Buy Now

Precision Irrigation Market Size, Share, Growth & Industry Analysis, By Component (Controllers, Sensors, Valves, Sprinklers & Emitters, Pumps, Others), By Type (Drip Irrigation, Micro-Sprinkler Irrigation, Pivot Irrigation, Smart Irrigation Systems), By Application (Agriculture, Horticulture), and Regional Analysis, 2024-2031

Pages: 190 | Base Year: 2023 | Release: March 2025 | Author: Sunanda G.

The precision irrigation market focuses on advanced irrigation techniques that optimize water and nutrient delivery to crops through controlled, data-driven methods. This involves technologies such as drip irrigation, micro-sprinklers, and variable rate irrigation (VRI), integrated with sensors, weather data, and automation systems.

These solutions enhance water-use efficiency by applying precise amounts of water based on soil conditions, crop type, and climatic factors. Precision irrigation supports sustainable agricultural practices, improving crop yield and quality while reducing water wastage. It is widely used in horticulture, greenhouse farming, and large-scale commercial agriculture, particularly for water-intensive crops like fruits, vegetables, and cereals.

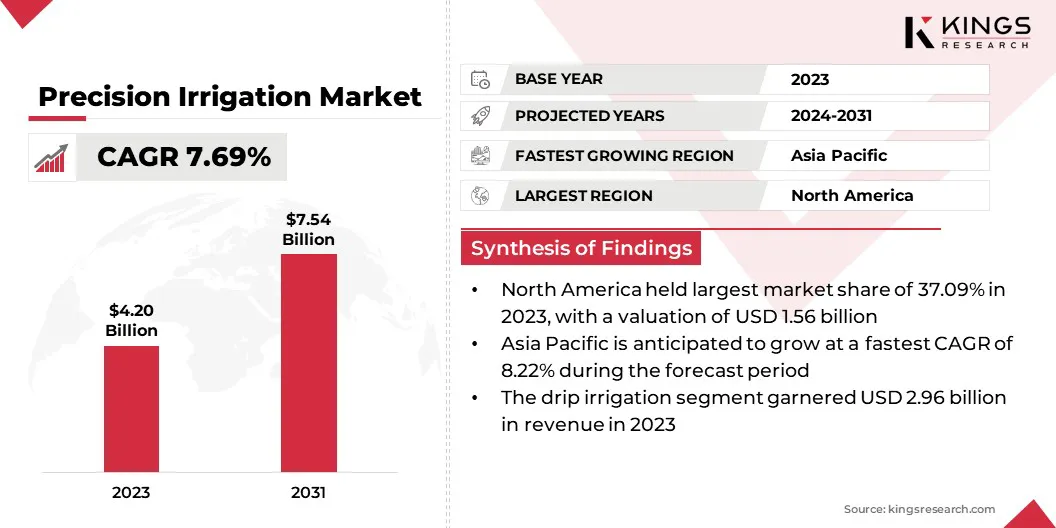

The global precision irrigation market size was valued at USD 4.20 billion in 2023 and is projected to grow from USD 4.49 billion in 2024 to USD 7.54 billion by 2031, exhibiting a CAGR of 7.69% during the forecast period.

The market is expanding, due to the growing need for efficient water management in agriculture, driven by increasing water scarcity and the rising demand for high-yield crop production.

Advancements in smart irrigation technologies, including AI-driven automation and IoT-enabled monitoring systems, are further accelerating market growth. Additionally, government initiatives promoting sustainable farming practices and water conservation are encouraging the widespread adoption of precision irrigation solutions.

Major companies operating in the global precision irrigation industry are Netafim, Rivulis, Lindsay Corporation, Senninger, Hunter Industries, The Toro Company, Rain Bird Corporation, Jain Irrigation Systems, Valmont Industries, Inc., Reinke Manufacturing Company, Inc., Ag Leader Technology, Nelson Irrigation Corporation, Trimble Inc., Metzer Group, and Topcon Positioning Systems, Inc.

Growing depletion of freshwater resources has intensified the need for efficient irrigation techniques that optimize water use and minimize waste. Agricultural regions facing severe water shortages are adopting precision irrigation systems to enhance resource utilization.

Agriculture, responsible for nearly 70% of global water withdrawals, continues to rely on inefficient irrigation methods and water-intensive crops. The increasing strain on freshwater resources is accelerating the adoption of precision irrigation technologies, which optimize water usage and enhance agricultural sustainability.

Drip and micro-irrigation technologies deliver water directly to plant roots, reducing evaporation and runoff. Governments and international organizations are introducing policies that promote water-efficient irrigation systems to address sustainability challenges.

Amid increasing concerns over global water scarcity, the adoption of precision irrigation solutions is accelerating, strengthening the growth of the market.

Market Driver

"Increased Demand for High Crop Yields"

The need to enhance agricultural productivity is accelerating the adoption of precision irrigation solutions, supporting the growth of the precision irrigation market. Population growth and rising food security concerns are compelling farmers to maximize crop yields while maintaining sustainable farming practices.

Precision irrigation optimizes water distribution, improving plant health and boosting harvest volumes. Large-scale farming operations are leveraging data-driven irrigation systems to increase efficiency and profitability.

The ability to achieve higher yields with precise water management is driving the use of precision irrigation solutions across various agricultural landscapes.

Market Challenge

"High Initial Investment and Infrastructure Costs"

The widespread adoption of precision irrigation is hindered by the high initial investment required for advanced irrigation systems, sensors, and automation technologies. Many farmers, particularly in developing regions, struggle with the affordability of these solutions, limiting market penetration.

Several manufacturers are offering flexible financing options, leasing models, and government-backed subsidy programs to make precision irrigation more accessible. Additionally, advancements in cost-effective sensor technology and cloud-based irrigation management platforms are helping reduce implementation expenses.

Strategic partnerships with agribusiness cooperatives and public agencies are further enabling farmers to integrate precision irrigation solutions without significant financial strain.

Market Trend

"Adoption of Digital Irrigation Platforms and Automation"

The integration of digital irrigation platforms is transforming water management in agriculture, accelerating the adoption of precision irrigation systems. Smart irrigation controllers, remote sensing technologies, and automated irrigation scheduling are enabling farmers to optimize water use with minimal manual intervention.

AI-driven analytics and Machine Learning (ML) algorithms are improving irrigation decision-making by analyzing real-time soil and weather data. Cloud-based irrigation platforms are enhancing connectivity, allowing farmers to remotely monitor and control irrigation systems through mobile applications.

The increasing reliance on digital irrigation solutions is driving efficiency, reducing costs, and strengthening the expansion of the precision irrigation market.

|

Segmentation |

Details |

|

By Component |

Controllers, Sensors, Valves, Sprinklers & Emitters, Pumps, Others |

|

By Type |

Drip Irrigation, Micro-Sprinkler Irrigation, Pivot Irrigation, Smart Irrigation Systems |

|

By Application |

Agriculture, Horticulture, Greenhouses & Nurseries, Golf Courses & Sports Grounds |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

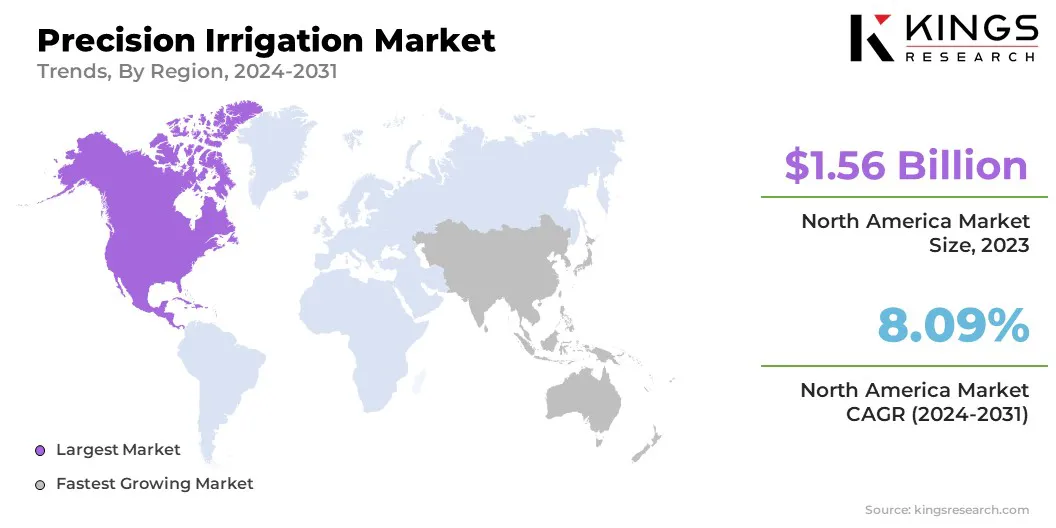

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a precision irrigation market share of around 37.09% in 2023, with a valuation of USD 1.56 billion. The rise of controlled environment agriculture, including greenhouse farming, vertical farming, and hydroponics, is boosting the need for precision irrigation systems in North America. These high-tech farming methods rely on precise water and nutrient delivery, making precision irrigation essential for maintaining crop health and productivity.

Urban farming initiatives in cities such as New York, Chicago, and Toronto are further driving the demand for efficient irrigation solutions tailored to indoor agriculture. The expansion of controlled environment agriculture (CEA) is creating opportunities for precision irrigation technology providers, reinforcing market growth in the region.

The establishment and expansion of advanced micro irrigation manufacturing facilities across North America are significantly driving the precision irrigation industry. Leading companies are investing in large-scale, state-of-the-art production plants to meet the rising demand for efficient irrigation solutions.

These manufacturing hubs are equipped with cutting-edge automation, robotics, and precision engineering capabilities, enabling the production of high-quality drip irrigation systems, emitters, and micro-sprinklers tailored for diverse agricultural applications.

The precision irrigation industry in Asia Pacific is poised for significant growth at a robust CAGR of 8.22% over the forecast period. Governments across Asia Pacific are implementing policies and financial incentives to promote water-efficient agricultural practices.

Subsidies, low-interest loans, and direct funding for precision irrigation equipment are encouraging farmers to adopt advanced irrigation systems. Countries such as India, China, and Australia have introduced initiatives to support micro-irrigation adoption, including drip and sprinkler systems, to combat water scarcity and enhance crop productivity.

These measures are driving large-scale implementation of precision irrigation technologies, strengthening market expansion across the region. Furthermore, the rising production of high-value crops, including fruits, vegetables, and cash crops for export markets, is increasing the demand for precision irrigation.

Countries such as China, India, and Thailand are registering significant growth in horticulture and floriculture, where controlled irrigation is essential for quality and yield improvement.

Precision irrigation ensures optimal hydration and nutrient delivery, enhancing crop quality for international trade. The increasing emphasis on agricultural exports is prompting farmers to adopt efficient irrigation technologies, boosting the market.

The global precision irrigation market is characterized by several market players that are implementing strategies focused on technological advancements in comprehensive irrigation operating systems, enhancing efficiency and automation in precision irrigation processes.

These innovations integrate advanced sensors, real-time data analytics, and AI-driven automation, optimizing water and nutrient distribution based on field conditions. Companies are developing all-in-one irrigation platforms that streamline monitoring, control, and fertigation.

These aid in improving crop yields while conserving resources. By investing in next-generation irrigation management systems, industry leaders are addressing the growing demand for sustainable agriculture solutions, strengthening their market position, and driving themarket globally.

Recent Developments (M&A/Partnerships/Agreements/Product Launch)

Frequently Asked Questions