Buy Now

Plant Factory Market Size, Share, Growth & Industry Analysis, By Crop Type (Leafy Greens, Fruits and Vegetables, Flowers and Ornamentals, Others), By Light Type (Full Artificial Light, Sunlight), By Facility Type (Indoor Farms, Greenhouses), By Growing System, and Regional Analysis, 2024-2031

Pages: 210 | Base Year: 2023 | Release: April 2025 | Author: Sunanda G.

The market encompasses controlled-environment agriculture (CEA) systems that integrate advanced technologies to optimize plant growth. These technologies include hydroponics, aeroponics, and aquaponics, combined with artificial lighting, climate control, and automated nutrient delivery systems to enhance crop yield and quality.

Plant factories facilitate year-round cultivation of leafy greens, herbs, microgreens, and high-value medicinal plants by maintaining precise control over temperature, humidity, CO₂ levels, and light spectra.

Their ability to produce pesticide-free crops with minimal water usage makes them essential for food security and specialized crop cultivation, including sustainable urban farming, pharmaceutical-grade botanical production, and research applications.

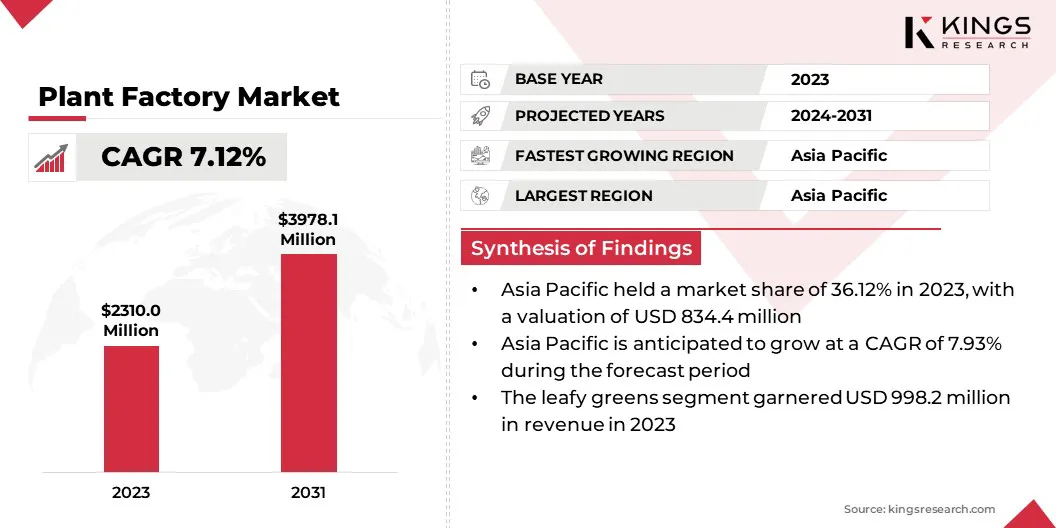

The global plant factory market size was valued at USD 2,310.0 million in 2023 and is projected to grow from USD 2,457.3 million in 2024 to USD 3,978.1 million by 2031, exhibiting a CAGR of 7.12% during the forecast period.

The market is expanding due to advancements in automation within controlled-environment agriculture, enhancing operational efficiency, reducing labor costs, and optimizing resource utilization. Increasing consumer demand for pesticide-free, locally grown produce further accelerates market growth, encouraging large-scale adoption of hydroponic and vertical farming systems.

Additionally, government initiatives for sustainable food production and AgriTech innovation are driving high-yield, climate-resilient farming solutions.

Major companies operating in the plant factory industry are AeroFarms, Plenty Unlimited Inc., MIRAI, Infarm, BrightFarms, Gotham Greens, Sky Greens, Green Sense Farms, Oishii, Vertical Harvest, Freight Farms, Crop One Holdings, AppHarvest, JFC Group, and Hydrofarm.

The growing preference for pesticide-free and nutrient-rich crops is accelerating the growth of the market. Consumers are shifting toward organic and locally grown vegetables due to increasing concerns about food safety and health.

Plant factories ensure this by maintaining a fully controlled environment that regulates temperature, humidity, CO₂ levels, and light spectra, preventing contamination from soil, water, and air pollutants. Supermarkets, restaurants, and food service providers are investing in these facilities to meet the rising demand for fresh and sustainable produce.

Market Driver

Climate Change and Land Scarcity

The growing impact of climate change and the decreasing availability of arable land is accelerating the adoption of plant factories as a sustainable solution for food production.

Extreme weather conditions, soil degradation, and water scarcity are disrupting traditional agriculture, creating a need for alternative farming methods. This shift is driving market growth by increasing demand for controlled-environment agriculture, which ensures consistent crop yields, resource efficiency, and reduced dependency on traditional farmland.

Additionally, urban expansion is reducing farmland, increasing the need for alternative farming solutions. In response, governments and private sector are investing in vertical farming and hydroponic systems. This shift is positioning plant factories as a key solution for global food security and agricultural sustainability.

Market Challenge

High Initial Investment and Operational Costs

The plant factory market faces significant challenges due to the high initial investment and operational costs associated with advanced infrastructure, energy-intensive climate control systems, and automation technologies. These expenses can limit market entry for new players and slow expansion efforts.

Market players are addressing this challenge by adopting energy-efficient LED lighting, renewable energy sources, and AI-driven automation to optimize resource utilization and reduce costs. Strategic partnerships, government subsidies, and technological innovations in hydroponic and aeroponic systems are further helping businesses enhance profitability and scale operations sustainably.

Market Trend

Rising Adoption of AI and Automation

The integration of artificial intelligence (AI) and automation is transforming operations in the market. Advanced AI algorithms optimize lighting, irrigation, and climate conditions to maximize yield and minimize energy consumption. Robotics and sensor-based monitoring systems are improving efficiency by automating planting, harvesting, and quality control.

Additionally, machine learning technologies analyze plant health and growth patterns, enabling predictive maintenance and real-time decision-making in nutrient optimization and disease prevention. These innovations are reducing labor costs while increasing production consistency.

Companies investing in AI-driven plant factory solutions are gaining a competitive edge, accelerating market adoption and strengthening the role of automation in sustainable agriculture.

|

Segmentation |

Details |

|

By Crop Type |

Leafy Greens, Fruits and Vegetables, Flowers and Ornamentals, Others |

|

By Light Type |

Full Artificial Light, Sunlight |

|

By Facility Type |

Indoor Farms, Greenhouses |

|

By Growing System |

Soil-Based, Non-Soil-Based, Hybrid |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

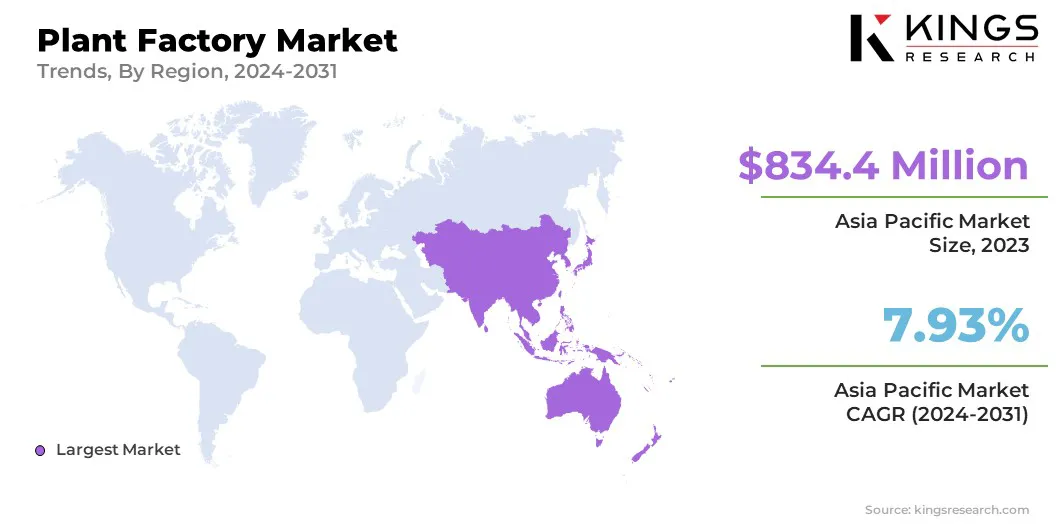

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific plant factory market share stood around 36.12% in 2023 in the global market, with a valuation of USD 834.4 million. Governments across Asia Pacific are actively promoting controlled environment agriculture to address food security concerns and enhance domestic food production.

Countries such as Japan, China, and Singapore are investing in plant factory infrastructure, offering subsidies and policy support to encourage its adoption. Singapore’s "30 by 30" initiative, which aims to produce 30% of the nation's nutritional needs locally by 2030, has led to increased funding for plant factories. Additionally, the government of China is promoting agricultural modernization through high-tech farming initiatives across the country.

Furthermore, rapid urbanization in Asia Pacific is driving demand for efficient, space-saving food production methods. With shrinking arable land in densely populated cities such as Tokyo, Seoul, and Hong Kong, plant factories are emerging as a viable solution to meet the growing need for fresh produce.

Vertical farming and hydroponic systems allow for high-yield crop cultivation in limited spaces, ensuring food availability in urban areas. This shift toward decentralized agriculture reduces reliance on long-distance supply chains, improving food resilience in cities.

Europe is poised for significant growth at a robust CAGR of 7.48% over the forecast period. Europe is at the forefront of agritech innovation, with companies leveraging artificial intelligence (AI), robotics, and automation to enhance plant factory efficiency.

Smart climate control systems, AI-driven crop monitoring, and automated harvesting technologies are improving productivity while reducing operational costs. For instance, the Netherlands, is leading in the development of precision-controlled indoor farms, with advanced systems improving efficiency and consistency.

Furthermore, major retailers and agribusiness corporations in Europe are investing heavily in plant factories to secure a stable supply of fresh produce. Supermarket chains such as Tesco, Carrefour, and Aldi are forming partnerships with indoor farm operators to stock vertically farmed greens for year-round availability.

Leading food service providers and hospitality brands are incorporating locally grown, high-quality ingredients from plant factories to meet consumer demand for sustainable dining options. These strategic investments are expanding the market’s commercial reach, driving growth across the region.

The plant factory industry is characterized by several market players adopting technology-driven strategies to enable large-scale cultivation of highly nutritious vegetables, driving market growth. Innovations in automation, climate control, and precision agriculture are optimizing resource efficiency, reducing reliance on traditional farming methods, and ensuring steady high-yield production.

Advanced hydroponic and aeroponic systems, coupled with AI-driven monitoring, enhance crop quality while minimizing water and land usage. These advancements allow for year-round cultivation, mitigating seasonal fluctuations and supply chain disruptions.

By integrating data analytics and smart farming techniques, companies are enhancing operational efficiency, reducing costs, and addressing the increasing demand for sustainable, high-quality fresh produce.

Recent Developments (Agreements/Expansion)

Frequently Asked Questions