buyNow

Distributed Acoustic Sensing Market

Distributed Acoustic Sensing Market Size, Share, Growth & Industry Analysis, By Fiber (Single-Mode, Multi-Mode), By Application (Pipeline Monitoring, Perimeter Intrusion Detection, Railway Track Monitoring, Highway Monitoring), By End-use Industry (Oil & Gas, Military & Defense, Infrastructure, Utilities, Transportation), and Regional Analysis, 2025-2032

pages: 180 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Distributed acoustic sensing is a technology that converts standard fiber optic cables into continuous, real-time sensors for detecting acoustic and vibrational signals. It enables the measurement of seismic activity, pipeline leaks, and structural disturbances by analyzing backscattered light from laser pulses along the fiber.

Widely used in oil and gas, transportation infrastructure, and geotechnical monitoring, distributed acoustic sensing offers high spatial resolution over extended distances. The technology also supports applications in perimeter security, railway monitoring, and environmental sensing, where real-time situational awareness and non-intrusive sensing are essential.

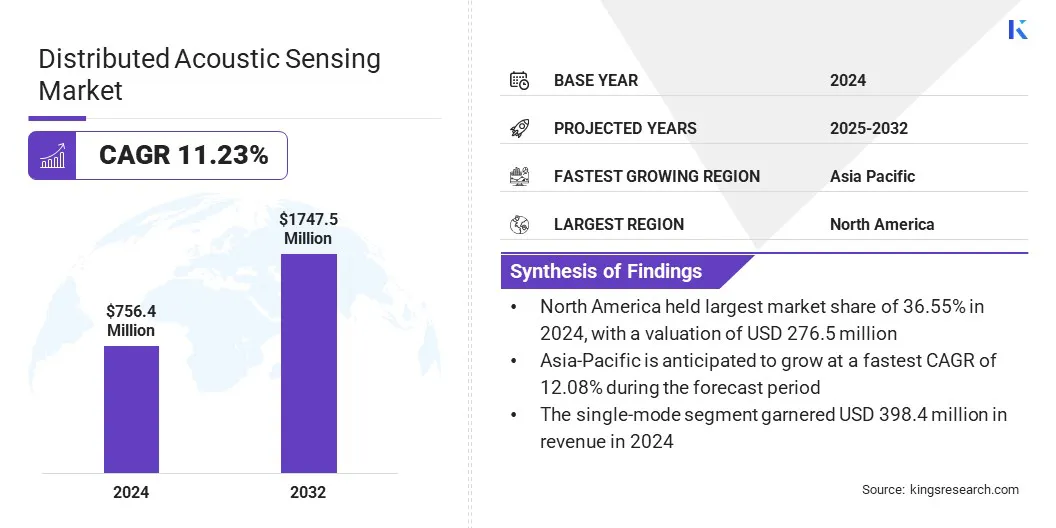

The global distributed acoustic sensing market size was valued at USD 756.4 million in 2024 and is projected to grow from USD 829.8 million in 2025 to USD 1,747.5 million by 2032, exhibiting a CAGR of 11.23% during the forecast period.

This growth is attributed to the rising adoption of distributed acoustic sensing systems across key end-use sectors such as oil and gas, transportation, and infrastructure monitoring. Increasing demand for real-time pipeline surveillance, seismic activity detection, and structural health monitoring is boosting the use of these systems in energy production, railway networks, and perimeter security.

Key Highlights

- The distributed acoustic sensing industry size was valued at USD 756.4 million in 2024.

- The market is projected to grow at a CAGR of 11.23% from 2025 to 2032.

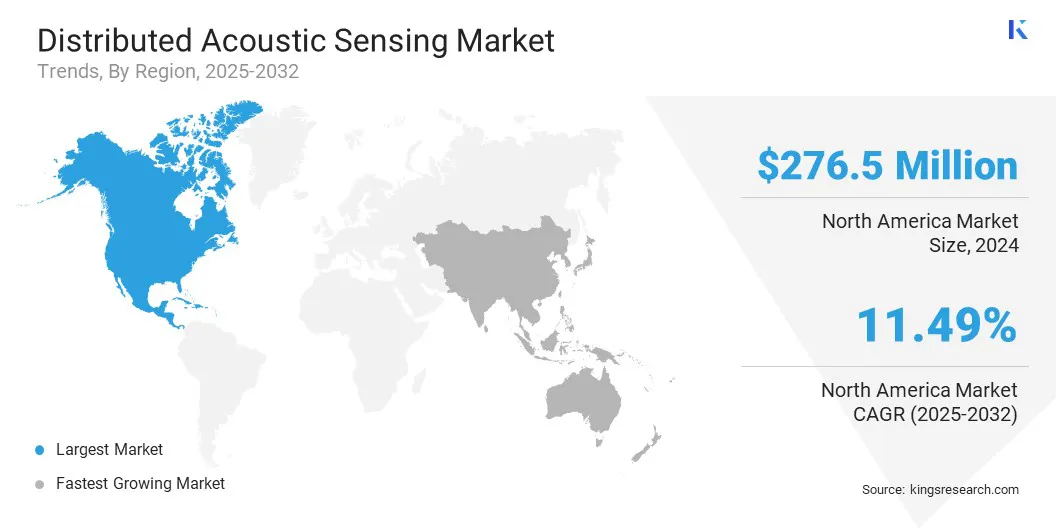

- North America held a share of 36.55% in 2024, valued at USD 276.5 million.

- The single-mode segment garnered USD 398.4 million in revenue in 2024.

- The perimeter intrusion detection segment is expected to reach USD 609.7 million by 2032.

- The utilities segment is anticipated to witness the fastest CAGR of 13.49% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 12.08% through the forecast period.

Major companies operating in the distributed acoustic sensing market are Halliburton Energy Services, Inc., SLB, Baker Hughes Company, Luna Innovations Incorporated, Silixa Ltd, Bandweaver, Hifi Inc., Omnisens SA, Future Fibre Technologies, AP Sensing, QinetiQ, Weatherford, FEBUS Optics, ARAGON PHOTONICS LABS S.L.U, and fibrisTerre Systems GmbH.

Distributed Acoustic Sensing Market Report Scope

|

Segmentation |

Details |

|

By Fiber |

Single-Mode, and Multi-Mode |

|

By Application |

Pipeline Monitoring, Perimeter Intrusion Detection, Railway Track Monitoring, Highway Monitoring, and Others |

|

By End-use Industry |

Oil & Gas, Military & Defense, Infrastructure, Utilities, Transportation, and Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Distributed Acoustic Sensing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America distributed acoustic sensing market share stood at 36.55% in 2024, valued at USD 276.5 million. This dominance is reinforced by the region's extensive oil and gas infrastructure, early adoption of fiber optic sensing technologies, and the presence of major energy and sensing solution providers actively deploying distributed acoustic sensing systems.

Furthermore, increasing investments in pipeline integrity monitoring, seismic surveillance, and smart transportation networks continue to boost the adoption of distributed acoustic sensing across industrial and infrastructure applications.

The region’s rising emphasis on operational safety, environmental compliance, and real-time data acquisition supports its leading position. Growing demand for intelligent infrastructure, perimeter security solutions, and advanced monitoring technologies, along with continuous advancements in AI-driven analytics and edge computing, aids regional market expansion.

The Asia-Pacific distributed acoustic sensing industry is set to grow at a CAGR of 12.08% over the forecast period. This growth is propelled by large-scale infrastructure development, rising investments in energy security, and the expansion of smart city projects across key Asia-Pacific economies.

The region’s increasing focus on modernizing transportation networks and deploying real-time monitoring systems is creating a strong demand for distributed acoustic sensing technologies.

Government initiatives aimed at improving pipeline safety, railway surveillance, and disaster management capabilities are further fueling domestic market expansion. Moreover, the growing emphasis on environmental protection, industrial automation, and the adoption of advanced fiber optic sensing in utility sectors is accelerating the integration of distributed acoustic sensing systems throughout Asia-Pacific.

- In May 2025, Universitas Gadjah Mada (UGM) and Telkom Indonesia developed an earthquake early warning system using distributed acoustic sensing (DAS) over existing undersea optical cables. The system detects early P-waves via Telkom’s submarine network, enabling faster alerts without the need for new sensors. This innovation enhances Indonesia’s seismic monitoring by leveraging existing telecom infrastructure for real-time disaster response.

Distributed Acoustic Sensing Market Overview

The growing emphasis on early fault detection, operational safety, and cost-effective remote sensing is fueling market expansion. Additionally, ongoing advancements in fiber optic technology, integration with artificial intelligence, and the expanding deployment of smart infrastructure projects are accelerating market development.

- In March 2025, Researchers from Nanjing University successfully integrated photonic neural networks with distributed acoustic sensing, enabling real-time, all-optical data processing. Published by the International Society for Optics and Photonics (SPIE), the study demonstrated record-high performance of approximately 1.6 trillion operations per second, offering significant improvements in speed and energy efficiency over conventional GPU-based systems.

Market Driver

Increasing Utilization in Oil and Gas Operations

The progress of the distributed acoustic sensing market is bolstered by the expanding application of fiber optic sensing technologies in oil and gas operations to enhance safety and operational efficiency. Rising concerns over pipeline integrity, leak detection, and wellbore monitoring have increased the demand for real-time, high-resolution sensing solutions that enable continuous and remote surveillance.

Energy companies are increasingly replacing traditional monitoring tools with distributed acoustic sensing systems, valuing their ability to cover long distances, operate in harsh environments, and detect subtle acoustic changes without requiring additional infrastructure.

This shift is further supported by the growing emphasis on predictive maintenance, environmental compliance, and cost reduction in hydrocarbon extraction and transport. The focus on minimizing operational risks and improving asset performance is prompting broader adoption of distributed acoustic sensing solutions, thereby accelerating market growth.

Market Challenge

Limited Compatibility with Existing Infrastructure

Limited compatibility with existing infrastructure presents a significant challenge to the growth of the distributed acoustic sensing market, particularly in oil and gas fields, transportation networks, and utility systems. These assets often lack the necessary fiber optic infrastructure or were not designed for high-resolution sensing, making retrofitting complex and expensive.

The need for physical modifications, integration with outdated data acquisition systems, and operational downtime further increase implementation costs and delays, discouraging broader adoption..

To overcome these challenges, solution providers are developing retrofittable systems, leveraging existing telecom fibers, and offering non-intrusive surface-mounted alternatives. Industry collaborations and the adoption of interoperable, modular technologies are simplifying integration with older infrastructure. Additionally, pilot programs, government incentives, and flexible deployment models are being used to demonstrate value and ease entry barriers.

Market Trend

Integration of AI and Edge Analytics

Integration of AI and edge analytics is influencing the distributed acoustic sensing market by enabling real-time data interpretation, automated signal classification, and enhanced decision-making capabilities.

Advanced machine learning algorithms and neural networks are being applied to vast distributed acoustic sensing datasets to differentiate between environmental noise and critical acoustic events such as pipeline leaks, intrusions, or structural vibrations. These technologies reduce false alarms, improve detection accuracy, and enable faster incident response across sectors such as oil and gas, transportation, and security.

Edge computing further enhances system performance by processing data closer to the sensing point, reducing latency and dependence on centralized infrastructure. This localized intelligence supports continuous monitoring in remote or bandwidth-limited environments.

As AI-enabled distributed acoustic sensing systems become more adaptive and self-learning, they are opening new possibilities for scalable, autonomous sensing applications supporting the development of smart infrastructure, predictive maintenance, and next-generation perimeter security solutions.

- In May 2023, AP Sensing and its partner Crony deployed DAS with AI (deep neural networks) to monitor underground urban power cables in Serbia, successfully detecting and classifying third-party intrusion events such as digging and hammering. Employing their N5225B DAS system and SmartVision with CNN signal classifiers, the solution achieved detection accuracies of 97.7% for excavators and 98.1% for jackhammers, demonstrating high reliability in urban noise conditions.

Market Segmentation

- By Fiber (Single-Mode and Multi-Mode): The single-mode segment earned USD 398.4 million in 2024, mainly due to its superior sensitivity, longer sensing range, and widespread adoption in oil and gas and infrastructure monitoring applications.

- By Application (Pipeline Monitoring, Perimeter Intrusion Detection, Railway Track Monitoring, Highway Monitoring, and Others): The pipeline monitoring segment held a share of 37.65% in 2024, attributed to the growing need for real-time leak detection, flow assurance, and asset integrity in oil and gas transportation networks.

- By End-use Industry (Oil & Gas, Military & Defense, Infrastructure, Utilities, Transportation, and Others): The oil & gas segment is projected to reach USD 515.0 million by 2032, owing to the increasing adoption of distributed acoustic sensing for wellbore monitoring, pipeline leak detection, and enhanced safety across upstream and midstream operations.

Regulatory Frameworks

- In the U.S., 49 CFR Part 195 (Pipeline Safety Regulations) governs the design, construction, and operation of hazardous liquid pipelines. It mandates continuous monitoring and leak detection systems, supporting the adoption of DAS for real-time pipeline integrity and safety compliance.

- In Canada, CSA Z662 (Oil and Gas Pipeline Systems Standard) regulates the design and maintenance of pipeline systems. It promotes the use of technologies such as DAS to enhance leak detection and meet continuous integrity monitoring requirements.

- In Australia, AS 2885 (Pipelines - Gas and Liquid Petroleum) governs the safety and environmental integrity of pipeline operations. It encourages the implementation of advanced monitoring technologies such as DAS to ensure compliance with risk mitigation and integrity management obligations.

Competitive Landscape

Companies operating in the distributed acoustic sensing industry are actively enhancing their competitive position through technological innovation, portfolio diversification, and strategic collaborations. Leading players are investing in advanced signal processing, artificial intelligence integration, and multi-parameter sensing to improve system accuracy, scalability, and real-time analytics across diverse applications.

They are also developing hybrid distributed acoustic sensing solutions that combine acoustic, temperature, and strain measurements while optimizing systems for deployment in harsh and remote environments such as oilfields, rail corridors, and border zones.

Additionally, firms are partnering with infrastructure operators, energy companies, and government agencies to enable large-scale deployments, secure multi-year contracts, and strengthen their presence in both developed and emerging markets.

- For instance, in December 2023, Luna Innovations acquired UK‑based Silixa for approximately USD 21.5 million upfront, with potential earnouts of up to USD 16.5 million. The acquisition strengthens its fiber optic sensing portfolio by adding Silixa’s advanced DAS, DTS, and DSS technologies, supported by around 200 patents and USD 30 million in 2023 revenue. This initiative expands Kuna's presence in energy, mining, defense, and carbon-capture monitoring across Europe and other regions.

Key Companies in Distributed Acoustic Sensing Market:

- Halliburton Energy Services, Inc.

- SLB

- Baker Hughes Company

- Luna Innovations Incorporated

- Silixa Ltd

- Bandweaver

- Hifi Inc.

- Omnisens SA

- Future Fibre Technologies

- AP Sensing

- QinetiQ

- Weatherford

- FEBUS Optics

- ARAGON PHOTONICS LABS S.L.U

- fibrisTerre Systems GmbH

Recent Developments (Agreements/Launches)

- In November 2024, Thales and FEBUS Optics signed a strategic co-development agreement to enhance the protection of undersea infrastructure using distributed acoustic sensing (DAS). The partnership combines FEBUS’s advanced DAS technology with Thales’s expertise in sonar and maritime surveillance, aiming to integrate DAS into the BlueGuard system for real-time monitoring of subsea cables, pipelines, and power lines.

- In July 2024, VIAVI launched NITRO Fiber Sensing, a unified platform that combines distributed acoustic sensing, temperature sensing, and strain sensing for real-time monitoring of critical infrastructure. Using remote Fiber Test Heads, the system detects and pinpoints disturbances, such as excavation, vehicle movement, or anchor strikes, along power lines, pipelines, and fiber routes, thereby enhancing asset protection, minimizing downtime, and reducing operational costs.

freqAskQues