Buy Now

Pitch Based Carbon Fiber Market Size, Share, Growth & Industry Analysis, By Type (High Modulus Type, Intermediate Modulus Type, Standard Modulus Type), By Form (Composites, Non-Composites), By End-user Industry (Aerospace & Defense, Automotive, Construction & Infrastructure, Others) and Regional Analysis, 2025-2032

Pages: 170 | Base Year: 2024 | Release: July 2025 | Author: Versha V.

Pitch based carbon fiber is a high-performance material manufactured from petroleum or coal tar pitch that offers high thermal conductivity and dimensional stability. The market includes the production and supply of fibers made from pitch precursors and covers intermediate materials such as prepregs and finished components used in end-use sectors.

These sectors include aerospace, automotive, electronics, and industrial equipment. The market involves both fiber manufacturing and application across industries that require materials with high stiffness and heat resistance.

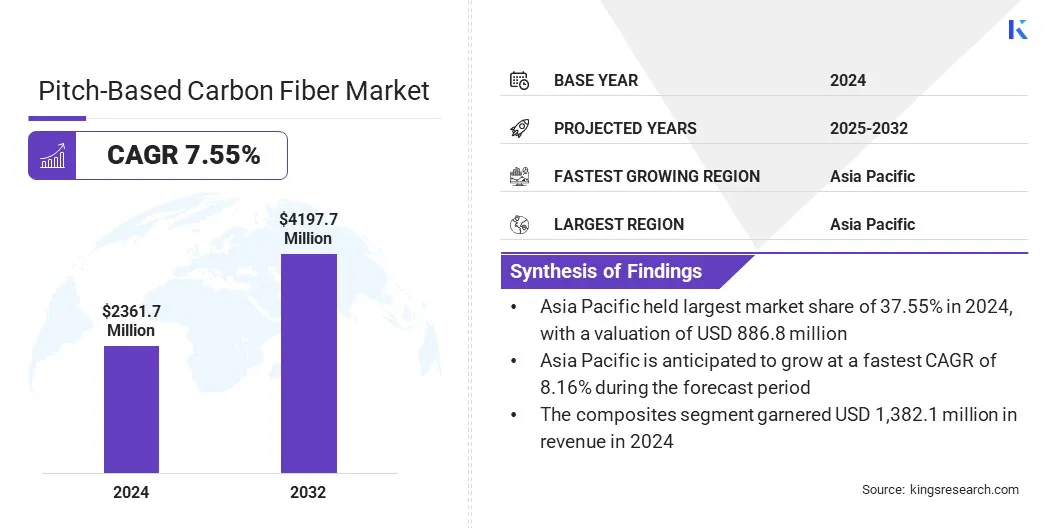

The global pitch based carbon fiber market size was valued at USD 2,361.7 million in 2024 and is projected to grow from USD 2,521.7 million in 2025 to USD 4,197.7 million by 2032, exhibiting a CAGR of 7.55% during the forecast period.

The market is driven by the increasing demand from the aerospace, automotive, and defense sectors. These industries rely on high-modulus materials for lightweight and high-strength components.

In addition, pitch-based carbon fiber offers superior thermal conductivity, making it suitable for applications in electronic devices and advanced heat management systems, thereby increasing its adoption.

Major companies operating in the pitch based carbon fiber market are Mitsubishi Chemical Group Corporation, TORAY INDUSTRIES, INC., TEIJIN LIMITED, SGL Carbon, Hexcel Corporation, HS HYOSUNG ADVANCED MATERIALS, Nippon Graphite Fiber Co., Ltd., Solvay, Syensqo, Formosa M Co., Ltd., KUREHA CORPORATION, Aksa Akrilik Kimya Sanayii A.Ş., Alfa Chemistry, UNITIKA LTD, and EVERTECH ENVISAFE ECOLOGY CO., LTD.

Rising demand for high-performance materials in advanced electronics and semiconductor manufacturing supports the growth of the market. The material’s excellent thermal conductivity and dimensional stability make it ideal for use in heat spreaders, electronic packaging, and wafer carriers.

Efficient heat management is becoming critical as devices grow smaller and more powerful. Pitch-based carbon fiber enables compact designs without compromising thermal control. Its consistent performance under thermal cycling conditions makes it suitable for precision electronic components, increasing its adoption in high-tech manufacturing environments.

Increased Demand for High-Modulus Materials in Satellite and Space Applications

The market is growing due to rising satellite deployment and increased focus on space exploration. High-modulus pitch-based carbon fiber offers stiffness, thermal resistance, and dimensional stability, making it suitable for structural components exposed to extreme space conditions.

Manufacturers in the aerospace industry use it in satellite frames, thermal control systems, and load-bearing assemblies. Space programs require materials that maintain performance under thermal cycling and mechanical stress.

The global surge in satellite launches for communication and Earth observation is increasing the need for reliable and lightweight materials. This demand supports the use of pitch-based carbon fiber in critical aerospace systems, driving its adoption in satellite manufacturing, launch vehicle development, and space-based research infrastructure.

High Production Costs and Limited Scalability

A major challenge in the pitch based carbon fiber market is the high cost of production and limited scalability. Manufacturing involves complex processes such as pitch purification, melt spinning, stabilization, and carbonization, all of which require specialized equipment and strict control over processing conditions.

These factors increase operational costs and hinder large-scale production. Growing demand in aerospace, defense, and electronics sectors is making scalability a critical concern. To address this, manufacturers are adopting continuous processing technologies and exploring automation to improve yield and reduce labor dependence.

Advancements in precursor refinement and energy-efficient furnaces also contribute to lowering costs. These solutions support more competitive pricing and enable wider adoption of pitch-based carbon fiber across industries.

Shift Toward Advanced Processing of Hydrocarbon-Based Precursors

The market is witnessing a trend toward innovation in feedstock utilization, particularly through the use of refined hydrocarbon-based precursors. Manufacturers are converting coal tar and petroleum-derived mesophase pitch into high-performance fibers using advanced thermal and spinning techniques.

This approach enables better control over fiber quality and improves mechanical properties such as tensile strength and modulus. Enhanced feedstock processing increases production efficiency and expands the range of end-use applications.

Companies seeking cost-effective and scalable methods rely on optimized feedstock selection and conversion to ensure product consistency and performance. This trend is strengthening the material’s position in aerospace, electronics, and industrial applications.

|

Segmentation |

Details |

|

By Type |

High Modulus Type, Intermediate Modulus Type, Standard Modulus Type |

|

By Form |

Composites, Non-Composites |

|

By End-user Industry |

Aerospace & Defense, Automotive, Construction & Infrastructure, Electrical & Electronics, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

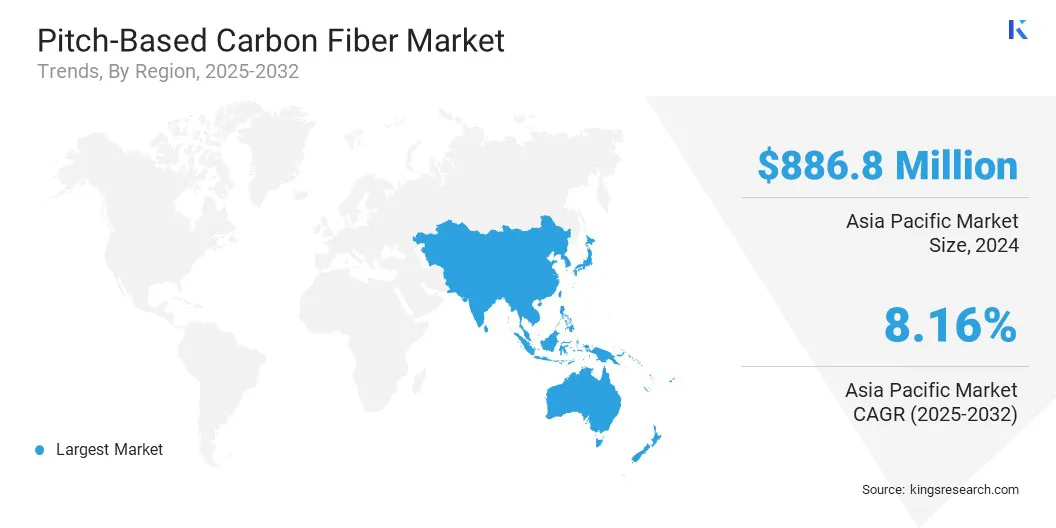

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific accounted for a substantial market share of 37.55% in 2024 in the pitch based carbon fiber market, with a valuation of USD 886.8 million. The region holds the largest share due to the strong demand from the aerospace and electronics industries in countries such as Japan, India, South Korea, and China.

For instance, India's expanding satellite programs and Japan’s advancements in space technology is driving the need for high-modulus carbon fiber components in spacecraft structures.

Taiwan, South Korea, and Japan are also major producers of semiconductors, where pitch-based carbon fiber is used in heat management solutions for precision electronics. Additionally, the market in this region benefits from a well-established carbon composite supply chain, supporting domestic production and export of high-performance materials to global aerospace and electronics manufacturers.

The market in North America is expected to register the fastest growth in the market, with a projected CAGR of 7.12% over the forecast period.

The market in this region benefits from sustained investments in advanced defense and aerospace platforms, particularly in the U.S. High-modulus pitch-based carbon fiber is increasingly used in missile components, space-grade structures, and thermal shielding systems.

Major aerospace manufacturers and defense contractors based in the U.S. integrate pitch-based carbon fiber in applications requiring high stiffness and dimensional stability.

In addition, the presence of research institutes and specialized material producers accelerates innovation and expands the regional adoption of next-generation carbon composite technologies, thereby driving market growth.

The pitch based carbon fiber market is characterized by companies forming strategic partnerships with aerospace, defense, and electronics manufacturers. These partnerships focus on co-developing tailored carbon fiber solutions that meet specific end-user requirements and secure long-term supply agreements.

This approach helps companies stay aligned with evolving industry demands and improves product relevance. Companies also invest heavily in product innovation to enhance fiber modulus and thermal conductivity while reducing production waste.

These improvements help firms differentiate their products in competitive, high-performance applications. Innovation supports entry into emerging industrial segments, allowing companies to expand their market presence and meet specialized material needs effectively.

Frequently Asked Questions