Buy Now

Particle Counter Market Size, Share, Growth & Industry Analysis, By Type (Airborne, Liquid, Others), By Modality (Benchtop, Portable, Remote), By Application (Cleanroom Monitoring, Contamination Monitoring of Liquids, Aerosol Monitoring and Research, Others), and Regional Analysis, 2025-2032

Pages: 190 | Base Year: 2024 | Release: July 2025 | Author: Sunanda G.

Particle counter includes instruments designed to detect and measure the concentration of particles in air, liquids, and gases. These devices utilize light scattering, laser diffraction, and condensation particle counting to assess contamination levels in controlled environments.

Particle counters play a crucial role in cleanroom monitoring, pharmaceutical formulation, semiconductor manufacturing, and environmental air quality assessment. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

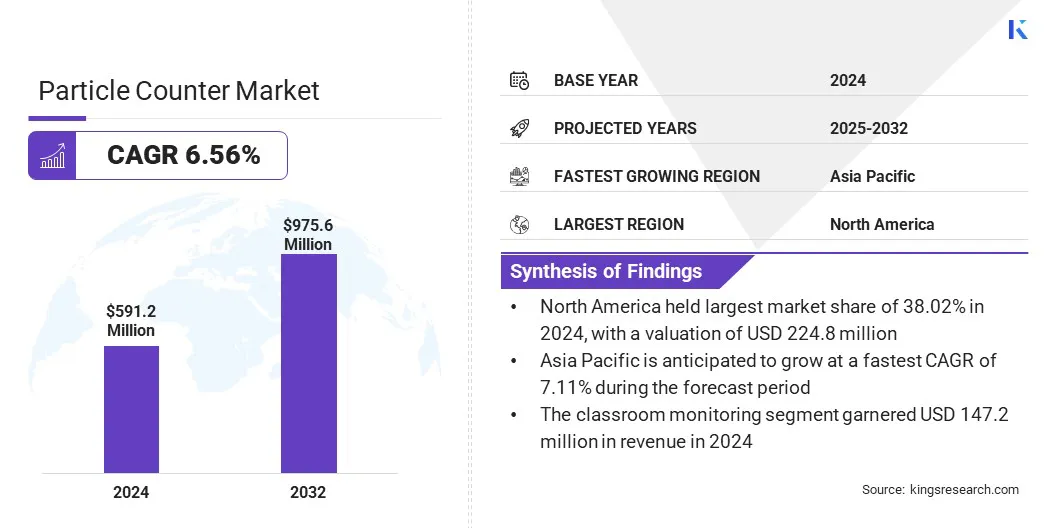

The global particle counter market size was valued at USD 591.2 million in 2024 and is projected to grow from USD 625.6 million in 2025 to USD 981.3 million by 2032, exhibiting a CAGR of 6.64% during the forecast period.

Market growth is driven by stringent regulatory standards for air quality and contamination control across pharmaceutical, healthcare, and semiconductor industries. Additionally, the rising demand for real-time air quality monitoring, particularly for detecting ultrafine nanoparticles, is promoting developments in particle counter technology. Increased investments in R&D to enhance detection accuracy along with IoT integration further contribute to market expansion.

Major companies operating in the particle counter market are Particles Plus, Inc., Beckman Coulter, Inc., Particle Measuring Systems, HCT Co., Ltd., Lighthouse Worldwide Solutions, TSI Incorporated, GrayWolf Sensing Solutions, ARGO-HYTOS, Cubic Sensor and Instrument Co., Ltd., Durag Group, Climet Instruments Company, Rion Co., Ltd., Kanomax USA, Inc., Chemtrac, Inc., and HAL Technology.

Regulatory bodies such as the FDA, ISO, and EPA mandate contamination control standards, prompting industries to adopt advanced monitoring solutions. Cleanrooms in pharmaceuticals, biotechnology, and semiconductor manufacturing require constant particle measurement to comply with these standards.

Regulatory bodies such as the FDA, ISO, and EPA mandate contamination control standards, prompting industries to adopt advanced monitoring solutions. Cleanrooms in pharmaceuticals, biotechnology, and semiconductor manufacturing require constant particle measurement to comply with these standards.

Companies are investing in high-precision particle counters to meet regulatory requirements and prevent operational disruptions. Air and liquid quality standards in healthcare and industrial sectors further support market expansion. This is accelerating market growth, ensuring compliance and product integrity across industries.

Demand for Real-time Air Quality Monitoring and Nanoparticle Detection

Increasing focus on air quality monitoring has intensified the demand for advanced particle counters capable of real-time nanoparticle detection. Rising concerns over health risks posed by ultrafine particles, which affect the respiratory system, have driven regulatory bodies and industries to adopt precise monitoring solutions.

Traditional monitoring tools face limitations in detecting nanoparticles, creating opportunities for innovative technologies such as semi-nanoparticle sensors (SNS) and hybrid inertial filters (HIF). These advancements enhance accuracy, affordability, and portability, supporting the adoption of next-generation particle counters across industrial, environmental, and research applications. This leads to significant growth in the particle counter market.

High Cost Associated with Advanced Particle Counters

High costs of advanced particle counters is a major challenge to their growth, particularly for small-scale industries and emerging economies. Sophisticated technologies such as optical particle counters (OPCs) and condensation particle counters (CPCs) require substantial investment, limiting widespread adoption.

Companies are developing cost-effective and portable solutions with enhanced efficiency for addressing this challenge. The integration of IoT and AI-driven analytics is enhancing data processing and reducing operational costs.

Additionally, manufacturers are offering flexible leasing models and subscription-based services to improve accessibility. These strategies are expanding market reach, ensuring high-performance particle monitoring across industries.

Technological Advancements in Particle Counters

Innovations in particle counter technology including IoT connectivity, real-time data analytics, and AI-driven contamination monitoring have enhanced efficiency and accuracy. Portable and remote particle counters with cloud-based monitoring capabilities allow industries to track contamination levels precisely.

For instance, Triplett Test Equipment provides the Triplett Model EPC600 Environmental Particle Counter, a compact and portable device designed for indoor air quality testing. It is well-suited for use in semiconductor manufacturing, pharmaceuticals, data centers, optics, aerospace, cleanrooms, operating rooms, and other environments that require precise contamination monitoring.

Enhanced laser detection and advanced optical sensors improve sensitivity, enabling the detection of smaller particles. Companies are investing in R&D to develop high-performance instruments that integrate with automated cleanroom monitoring systems. The growth of the particle counter market is driven by continuous technological advancements that enhance user convenience and regulatory compliance across industries.

Biofluorescent particle counters (BFPCs) for instance, provide a faster and more efficient solution for viable particle monitoring. Unlike traditional culture-based methods that require days for results, BFPCs detect the intrinsic fluorescence of biological particles in real time.

|

Segmentation |

Details |

|

By Product Type |

Airborne Particle Counters, Liquid Particle Counters, Inline Particle Counters, Portable/Handheld Counters, Remote/Online Counters, Digital Particle Imaging Systems, Consumables |

|

By Application |

Cleanroom Monitoring, Pharmaceutical Manufacturing, Water & Wastewater Monitoring, Aerospace & Automotive, Semiconductor Manufacturing, Food & Beverage Testing, Environmental Monitoring |

|

By Distribution Channel |

Direct Sales, Distributors & Resellers, Online Sales Platforms, |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America particle counter market share stood at a 38.02% in 2024, with a valuation of USD 224.8 million. The pharmaceutical and biotechnology industries in North America have experienced significant expansion, particularly with the rising demand for biologics, personalized medicine, and vaccine production.

Strict regulatory requirements set by the U.S. Food and Drug Administration (FDA) and the need for aseptic manufacturing environments drive the use of particle counters in cleanrooms and controlled environments. The development of new drugs and biologics further increases the demand for contamination monitoring solutions, supporting market growth.

Furthermore, the adoption of Industry 4.0 technologies has also transformed manufacturing processes in North America, increasing the demand for automated and real-time air quality monitoring.

Particle counters featuring smart sensors and cloud-based platforms enable industries to track contamination levels, optimize production processes, and enhance workplace safety. The shift toward predictive maintenance and data-driven decision-making has further strengthened the role of advanced particle monitoring systems in industrial settings.

Asia Pacific particle counter industry is poised for significant growth at a CAGR of 7.11% over the forecast period. Asia Pacific is a global leader in semiconductor and electronics production, with key markets like China, Taiwan, South Korea, and Japan investing heavily in fabrication facilities. The increasing complexity of semiconductor manufacturing requires stringent cleanroom standards, which drive the demand for high-precision particle counters.

The growing need for consumer electronics, 5G infrastructure, and automotive semiconductors has further accelerated investments in contamination control solutions, strengthening the market.

The rapid pace of industrialization across Asia Pacific has led to growing concerns over air quality at the workplace. Governments have introduced stricter occupational safety standards to reduce workers’ exposure to airborne contaminants, leading to the higher adoption of particle counters in manufacturing plants, chemical processing facilities, and heavy industries.

The expansion of metallurgy, automotive, and aerospace industries has further fueled the need for real-time air quality monitoring and contamination control measures.

Players operating in the particle counter industry are implementing strategies that are focused on product development and innovation. Companies are introducing advanced particle counters with enhanced accuracy, real-time monitoring capabilities, and compliance with international standards.

These innovations address industry demands for improved contamination control and air quality monitoring across pharmaceuticals, semiconductors, and environmental sectors. By constantly enhancing their product portfolios, manufacturers are strengthening their market presence and meeting regulatory requirements.

Frequently Asked Questions