Healthcare Medical Devices Biotechnology

Protein Sequencing Market

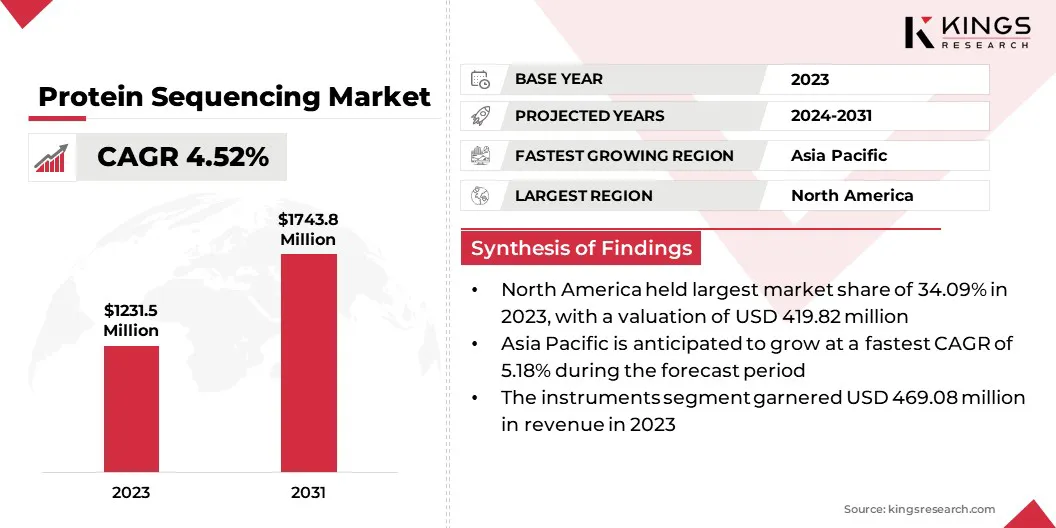

Protein Sequencing Market Size, Share, Growth & Industry Analysis, By Product & Service (Instruments, Reagents & Consumables, Software, Services), By Technology (Mass Spectrometry, Edman Degradation, Hybrid Approaches), By Application (Biopharmaceuticals, Academic & Research Institutes), and Regional Analysis, 2024-2031

Pages : 190

Base Year : 2023

Release : April 2025

Report ID: KR1631

Market Definition

The market encompasses technologies for determining tprotein amino acid sequence, essential for structural and functional analysis. Advanced solutions, including reagents, sequencing kits, and bioinformatics tools, enhance accuracy.

Key applications span drug discovery, biomarker identification, and proteomics research, supporting advancements in personalized medicine and biotechnology. It plays a crucial role in understanding protein interactions, post-translational modifications, and disease mechanisms across pharmaceutical, clinical, and academic research settings.

Protein Sequencing Market Overview

The global protein sequencing market size was valued at USD 1231.5 million in 2023 and is projected to grow from USD 1,279.9 million in 2024 to USD 1,743.8 million by 2031, exhibiting a CAGR of 4.52% during the forecast period.

This growth is fueled by its critical role in drug discovery and biomarker identification. Rising proteomics research initiatives in both public and private sectors are advancing sequencing technologies, enhancing insights into protein structures and functions.

Additionally, the increasing adoption of proteomics in clinical diagnostics and disease research is expanding its applications in precision medicine, facilitating early disease detection and targeted therapeutic development.

Major companies operating in the protein sequencing industry are Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Shimadzu Corporation, Rapid Novor, Inc., Charles River Laboratories International, Inc., Proteome Factory AG, Merck KGaA, Bruker Corporation, Fujifilm Holdings Corporation, Bio-Rad Laboratories, Inc., Bioinformatics Solutions Inc., PerkinElmer, Inc., Oxford Nanopore Technologies plc, Waters Corporation, QIAGEN N.V., and others.

Pharmaceutical companies are leveraging sequencing technologies to analyze disease-associated proteins, enabling the development of targeted therapeutics. Proteomic insights aid in identifying novel drug targets, improving treatment efficacy and patient outcomes.

Biomarker discovery supports early disease detection and personalized medicine initiatives, fueling demand for sequencing solutions. The rise of biologics and antibody-based therapies further expands the market. Growing R&D investments in precision medicine establish protein sequencing as an essential tool in next-generation drug development.

Key Highlights:

- The protein sequencing industry size was recorded at USD 1,231.5 million in 2023.

- The market is projected to grow at a CAGR of 4.52% from 2024 to 2031.

- North America held a share of 34.09% in 2023, valued at USD 419.8 million.

- The instruments segment garnered USD 469.1 million in revenue in 2023.

- The mass spectrometry segment is expected to reach USD 1,150.2 million by 2031.

- The clinical diagnostics is set to grow at a CAGR of 6.89% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 5.18% through the projection period.

Market Driver

Rising Proteomics Research Initiatives

The protein sequencing market is expanding due to the growing use of proteomics in clinical diagnostics and disease research. Sequencing technologies aid in idenfying disease-associated proteins, enabling early detection of conditions such as cancer, neurological disorders, and infectious diseases.

- In January 2025, UK Biobank introduced the world’s largest study on circulating proteins, set to transform disease research and treatment. This initiative aims to analyze up to 5,400 proteins in 600,000 samples, including contributions from 500,000 UK Biobank participants and 100,000 follow-up samples over 15 years. Researchers will gain access to an unprecedented database, offering insights into how protein level variations in mid-to-late life impact disease progression. Protein detection and sequencing will be conducted by Regeneron Genetics Center using Thermo Fisher Scientific’s Olink Explore HT platform and Ultima UG 100 sequencers from Ultima Genomics, both optimized for high-throughput applications.

Clinical laboratories are integrating sequencing solutions for diagnostic biomarker validation and patient stratification. Proteomic insights enhance the understanding of disease progression, guiding targeted therapeutic interventions.

Research initiatives focused on rare and complex diseases are boosting demand for sequencing-based proteomic analysis. The increasing reliance on proteomics in precision medicine is propelling growth in healthcare and diagnostics.

Market Challenge

Data Complexity and Interpretation Challenges

The protein sequencing market faces challenges due to the complexity of data generated from high-throughput sequencing platforms. The vast volume of proteomic data requires advanced bioinformatics tools for accurate interpretation, making data processing a bottleneck in research and clinical applications.

To address this, companies are investing in AI-driven bioinformatics solutions, cloud-based data analysis platforms, and machine learning algorithms to enhance data accuracy and streamline analysis.

Additionally, strategic collaborations with computational biology firms are facilitating the integration of automated workflows, enabling faster and more precise protein identification and functional analysis, thereby improving the scalability of proteomics research.

Market Trend

Increasing Adoption of Proteomics in Clinical Diagnostics and Disease Research

The increasing focus on proteomics research is accelerating the growth of the market. Government agencies and private organizations are allocating substantial funding to advance proteomic studies, fostering innovation in sequencing technologies. Large-scale research projects are leading to a strong demand for high-throughput sequencing solutions.

Academic institutions and research laboratories are adopting advanced sequencing platforms to explore protein structures, interactions, and functions. Strategic collaborations between public research institutes and biotechnology firms are expanding access to cutting-edge sequencing tools, promoting continuous technological advancements.

- In October 2024, Rapid Novor released a study titled "De Novo Protein Sequencing of Antibodies for Identification of Neutralizing Antibodies in Human Plasma Post SARS-CoV-2 Vaccination." The research emphasizes how de novo antibody sequencing, which directly identifies antibodies from blood samples without dependence on genetic databases, offers critical insights into unique and functional antibodies present in serum. This approach revealed antibodies not detected in conventional B-cell sequencing, underscoring its role as an innovative method for antibody identification.

Protein Sequencing Market Report Snapshot

|

Segmentation |

Details |

|

By Product & Service |

Instruments, Reagents & Consumables, Software, Services |

|

By Technology |

Mass Spectrometry, Edman Degradation, Hybrid Approaches |

|

By Application |

Biopharmaceuticals, Academic & Research Institutes, Clinical Diagnostics, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Product & Service (Instruments, Reagents & Consumables, Software, and Services): The instruments segment earned USD 469.08 million in 2023 due to the rising adoption of advanced mass spectrometry and next-generation sequencing platforms, which enhance accuracy, throughput, and sensitivity in proteomic analysis for research and clinical applications.

- By Technology (Mass Spectrometry, Edman Degradation, and Hybrid Approaches): The mass spectrometry segment held a share of 68.09% in 2023, attribiuted to its high sensitivity, precision in identifying post-translational modifications, and ability to analyze complex protein structures, making it the preferred technology for advanced proteomic research and clinical applications.

- By Application (Biopharmaceuticals, Academic & Research Institutes, Clinical Diagnostics, and Others): The biopharmaceuticals segment is projected to reach USD 777.69 million by 2031, propelled by the increasing reliance on proteomic analysis for biologic drug development, quality control, and therapeutic protein characterization, regulatory compliance, and enhancing drug efficacy.

Protein Sequencing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America protein sequencing market share stood at around 34.09% in 2023, valued at USD 419.8 million. The increasing prevalence of cancer, Alzheimer’s disease, and autoimmune disorders in North America is fueling the demand for protein sequencing in biomarker discovery.

Top research institutions and cancer centers in the region are leveraging sequencing technologies to identify disease-specific protein signatures, enabling early diagnosis and targeted therapy development.

Moreover, the regional market is benefiting from numerous strategic collaborations between biotech firms, pharmaceutical companies, and academic research centers. Leading organizations, including Harvard Medical School, MIT, Stanford University, and the Broad Institute, are partnering with industry players to advance proteomics research and sequencing technology development.

These collaborations facilitate large-scale protein mapping projects, improve sequencing accuracy, and support the commercialization of innovative sequencing solutions, accelerating advancements in proteomics and strengthening the region's market position.

The increasing focus on precision medicine in the U.S. and Canada is further fueling the adoption of sequencing-based proteomic analysis to identify therapeutic targets and develop personalized treatment strategies. Regulatory support for biologic drug approvals and growing investments in next-generation therapeutics are aiding regional market progress.

Asia Pacific protein sequencing industry is estimated to grow at a CAGR of 5.18% over the forecast period. Asia Pacific is at the forefront of biomanufacturing, supported by substantial investments in proteomics infrastructure. Governments and private enterprises in China, India, and Australia are advancing proteomics research with high-throughput sequencing platforms to enhance biologic drug development.

Biomanufacturing hubs in Singapore and South Korea are leveraging protein sequencing for cell line development, recombinant protein production, and stringent quality control processes.

The expansion of biotech incubators and proteomics-focused R&D facilities is accelerating innovations in protein characterization, promoting the widespread adoption of sequencing technologies within the pharmaceutical and biopharmaceutical industries.

- In December 2024, Alamar Biosciences, a company specializing in precision proteomics for early disease detection, expanded its commercial presence in the Asia Pacific region by deploying the ARGO HT System at the Hong Kong Center for Neurodegenerative Diseases (HKCeND). This advanced ultra-sensitive proteomics platform, alongside the NULISA Platform, enhances biomarker discovery by highly sensitive and accurate protein detection, advancing proteomic research and early disease diagnostics in the region

Regulatory Frameworks

- The U.S. Food and Drug Administration (FDA) oversees next-generation sequencing (NGS) technologies, which including protein sequencing applications through guidances that ensure the reliability and clinical validity of NGS-based tests.These guidances facilitate the integration of NGS technologies into clinical practice while maintaining rigorous standards of safety and effectiveness.

- In Europe, the In Vitro Diagnostic Regulation (IVDR) (EU) 2017/746 governs in vitro diagnostic devices, including those based on protein sequencing technologies. The IVDR mandates rigorous clinical evidence and performance evaluation to ensure the safety and efficacy of diagnostic devices within the EU market.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) regulates medical devices, including those used for protein sequencing, ensuring compliance with safety and efficacy standards prior to market approval.

Competitive Landscape

The protein sequencing industry is characterized by several market players focused on technological advancements to enhance proteomic analysis accuracy and depth. The integration of next-generation sequencing software with de novo sequencing capabilities enables precise identification of protein variants and structural modifications.

Companies are also leveraging high-resolution mass spectrometry and multi-level sequencing approaches to improve data interpretation and protein characterization.

These advancements are boosting the adoption of protein sequencing solutions in research and clinical applications, expanding market opportunities. Ongoing improvements in sequencing platforms are further advancing biomarker discovery and therapeutic development.

- In February 2025, at the 21st Annual US HUPO Conference, Bruker Corporation introduced major advancements in 4D-Proteomics performance, software, and applications to enhance biological insights. The company unveiled OmniScape 2025b, a major update to its top-down protein sequencing software. This version delivers a tenfold improvement in de novo sequencing capabilities, detects truncated protein variants, and provides comprehensive sequence annotation overviews. Additionally, it integrates sequence maps across MSn levels (MS2 & MS3) and incorporates MALDI T³-sequencing, enhancing the accuracy and depth of proteomic analysis.

List of Key Companies in Protein Sequencing Market:

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Shimadzu Corporation

- Rapid Novor, Inc.

- Charles River Laboratories International, Inc.

- Proteome Factory AG

- Merck KGaA

- Bruker Corporation

- Fujifilm Holdings Corporation

- Bio-Rad Laboratories, Inc.

- Bioinformatics Solutions Inc.

- PerkinElmer, Inc.

- Oxford Nanopore Technologies plc

- Waters Corporation

- QIAGEN N.V.

Recent Developments (Product Launch)

- In January 2025, Illumina, Inc., in partnership with deCODE Genetics, Standard BioTools, Tecan, GSK, Johnson & Johnson, and Novartis, launched a pilot proteomics program to analyze 50,000 UK Biobank samples. This initiative centers on Illumina’s forthcoming proteomics assay, Illumina Protein Prep, which utilizes SOMAmer technology. This next-generation sequencing (NGS)-based solution aims to enhance scalability in proteomic research, providing broader access to in-depth protein analysis.

- In April 2024, MilliporeSigma, a subsidiary of Merck KGaA, introduced Aptegra, an innovative “all-in-one” CHO genetic stability assay. This platform reduces biosafety testing time by two-thirds, accelerating the commercialization process for biotech and pharmaceutical companies. CHO cells, used in protein production and toxicology studies, are prone to genetic instability, potentially affecting protein quality, production efficiency, and test outcomes. Aptegra provides a more reliable and efficient solution for genetic stability assessment.

- In January 2024, Agilent Technologies Inc. introduced the Agilent ProteoAnalyzer system at the 23rd Annual PepTalk Conference. This automated parallel capillary electrophoresis platform enhances protein analysis with high resolution, rapid processing, and minimal sample consumption, solidifying its role in proteomic research and quality control.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years