Healthcare Medical Devices Biotechnology

Pharmaceutical Analytical Testing Outsourcing Market

Pharmaceutical Analytical Testing Outsourcing Market Size, Share, Growth & Industry Analysis, By Product Type (Small Molecule Drugs, Biologics, Medical Devices), By Service Type (Bioanalytical Testing, Method Development & Validation, Stability Testing, Raw Material Testing, Others), By End User, and Regional Analysis, 2024-2031

Pages : 170

Base Year : 2023

Release : February 2025

Report ID: KR1351

Market Definition

Pharmaceutical analytical testing outsourcing refers to the practice of pharmaceutical companies contracting third-party laboratories or specialized service providers to perform analytical testing on drug products, raw materials, intermediates, and finished pharmaceuticals.

Pharmaceutical Analytical Testing Outsourcing Market Overview

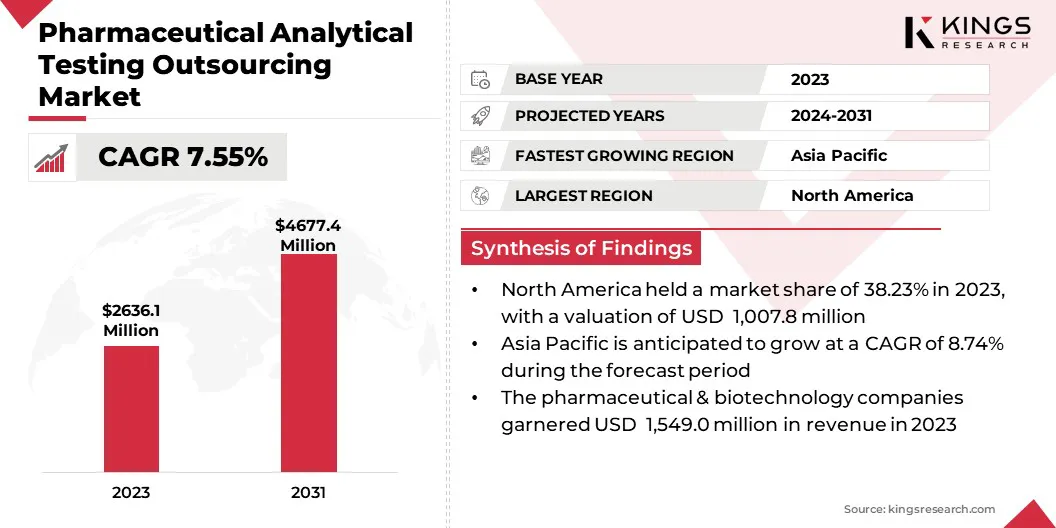

The global pharmaceutical analytical testing outsourcing market size was valued at USD 2,636.1 million in 2023 and is projected to grow from USD 2,809.9 million in 2024 to USD 4,677.4 million by 2031, exhibiting a CAGR of 7.55% during the forecast period.

This market is driven by the increasing demand for high-quality, cost-effective testing services in drug development and manufacturing. Outsourcing analytical testing helps pharmaceutical companies reduce operational costs, access specialized expertise, and speed up the time-to-market for new drugs.

Major companies operating in the pharmaceutical analytical testing outsourcing industry are Charles River Laboratories, Eurofins Scientific, Intertek Group plc, SGS Société Générale de Surveillance SA, Pace, WuXi AppTec Co., Ltd., Labcorp, West Pharmaceutical Services, Inc., ICON plc, Thermo Fisher Scientific Inc., Cambrex Corporation, Novo Holdings A/S, AptarGroup, Inc., Pharmaron, and Dr. Reddy’s Laboratories Ltd.

Factors such as regulatory pressure, increasing research and development (R&D) activities, and the need for compliance with international standards contribute to the market growth. The demand for advanced testing capabilities is expanding, due to the rise of biologics, personalized medicine, and complex drug formulations.

- In December 2024, Intertek announced a partnership with CrystecPharma to accelerate development timelines for dry powder inhaler (DPI) products. The platform combines CrystecPharma's mSAS technology with Intertek’s expertise in analytical development and GMP manufacturing, offering a faster, more efficient approach to formulating and manufacturing DPI medicines for respiratory diseases and other applications.

Key Highlights:

- The global pharmaceutical analytical testing outsourcing industry size was valued at USD 2,636.1 million in 2023.

- The market is projected to grow at a CAGR of 7.55% from 2024 to 2031.

- North America held a market share of 38.23% in 2023, with a valuation of USD 1,007.8 million.

- The small molecule drugs segment garnered USD 1,425.9 million in revenue in 2023.

- The bioanalytical testing segment is expected to reach USD 1,825.2 million by 2031.

- The pharmaceutical & biotechnology companies segment is expected to reach USD 2,509.6 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.74% during the forecast period.

Market Driver

"Expansion of Drug Development Pipeline and Increasing Regulatory Requirements"

Increasingly stringent regulatory requirements for drug safety and quality are prompting pharmaceutical companies to rely on external testing services to ensure compliance with global standards, boosting the pharmaceutical analytical testing outsourcing market.

Additionally, outsourcing offers significant cost efficiency, allowing companies to reduce operational expenses by eliminating the need for in-house laboratories and testing facilities.

Furthermore, the expanding drug development pipeline, especially in biologics and complex therapies, is boosting the demand for specialized analytical testing services to support R&D and commercialization efforts, ensuring that new therapies meet the necessary standards for market approval.

- In November 2024, Charles River partnered with a leading biopharmaceutical company in Asia Pacific. The partnership aims to support the company’s preclinical development of gene therapy candidates targeting rare diseases, with plans to file an Investigational New Drug (IND) application for a Phase I clinical trial in 2025.

Market Challenge

"Increasing Complexity of Regulatory Requirements and Data Security Concerns"

One of the significant challenges is the increasing complexity of regulatory requirements, as pharmaceutical companies must comply with numerous regional and global standards, including those related to biologics, gene therapies, and other novel therapeutics. The evolving nature of these regulations can create difficulties in ensuring that outsourced testing meets all necessary guidelines.

Outsourcing providers need to invest in continuous training, upskilling their staff, and staying updated with the latest regulatory changes to ensure compliance across different regions. Another challenge of the pharmaceutical analytical testing outsourcing market is data security and confidentiality concerns, particularly as pharmaceutical companies share sensitive information with outsourcing partners.

Protecting proprietary data and ensuring secure handling of patient information becomes critical, due to the rise in cyber threats. Outsourcing providers can adopt robust cybersecurity protocols, such as encryption and secure cloud storage, and ensure compliance with data protection regulations like GDPR and HIPAA, thus safeguarding data integrity and fostering trust between companies and their partners.

Market Trend

"Adoption of AI and Rising Demand for Highly Specialized Analytical Testing"

Adoption of cutting-edge technologies, such as artificial intelligence (AI) and machine learning (ML), are revolutionizing testing processes. These technologies enable more accurate data analysis, reduce human error, and speed up the decision-making process, thereby enhancing testing efficiency and reliability.

- In February 2024, Eurofins Discovery introduced DiscoveryAI SAFIRE, an advanced AI-driven platform designed to expedite drug discovery. SAFIRE leverages proprietary datasets, artificial intelligence (AI), and machine learning (ML) to predict ADMET (Absorption, Distribution, Metabolism, Excretion, and Toxicity) properties of molecules.

Additionally, the growing focus on biologics and gene therapies is creating the demand for highly specialized analytical testing services that many pharmaceutical companies prefer to outsource to leverage expertise and scale. These therapies are more complex and require precise testing methodologies, further driving the trend of outsourcing to companies with niche capabilities.

Furthermore, the pharmaceutical industry is increasingly emphasizing sustainability and eco-friendly practices, leading to a rise in demand for environmentally conscious testing services.

Companies are seeking outsourcing partners that adhere to green chemistry principles and employ sustainable practices in their testing processes, aligning with global sustainability goals and helping to reduce the environmental impact of drug development.

Pharmaceutical Analytical Testing Outsourcing Market Report Snapshot

|

Segmentation |

Details |

|

By Product Type |

Small Molecule Drugs, Biologics (Vaccines, Monoclonal Antibodies, Gene & Cell Therapies), Medical Devices |

|

By Service Type |

Bioanalytical Testing, Method Development & Validation (Assay Development & Optimization, Validation of Analytical Methods (ICH Q2(R1) Compliance),Process-related Impurity Analysis, Forced Degradation Studies), Stability Testing (Long-term Stability Testing, Accelerated Stability Testing, Photostability Testing, Forced Degradation Studies, Temperature & Humidity Studies), Raw Material Testing (Identification & Purity Testing, Heavy Metal & Elemental Impurity Testing, Residual Solvent Analysis, Particle Size Analysis, Polymorphism Analysis), Microbial Testing (Sterility Testing, Endotoxin & Pyrogen Testing, Microbial Limits Testing, Bioburden Testing, Environmental Microbial Monitoring), Environmental Monitoring (Air & Surface Monitoring in Manufacturing Facilities, Water Quality Testing (USP, EP, JP Compliance), Particulate Contamination Testing), Other Analytical Testing Services (Extractables & Leachables Testing, Elemental Impurity Analysis, Batch Release Testing, Residual DNA & Host Cell Protein Testing) |

|

By End User |

Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs), Academic & Research Institutions, Other End Users |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (Small Molecule Drugs, Biologics, Medical Devices): The small molecule drugs segment earned USD 1,425.9 million in 2023, due to the high demand for generic drugs, increased R&D activities, and stringent regulatory requirements for quality and safety testing.

- By Service Type (Bioanalytical Testing, Method Development & Validation, Stability Testing, Raw Material Testing, Microbial Testing, Environmental Monitoring, and Other Analytical Testing Services): The bioanalytical testing segment held 36.09% share of the market in 2023, due to the increasing complexity of biologics and rising demand for pharmacokinetics and pharmacodynamics studies.

- By End User (Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs), Academic & Research Institutions, and Other End Users): The pharmaceutical & biotechnology companies segment is projected to reach USD 2,509.6 million by 2031, owing to increasing R&D investments, growing demand for outsourcing analytical testing to ensure regulatory compliance, and the rising development of biologics and personalized medicines.

Pharmaceutical Analytical Testing Outsourcing Market Regional Analysis

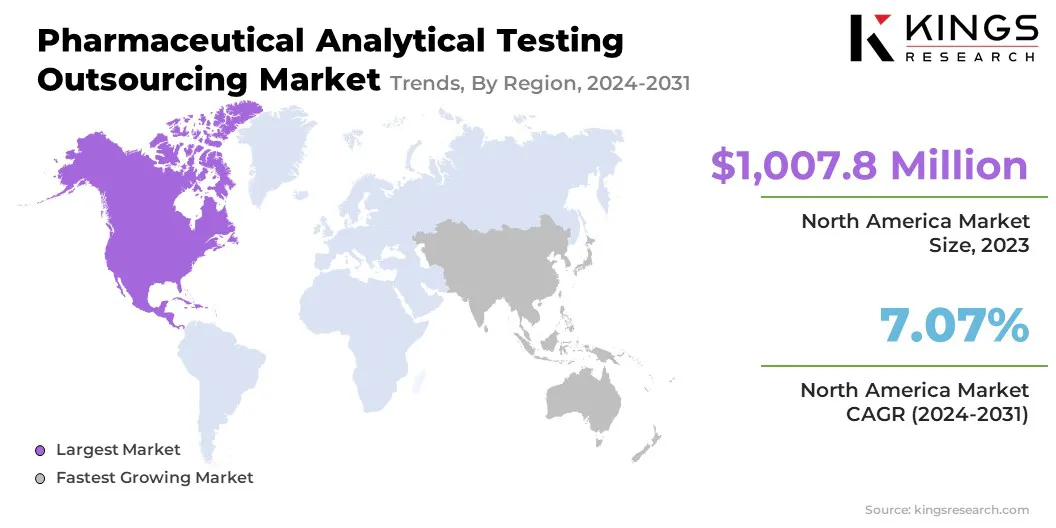

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a substantial pharmaceutical analytical testing outsourcing market share of 38.23% in 2023, with a valuation of USD 1,007.8 million. This dominance is attributed to the presence of a well-established pharmaceutical industry, strong regulatory frameworks, and high demand for outsourced testing services to meet stringent FDA guidelines.

The region's large pharmaceutical and biotechnology companies, as well as advanced infrastructure for drug development and testing, continue to drive the demand for analytical testing outsourcing. Additionally, the growing focus on biologics and personalized medicine in this region is expected to further boost the demand for bioanalytical testing and method development services.

- In September 2024, Eurofins Scientific completed the acquisition of Infinity Laboratories, Inc., expanding its BioPharma Product Testing network across the U.S. Infinity’s clients will benefit from Eurofins’ extensive laboratory network, analytical portfolio, and IT systems, further enhancing service capabilities in BioPharma and Medical Device Testing.

The pharmaceutical analytical testing outsourcing industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 8.74% over the forecast period. The key drivers behind this rapid expansion include cost advantages, a burgeoning pharmaceutical industry, and the increasing outsourcing of R&D and testing services to low-cost regions.

Countries like China and India are emerging as major hubs for pharmaceutical manufacturing and clinical trials, offering a skilled workforce and cost-effective testing solutions. Furthermore, the increasing number of drug approvals and rising healthcare investments in the region are fueling the demand for analytical testing services, particularly in biologics, stability testing, and microbial testing.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., pharmaceutical analytical testing outsourcing is regulated by the Food and Drug Administration (FDA), which ensures that all pharmaceutical products meet the necessary standards for safety, efficacy, and quality. The FDA sets forth requirements for GMP compliance, and outsourcing partners must adhere to these standards when conducting analytical testing for drug products.

- In Europe, pharmaceutical analytical testing outsourcing is regulated by the European Medicines Agency (EMA), which ensures that third-party testing labs comply with high standards of quality and safety. Outsourcing providers must follow the European Union Good Manufacturing Practice (EU GMP) guidelines for testing and validation of pharmaceutical products.

- In China, the National Medical Products Administration (NMPA) regulates pharmaceutical analytical testing outsourcing, ensuring that drugs are safe, effective, and comply with good manufacturing practices. The NMPA sets guidelines for third-party testing labs to meet stringent regulatory and quality standards.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) oversees pharmaceutical analytical testing outsourcing, ensuring compliance with regulatory requirements. Working with the Ministry of Health, Labour, and Welfare (MHLW), the PMDA sets guidelines for outsourcing providers, emphasizing stringent quality control measures to safeguard patient safety and ensure accurate test results.

- In India, pharmaceutical analytical testing outsourcing is regulated by the Central Drugs Standard Control Organization (CDSCO), which ensures compliance with national safety and efficacy standards. Outsourcing partners must follow CDSCO guidelines, including good laboratory practice and good manufacturing practice requirements.

Competitive Landscape:

The pharmaceutical analytical testing outsourcing industry is characterized by a large number of participants, including both established corporations and rising organizations.

Established organizations typically benefit from strong brand recognition, extensive experience, and advanced infrastructure, which enables them to offer comprehensive testing services across multiple stages of the drug development and manufacturing process. Emerging players are leveraging innovation, cost-effective solutions, and specialized expertise to carve out a niche in this competitive space.

The market's competitive nature is fueled by the need for tailored solutions for different therapeutic areas, such as biologics, vaccines, and generics. Regulatory compliance and adherence to stringent international standards are critical differentiators, with companies continuously striving to ensure that their testing services meet the latest requirements from regulatory bodies globally.

As the industry evolves, companies are expected to focus on enhancing operational efficiency, improving turnaround times, and maintaining high levels of customer satisfaction to stay competitive in this growing market.

- In September 2024, Charles River and Insightec announced a five-year collaboration to integrate focused ultrasound (FUS) technology into drug discovery and preclinical neuroscience research. Insightec’s platform enhances drug delivery for neurological diseases like Parkinson’s and Alzheimer’s, aiming to revolutionize CNS therapeutics.

List of Key Companies in Pharmaceutical Analytical Testing Outsourcing Market:

- Charles River Laboratories

- Eurofins Scientific

- Intertek Group plc

- SGS Société Générale de Surveillance SA

- Pace

- WuXi AppTec Co., Ltd.

- Labcorp

- West Pharmaceutical Services, Inc.

- ICON plc

- Thermo Fisher Scientific Inc.

- Cambrex Corporation

- Novo Holdings A/S

- AptarGroup, Inc.

- Pharmaron

- Dr. Reddy’s Laboratories Ltd.

Recent Developments (M&A/Partnerships/Agreements/Expansion)

- In January 2025, SGS announced the acquisition of RTI Laboratories, a leader in environmental and materials testing based in Detroit, Michigan. This acquisition expands SGS’s footprint in North America, enhancing its capabilities in PFAS (Perfluoroalkyl and polyfluoroalkyl substances) analysis and material testing.

- In January 2025, Pace Life Sciences, LLC, a U.S.-based contract research, development, and manufacturing organization (CRDMO), announced significant growth plans for its Salem, NH and Oakdale, MN facilities. The expansion will add sterile fill-finish capacity and enhanced analytical capabilities to support clients developing biologics, gene therapies, and other novel molecules.

- In December 2024, Intertek announced the opening of a new Electromagnetic Compatibility (EMC) and radio test chamber at its Leatherhead, UK facility. The new chamber, designed to support cutting-edge technology and future-proof for higher frequency bands, enhances Intertek's ability to meet the growing demand for fast and reliable EMC and radio testing across various industries, including consumer goods, medical, energy, and transportation.

- In October 2024, Eurofins Scientific reached an agreement to acquire SYNLAB’s clinical diagnostics operations in Spain. Following the acquisition, Eurofins will become a leading clinical diagnostics provider in Spain, with over 2,000 employees and the capacity to serve more than 10 million patients annually.

- In April 2024, Eurofins Scientific completed the acquisition of Ascend Clinical, the largest independent laboratory for kidney dialysis testing in the U.S. The acquisition strengthens Eurofins' presence in renal and transplant testing, broadening its clinical client base. Ascend gains access to Eurofins' extensive laboratory network and industry relationships, with its current leadership continuing to drive growth.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)