Enquire Now

Observability Tools and Platforms Market Size, Share, Growth & Industry Analysis, By Component (Solution, Services), By Deployment Model (Cloud, On-premises), By Organization Size [Small and Medium-sized Enterprises (SMEs), Large Enterprises], By Application, By Industry Vertical and Regional Analysis, 2024-2031

Pages: 180 | Base Year: 2023 | Release: April 2025 | Author: Sharmishtha M.

The market refers to the industry that offers software solutions to help organizations monitor, analyze, and optimize their systems and performance. These tools track metrics, logs, and traces to provide insights into system health and improve reliability. This market plays a key role in managing complex, cloud-native, and distributed environments within modern IT infrastructure.

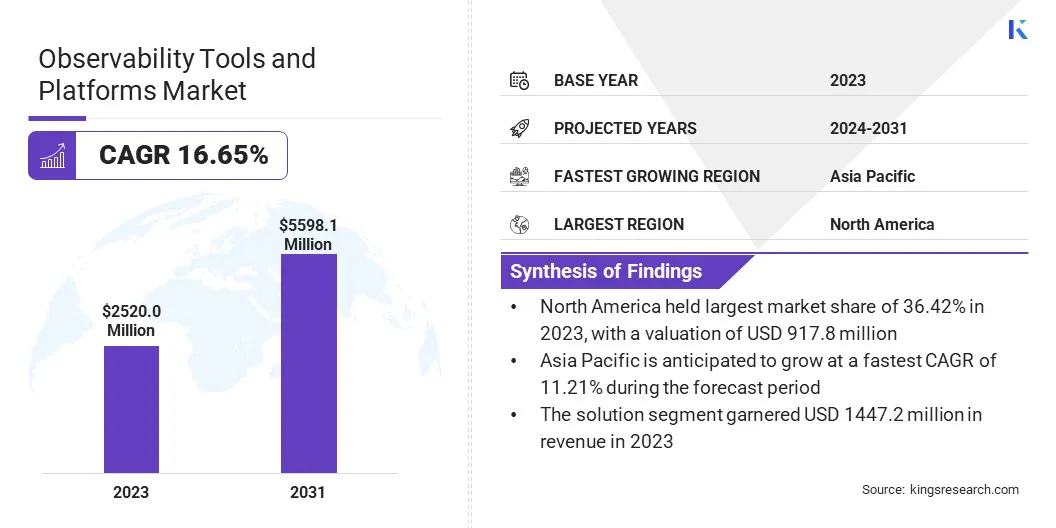

The global observability tools and platforms market size was valued at USD 2,520.0 million in 2023, which is estimated to be valued at USD 2,756.3 million in 2024 and reach USD 5,598.1 million by 2031, growing at a CAGR of 10.65% from 2024 to 2031.

The rapid increase in IoT devices has led to a data surge, requiring advanced monitoring and analytics tools to ensure efficient and secure operation. This demand fuels the growth of observability tools, leading to wider adoption across industries.

Major companies operating in the observability tools and platforms industry are Dynatrace LLC, ScienceLogic, LogicMonitor Inc., Auvik Networks Inc., New Relic, Inc, SolarWinds Worldwide, LLC., Splunk LLC, Datadog, Sumo Logic, IBM, StackState, Riverbed Technology, Broadcom, Microsoft, and NamLabs Technologies Private Limited.

The market is evolving with the growing need for seamless monitoring across increasingly complex IT environments. Organizations are adopting these solutions to gain insights into system performance, ensuring optimal operations.

As technologies advance, especially in AI and automation, observability platforms are becoming more proactive, offering predictive capabilities to resolve issues before they escalate. This helps businesses stay ahead of potential disruptions and enables faster decision-making, catering to the needs of dynamic, modern IT landscapes.

Market Driver

Proliferation of IoT Devices

The proliferation of IoT devices is a significant growth driver for the observability tools and platforms market. As more devices connect to networks, they generate vast amounts of data that need to be monitored, analyzed, and managed effectively.

This growing complexity requires advanced tools to track performance, detect anomalies, and ensure reliability across diverse IoT ecosystems. Observability platforms help businesses interpret and analyze data, enabling better decision-making, faster troubleshooting, and enhanced security, in turn accelerating market growth.

Market Challenge

Data Overload

Data overload is a significant challenge in the observability tools and platforms market. Organizations face large volumes of data from multiple sources, making it difficult to extract actionable insights. This leads to delayed resolutions and inefficiencies that hamper the ability to quickly identify root causes and impact overall system performance.

This can be addressed by leveraging AI and automation to analyze and correlate data, enabling faster issue identification and more efficient decision-making.

Market Trend

Advanced Integration and Ecosystem Support

A key trend in the market is the increasing focus on advanced integration and ecosystem support. As IT environments become more complex, observability platforms are evolving to be more open, enabling seamless integration with a wide range of third-party tools and partners.

This flexibility allows organizations to tailor their observability solutions to their unique IT infrastructure. By supporting diverse technologies and platforms, these solutions provide better interoperability, allowing for more comprehensive monitoring, improved data insights, and streamlined management across heterogeneous environments.

|

Segmentation |

Details |

|

By Component |

Solution, Services |

|

By Deployment Model |

Cloud, On-premises |

|

By Organization Size |

Small and Medium-sized Enterprises (SMEs), Large Enterprises |

|

By Application |

Infrastructure Monitoring, Application Performance Monitoring (APM), Cloud Monitoring, Network Monitoring |

|

By Industry Vertical |

IT and Telecom, Financial Services (BFSI), Healthcare, Retail, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

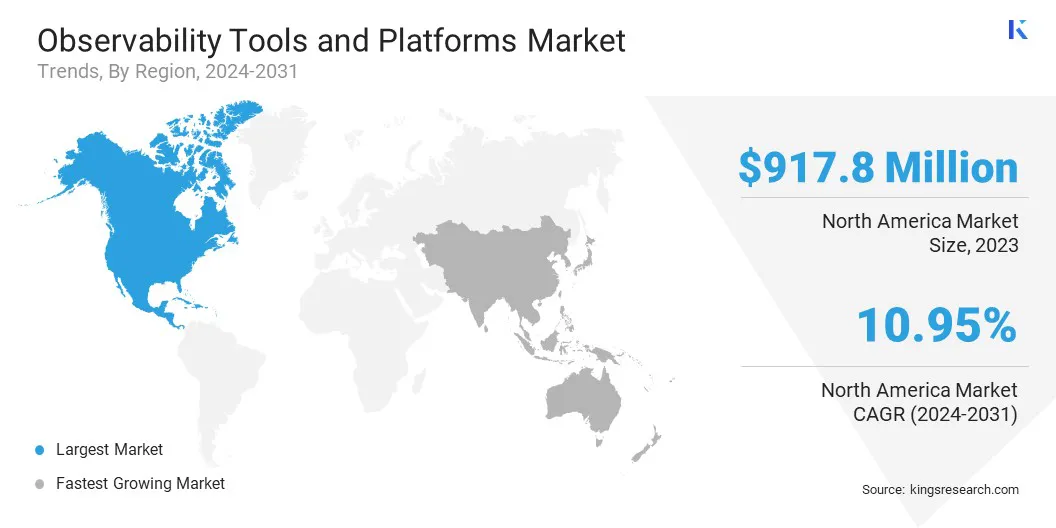

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America observability tools and platforms market share stood around 36.42% in 2023 in the global market, with a valuation of USD 917.8 million. North America continues to dominate the market due to the region’s early adoption of advanced technologies, well established IT infrastructure, and a high concentration of large enterprises.

The U.S., in particular, leads in innovation and demand for observability solutions, driven by the need for efficient monitoring in complex IT environments. As businesses prioritize optimizing digital experiences and system performance, the demand for advanced observability tools in this region is expected to remain strong, reinforcing its position in the market.

Asia-Pacific is poised for significant growth over the forecast period at a CAGR of 11.21%. Asia Pacific is emerging as the fastest-growing region in the observability tools and platforms industry due to rapid digital transformation, expanding IT infrastructures, and increased cloud adoption accross the region.

Additionally, the growing need for real-time monitoring solutions to support diverse and dynamic IT environments, coupled with rising investments in AI and automation, is further propelling the market’s growth in this region.

Strategic partnerships in the observability tools and platforms industry are key to driving innovation and expanding capabilities. These partnerships combine the strengths of different companies, such as expertise in AI, cloud infrastructure, and automation, to deliver comprehensive solutions.

By joining forces, organizations aim to offer enhanced performance, reduce operational complexities, and provide more efficient services to customers. These collaborations also allow for the rapid development of new technologies and help businesses scale while optimizing resources across hybrid and multi-cloud environments.

Recent Developments (M&A/Partnerships/New Product Launch)

Frequently Asked Questions