Buy Now

Organic Pigments Market Size, Share, Growth & Industry Analysis, By Source (Synthetic, Natural), By Type (Azo, Phthalocyanine, High performance pigments, Others), By Application (Paints & Coatings, Plastics & Polymer, Printing & Packaging, Textile, Others), and Regional Analysis, 2024-2031

Pages: 140 | Base Year: 2023 | Release: March 2025 | Author: Sharmishtha M.

The organic pigments market involves the application of colorants derived from organic compounds. These pigments are widely used across industries such as automotive, packaging, textiles, and coatings.

Driven by the demand for high-performance, eco-friendly, and durable color solutions, the market is characterized by continuous innovation and growth in diverse applications.

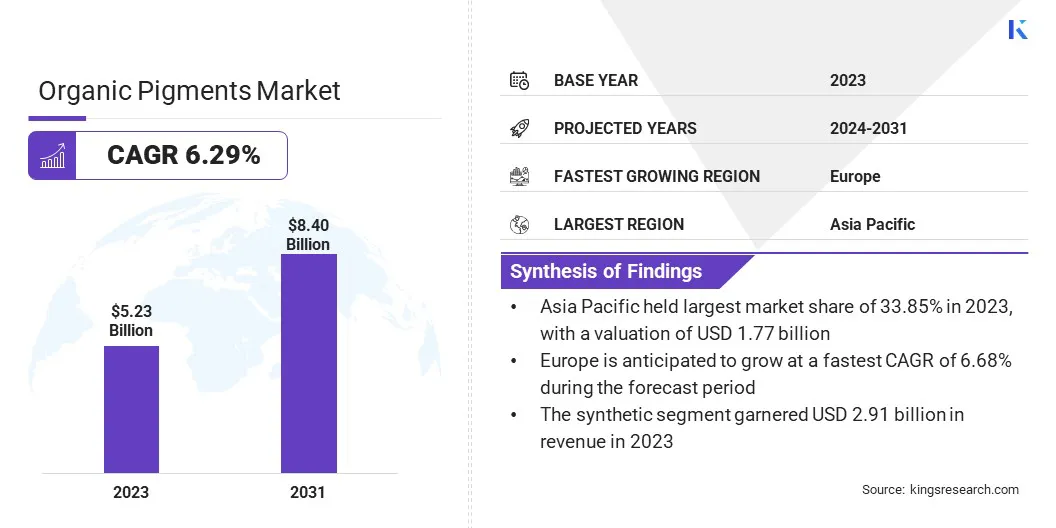

The global organic pigments market size was valued at USD 5.23 billion in 2023, which is estimated to be USD 5.48 billion in 2024 and reach USD 8.40 billion by 2031, growing at a CAGR of 6.29% from 2024 to 2031.

The increasing demand for vibrant, high-quality colorants in industries like automotive, packaging, and textiles is a key driver of the market. These industries require visually appealing, durable, and long-lasting colors to meet consumer expectations and enhance product esthetics.

Major companies operating in the global organic pigments industry are DIC CORPORATION, Lily Group Co., Ltd, Meghmani Organics Ltd, Sudarshan Chemical Industries Limited, Sunlour Pigment Co., Ltd, Dainichiseika Color & Chemicals Mfg.Co.,Ltd., ANSHAN HIFICHEM CO., LTD., BASF, Dayglo Color Corporation, artience Co., Ltd., Pidilite Industries Limited , Sensient Cosmetic Technologies, TRUST CHEM CO LTD, Vipul Organics Ltd., and Qualitron Chemicals.

The market is dynamic and evolving, catering to a wide range of applications such as paints, coatings, inks, plastics, textiles, and cosmetics. With a growing emphasis on sustainability and eco-friendly alternatives, the market continues to register advancements in pigment development.

The demand for organic pigments is driven by their superior color performance, durability, and environmental benefits. The market for organic pigments remains essential across diverse industries globally as they prioritize high-quality, long-lasting color solutions.

Market Driver

"Increasing Demand for Vibrant, High-quality Colorants"

The increasing demand for vibrant, high-quality colorants across industries like automotive, packaging, and textiles is a significant driver of the organic pigments market. The need for superior, long-lasting color solutions intensifies as these industries seek to enhance product esthetics, improve durability, and differentiate their brands.

Organic pigments, known for their vivid hues and stability, are being increasingly favored due to their ability to meet these demands, contributing to the market's expansion in diverse applications and product categories.

Market Challenge

"Supply Chain Issues"

A major challenge in the organic pigments market is the inconsistency in sourcing natural raw materials, which can lead to disruptions in the supply chain. Factors like seasonal variations, climate change, and fluctuations in agricultural yields can impact the availability of raw materials.

Companies can collaborate with farmers to establish more stable and sustainable farming practices, explore alternative crops, and invest in regional sourcing strategies to ensure a more reliable supply of natural pigments, mitigating potential supply chain risks.

Market Trend

"Rising Consumer Preference for Eco-friendly and Sustainable Products"

A key trend in the organic pigments market is the rising consumer preference for eco-friendly and sustainable products. As environmental concerns grow, consumers are increasingly demanding greener pigment options that are safer for both human health and the planet.

This shift is driving manufacturers to innovate and offer pigments derived from renewable resources, reducing the environmental impact of traditional colorants. The demand for non-toxic, biodegradable, and low-emission pigments is becoming central to the development of modern colorant solutions.

In January 2025, Ohio State University’s research unveiled anthocyanins, natural pigments derived from fruits like blackberries and grapes, as an alternative to synthetic dyes such as Red No. 3. These natural pigments not only provide vibrant colors but also offer health benefits, aligning with rising consumer demand for sustainable, clean-label products free from artificial additives.

|

Segmentation |

Details |

|

By Source |

Synthetic, Natural |

|

By Type |

Azo, Phthalocyanine, High performance pigments, Others |

|

By Application |

Paints & Coatings, Plastics & Polymer, Printing & Packaging, Textile, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a organic pigments market share of around 33.85% in 2023, with a valuation of USD 1.77 billion. Asia Pacific has emerged as the dominating region in the market, due to its robust industrial base, particularly in China and India.

The region benefits from high demand in key sectors like paints, coatings, and textiles, coupled with a large manufacturing capacity. Additionally, the growing focus on sustainable and eco-friendly production is further driving the adoption of organic pigments. As a result, Asia Pacific is poised to maintain its market leadership in the foreseeable future.

The organic pigments industry in Europe is poised for significant growth at a robust CAGR of 6.68% over the forecast period. Europe is the fastest-growing region for the market, primarily due to increasing environmental regulations and a shift toward sustainable production methods.

Countries like Germany, France, and the UK are driving the demand for eco-friendly, high-performance pigments in industries such as paints, coatings, and plastics. Furthermore, the growing consumer preference for clean-label products is pushing companies to adopt natural alternatives. This trend, along with a strong focus on innovation, positions Europe as a rapidly expanding market for organic pigments.

In the organic pigments market, companies are focusing on strategic acquisitions to expand their product portfolios and market presence. These acquisitions help firms access advanced technologies, enhance R&D capabilities, and develop sustainable, high-performance pigments.

By integrating complementary businesses, companies can strengthen their competitive edge, meet the growing demand for eco-friendly pigment solutions, and expand business reach.

Recent Developments (Divesture/Launch)

Frequently Asked Questions