrupted service delivery amplifies the need for real-time threat detection and incident response. MSS allows IT and telecom organizations to meet these needs cost-effectively, thereby fostering adoption and supporting segmental growth.

Managed Security Services Market Regional Analysis

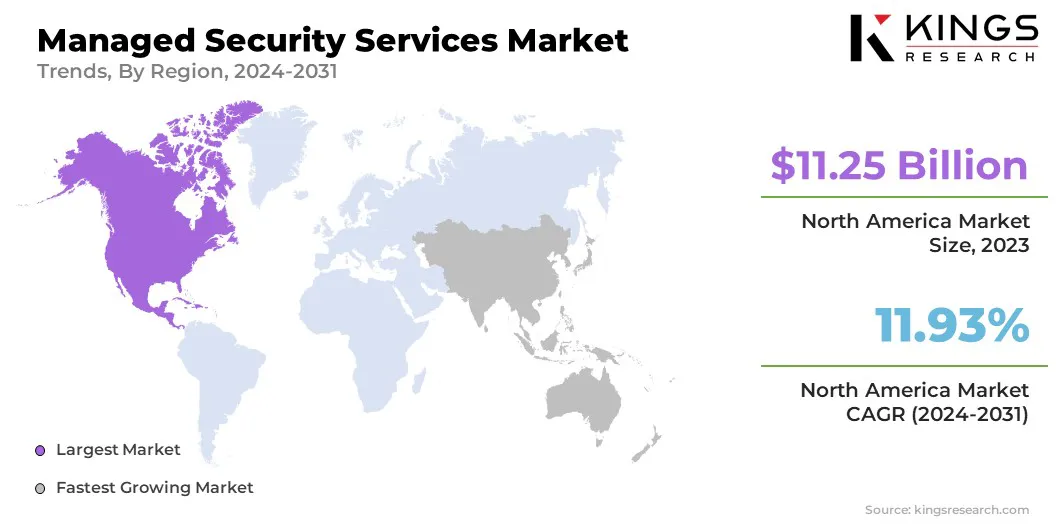

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America managed security services market accounted for a major share of 34.56% and was valued at USD 11.25 billion in 2023. This expansion is largely attributed to the region’s advanced IT infrastructure and increased focus on cybersecurity. The rising frequency of sophisticated cyberattacks, including ransomware and phishing campaigns, has led businesses across industries to adopt MSS to protect their critical assets.

Moreover, stringent regulatory frameworks such as GDPR, CCPA, and HIPAA have compelled organizations to enhance their security measures, boosting the demand for compliance-focused managed services. The strong presence of technology companies and MSS providers in the region further aided market growth, fueled by continuous innovations in AI-powered threat detection and incident response solutions.

Additionally, the rise of hybrid and remote work environments has expanded the attack surface, creating opportunities for MSS vendors to offer endpoint security, identity management, and secure cloud solutions. Investments in government-backed cybersecurity initiatives and partnerships between public and private sectors bolster regional market expansion.

Asia-Pacific is projected to grow at the highest CAGR of 12.27% in the forthcoming years, primarily due to rapid digital transformation and increasing cyber risks. The widespread adoption of cloud technologies, IoT integration, and mobile-first strategies among enterprises has significantly expanded the cybersecurity needs of organizations.

Emerging economies such as India, China, and Southeast Asian nations are witnessing a surge in cyber threats, prompting businesses to adopt managed security services to safeguard their operations.

- For instance, in May 2024, Lumen Technologies Asia Pacific expanded its Advanced MDR service, emphasizing proactive cybersecurity. By addressing AI-driven risks, including GenAI threats, the service helps enterprises future-proof digital infrastructures while safeguarding economic and community stability.

Furthermore, governments across Asia-Pacific are implementing stringent data protection regulations and cybersecurity frameworks, compelling organizations to invest in robust managed solutions to ensure compliance. The strong presence of multinational companies and local MSS providers in the region enhances service availability and customization.

Sectors such as BFSI, healthcare, and manufacturing are increasingly relying on MSS to manage sophisticated threats while minimizing operational costs. With continued advancements in AI and machine learning, MSS providers in Asia-Pacific are well-positioned to address the region’s evolving cybersecurity challenges and opportunities.

Competitive Landscape

The global managed security services market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Managed Security Services Market

- Broadcom

- Secureworks, Inc.

- Trustwave Holdings, Inc.

- AT&T Inc.

- IBM Corporation

- Fortra, LLC

- Palo Alto Networks

- Lumen Technologies Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

Key Industry Developments

- May 2024 (Partnership): WillJam Ventures and AT&T launched LevelBlue, a joint venture offering standalone managed cybersecurity services. Leveraging AI and cloud computing expertise, LevelBlue offers managed security, consulting, threat intelligence, and SOC support to help innovate securely amid evolving cyber threats.

- January 2024 (Partnership): Atturra partnered with Australian SaaS start-up MyCISO to enhance its managed security services for the education and commercial sectors. By using MyCISO's Assess module, Atturra’s cyber program delivers industry-aligned security management and proactive support to help clients counter evolving cyber threats effectively.

The global managed security services market has been segmented as:

By Type

- Fully managed

- Co-managed

By Security

- Cloud Security

- End-point Security

- Network Security

- Application Security

By Service

- Managed IPS and IDS

- Distributed Denial of Services (DDoS)

- Unified Threat Management (UTM)

- Secured Information & Event Management (SIEM)

- Firewall Management

- Others

By Vertical

- BFSI

- Government and Defense

- Manufacturing

- Healthcare

- IT and Telecommunications

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)