Buy Now

Polyvinyl Alcohol Market Size, Share, Growth & Industry Analysis, By Product Type (Fully Hydrolyzed, Partially Hydrolyzed, Sub-Partially Hydrolyzed, Low Foaming Grades, Others), By End-Use Industry (Food Packaging, Paper Manufacturing, Construction, Textile Manufacturing, Electronics, Others), and Regional Analysis, 2025-2032

Pages: 140 | Base Year: 2024 | Release: July 2025 | Author: Sharmishtha M.

Polyvinyl Alcohol (PVA) is a synthetic, water-soluble polymer made by the hydrolysis of polyvinyl acetate. It is biodegradable, non-toxic, and offers high film-forming, adhesive, and emulsifying properties.

It offers excellent film-forming, adhesive, and emulsifying properties, which contribute to its versatility in sectors such as packaging, textiles, paper manufacturing, construction, and pharmaceuticals. The market is involved in the production, distribution, and application of PVA across various sectors.

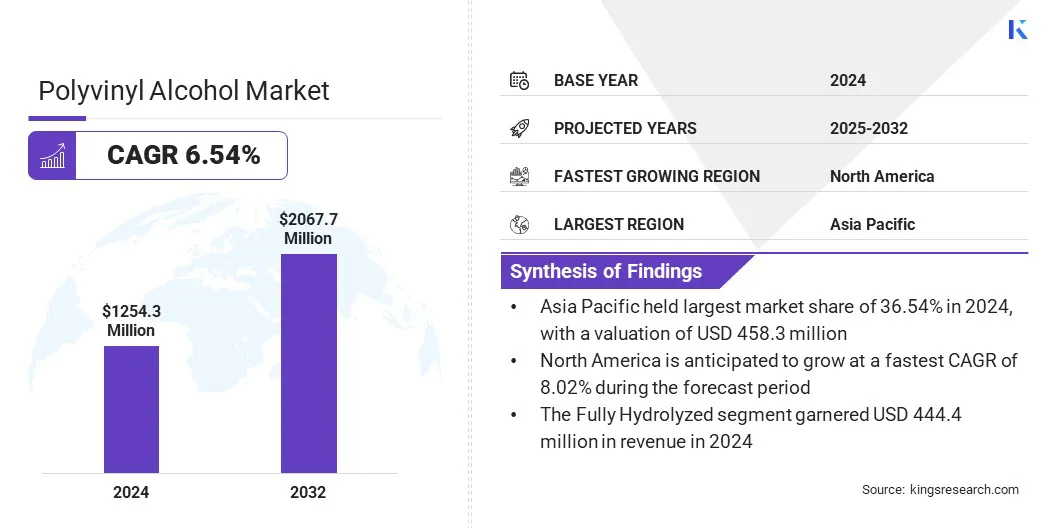

The global polyvinyl alcohol market size was valued at USD 1,254.3 million in 2024, which is estimated to be valued at USD 1,327.1 million in 2025 and reach USD 2,067.7 million by 2032, growing at a CAGR of 6.54% from 2025 to 2032.

The market's growth is increasingly propelled by advancements in nanotechnology, especially the emergence of PVA-based nanocomposites. These materials exhibit antibacterial, antioxidant, and anticancer properties, significantly enhancing PVA's potential in high-value biomedical applications. This is driving innovation and attracting growing commercial interest in the sector.

Major companies operating in the polyvinyl alcohol market are Mitsubishi Chemical Corporation, Merck, Eastman Chemical Company, Sekisui Specialty Chemicals, KURARAY CO., LTD., Qingdao Easthony Inc., SAJAN OVERSEAS, AKSHAR GROUP, SNP, Inc., Kanto Chemical Co., Inc., Junsei Chemical Co., Ltd., Kishida Chemical Co., Ltd., Astrra Chemicals, NACALAI TESQUE, INC, and Shanghai Chemex.

The market is experiencing steady growth due to the rising demand for eco-friendly, biodegradable, and water-soluble polymers across various industries. It is widely used in packaging, textiles, construction, and pharmaceuticals due to its properties such as strong film formation, adhesive capabilities, and chemical resistance.

Additionally, growing environmental regulations and consumer preference for sustainable products are prompting manufacturers to adopt greener practices. These sustainable innovations not only help companies meet regulatory compliance but also enhance brand value and open up new market opportunities, thereby driving growth in the market..

Advancements in Nanotechnology

The growth of the polyvinyl alcohol (PVA) market is being significantly driven by ongoing advancements in nanotechnology, which are enabling the development of highly functional PVA-based nanocomposites. These materials are attracting increasing interest due to their exceptional antibacterial, antioxidant, and anticancer properties—making them particularly well-suited for applications such as targeted drug delivery, wound healing, and cancer therapy.

PVA’s natural biocompatibility, along with its ability to blend seamlessly with other polymers, further enhances its effectiveness in nanomedical applications. With continued research focused on sustainable synthesis techniques and the discovery of novel biomedical uses, PVA is poised to play an even more prominent role in the healthcare sector, contributing to the global expansion of the market.

Competition from Alternative Polymers

One major challenge faced by the polyvinyl alcohol market is competition from alternative polymers, including synthetic and bio-based materials that offer similar properties such as biodegradability, flexibility, and water solubility. This challenge is particularly evident in sectors like packaging and medical applications, where newer materials are being adopted as substitutes for PVA due to performance, cost, or sustainability considerations.

To address this, manufacturers are focusing on product differentiation by enhancing the performance of PVA through nanocomposite integration, green synthesis methods, and polymer blending.

Shift Towards High-Performance Biomaterials

A key trend in the polyvinyl alcohol market is the shift toward high-performance biomaterials, driven by the growing demand for durable, biocompatible, and efficient materials in biomedical applications. PVA’s excellent mechanical strength, non-toxicity, and compatibility with biological systems make it an ideal choice for advanced cell culturing, tissue engineering, and regenerative medicine.

The rise in research efforts and the expansion in clinical applications are driving greater industrial adoption of PVA-based hydrogels and scaffolds. These advanced materials are being utilized to meet the evolving standards of modern healthcare and life sciences.

|

Segmentation |

Details |

|

By Product Type |

Fully Hydrolyzed, Partially Hydrolyzed, Sub-Partially Hydrolyzed, Low Foaming Grades, Others |

|

By End-Use Industry |

Food Packaging, Paper Manufacturing, Construction, Textile Manufacturing, Electronics, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific polyvinyl alcohol market share stood at 36.54% in 2024 in the global market, with a valuation of USD 458.3 million. Asia Pacific is the dominating region in the market, driven by rapid industrialization, expanding manufacturing sectors, and rising demand for biodegradable and water-soluble polymers. Countries like China, India, and Japan are leading contributors due to their strong presence in packaging, textiles, and pharmaceuticals.

Additionally, supportive government policies promoting sustainable materials and increased investments in research and development are accelerating market growth. The region's cost-effective production capabilities and growing consumer awareness further solidify its leadership in the global market.

North America polyvinyl alcohol industry is poised for significant growth at a robust CAGR of 8.02% over the forecast period. North America is the fastest growing region in the market, propelled by its strong emphasis on research and innovation, particularly in biomedical and advanced packaging applications.

The region benefits from significant investment in sustainable polymer development and supportive regulatory frameworks encouraging eco-friendly materials. Additionally, rising demand from pharmaceutical, electronics, and food industries for high-performance, biodegradable, and water-soluble polymers is accelerating growth. With collaborative efforts between academia, startups, and established manufacturers, North America continues to lead PVA innovation and adoption.

Companies operating in the polyvinyl alcohol industry are increasingly focusing on innovation, capacity expansion, and sustainable product development to meet rising global demand. Market players are enhancing the functional properties of PVA for applications in food packaging, pharmaceuticals, and electronics.

Moreover, key players are investing in advanced manufacturing facilities, pursuing strategic collaborations, and developing biodegradable and compostable PVA-based solutions. These initiatives aim to strengthen supply chains, improve performance, and align with global sustainability and regulatory requirements.

Frequently Asked Questions