Automotive and Transportation

Software Defined Vehicle Market

Software Defined Vehicle Market Size, Share, Growth & Industry Analysis, By Vehicle (Passenger cars, Commercial vehicles), By Propulsion (ICE, Electric, Hybrid), By Level of Authority (Level 1, Level 2, Level 3, Level 4, Level 5), By Application and Regional Analysis, 2024-2031

Pages : 190

Base Year : 2023

Release : February 2025

Report ID: KR1399

Market Definition

The software defined vehicle market encompasses vehicles that rely heavily on software for controlling, enhancing, and optimizing their functionality, performance, and user experience.These vehicles integrate advanced software systems for infotainment, navigation, and driver assistance, powertrain management, safety , and autonomous driving.

These vehicles leverage over-the-air (OTA) updates, AI-driven features, and continuous software improvements to enhance performance and provide personalized user experiences.

Software Defined Vehicle Market Overview

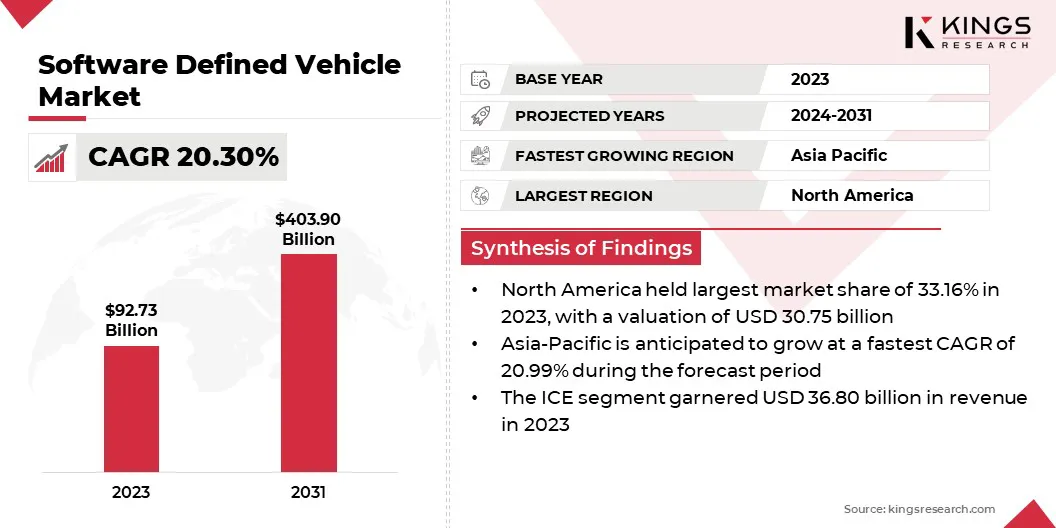

The global software defined vehicle market size was valued at USD 92.73 billion in 2023 and is projected to grow from USD 110.80 billion in 2024 to USD 403.90 billion by 2031, exhibiting a CAGR of 20.30% during the forecast period.

This robust growth is driven by the increasing integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) within vehicles. These innovations enable enhanced features such as autonomous driving capabilities, predictive maintenance, real-time diagnostics, and personalized in-car experiences.

The growing demand for electric vehicles (EVs) and the shift toward more sustainable transportation options are accelerating the adoption of software-centric vehicle designs.

Major companies operating in the global software defined vehicle Industry are Tesla, Li Auto Inc, NIO, Rivian, XPENG INC, Zeekr, Aptiv, Ford Motor Company, General Motors, Marelli Holdings Co., Ltd., Volkswagen Group, Mobileye, TOYOTA MOTOR CORPORATION., Stellantis NV, and Qualcomm Technologies, Inc.

The expansion of the market is further bolstered by advancements in 5G connectivity, which supports faster data transfer and enables real-time communication between vehicles and external infrastructure.

Furthermore, automakers are investing heavily in research and development to stay competitive in the evolving landscape, fostering innovation. With increasing regulatory pressures for improved safety, emissions reduction, and connectivity standards, the market is set to witness significant expansion across regions.

- In October 2024, BMW Group and Tata Technologies announced the establishment of BMW TechWorks India, a joint venture aimed at advancing automotive software and business IT innovations. This collaboration highlights the growing importance of software development in the automotive industry, particularly in accelerating connected and software-defined vehicle technologies.

Key Highlights

- The global software defined vehicle market size was recorded at USD 92.73 billion in 2023.

- The market is projected to grow at a CAGR of 20.30% from 2024 to 2031.

- North America held a share of 33.16% in 2023, valued at USD 30.75 billion.

- The passenger cars segment garnered USD 52.68 billion in revenue in 2023.

- The ICE segment is expected to reach USD 158.08 billion by 2031.

- The level 3 segment is anticipated to witness the fastest CAGR of 20.59% over the forecast period.

- The advanced driver assistance systems (ADAS) segment is expected to reach USD 112.28 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 20.99% through the projection period.

Market Driver

"Increased Demand for Connectivity and Digitalization"

As consumer demand for seamless, connected experiences grows, automakers are transitioning to software-centric designs to provide real-time updates, personalized features, and enhanced in-vehicle services, propelling the growth of the software defined vehicle market.

Connectivity facilitates OTA software updates, enabling manufacturers to enhance vehicle performance, introduce new functionalities, and address security vulnerabilities without necessitating physical visits to service centers.

Furthermore, the ability to integrate vehicles into broader digital ecosystems, such as ride-sharing platforms, smart cities, and mobility-as-a-service (MaaS), is reshaping vehicle-environment interactions. This shift toward digital and connected vehicles is improving user experience while boosting advancements in ADAS and autonomous driving.

- In March 2024, Marelli introduced a light domain controller designed for software defined vehicle architectures, enabling control of front, rear, and 360° lighting features. This innovative solution is part of Marelli's strategy to advance the shift toward more flexible, software-centric vehicle platforms.

Market Challenge

"Complexity in Software Integration"

The complexity of software integration presents a significant challenge to the expansion of the software defined vehicle market, as these vehicles rely on the seamless coordination of a wide range of software systems.

Infotainment, ADAS, autonomous driving, vehicle control, and connectivity solutions often originate from different suppliers and operates on distinct platforms. Integrating these systems into a unified, efficient architecture requires ensuring compatibility without compromising vehicle performance or safety.

Furthermore, software defined vehicle must process real-time data from a variety of sensors, including cameras, LIDAR, radar, and GPS, which generate vast data volumes that must be analyzed immediately to ensure safe driving.

Standardizing software architecture ensures seamless interoperability across systems such as ADAS, infotainment, and autonomous driving. Modular software designs facilitates updates and scalability, while agile methodologies allow for iterative improvements and faster resolution of issues.

Robust testing frameworks, simulating real-world conditions, ensure system reliability. Advanced data management techniques, such as edge computing, optimize real-time sensor data processing, reducing latency and enhancing vehicle performance. These approaches collectively enhance integration, reliability, and adaptability in software defined vehicle.

Market Trend

"Increased Adoption of Autonomous Driving"

The increased adoption of autonomous driving represents a significant trend in the software defined vehicle market, supported by advancements in AI, sensor technologies, and real-time data processing.

AI and machine learning enable vehicles to process extensive data from sensors such as cameras, radar, and LIDAR, facilitating enhanced object recognition, decision-making, and navigation in complex environments.

These technological improvements are driving progress toward Level 4 and Level 5 autonomy, allowing vehicles to operate with minimal or no human intervention. The widespread adoption of autonomous driving is poised to revolutionize the automotive industry, enhancing safety, efficiency, and personalization.

- In November 2024, XPENG Motors launched the P7+ in China, the world’s first AI-defined vehicle. The P7+ delivers premium quality with advanced AI-driven technology, enhances intelligent driving and smart cockpit experiences through XPENG’s cutting-edge AI architecture. This launch reinforces XPENG’s leadership in AI-defined mobility.

Software Defined Vehicle Market Report Snapshot

|

Segmentation |

Details |

|

By Vehicle |

Passenger cars, Commercial vehicles |

|

By Propulsion |

ICE, Electric, Hybrid |

|

By Level of Autonomy |

Level 1, Level 2, Level 3, Level 4, Level 5 |

|

By Application |

Advanced Driver Assistance Systems (ADAS), Powertrain control, Infotainment systems, Autonomous driving, Telematics, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Vehicle (Passenger cars and Commercial vehicles): The passenger cars segment earned USD 52.68 billion in 2023 due to the increasing demand for advanced technologies such as autonomous driving, connectivity, and over-the-air software updates in personal vehicles.

- By Propulsion (ICE, Electric, and Hybrid): The ICE segment held a major share of 39.68% in 2023, largely attributed to the continued dominance of traditional internal combustion engine vehicles, particularly in regions with established infrastructure and consumer preferences for conventional fueling methods.

- By Level of Autonomy (Level 1, Level 2, Level 3, Level 4, and Level 5): The Level 1 segment is projected to reach USD 116.73 billion by 2031, owing to the widespread adoption of basic driver assistance systems such as adaptive cruise control and lane-keeping assist, which offer incremental improvements in vehicle safety and convenience.

- By Application (Advanced Driver Assistance Systems (ADAS), Powertrain Control, Infotainment Systems, Autonomous Driving, Telematics, and Others): The advanced driver assistance systems segment earned USD 25.79 billion in 2023, fueled by the growing demand for safety features such as automatic emergency braking, lane departure warnings, and collision detection systems, which are becoming standard in many modern vehicles.

Software Defined Vehicle Market Regional Analysis

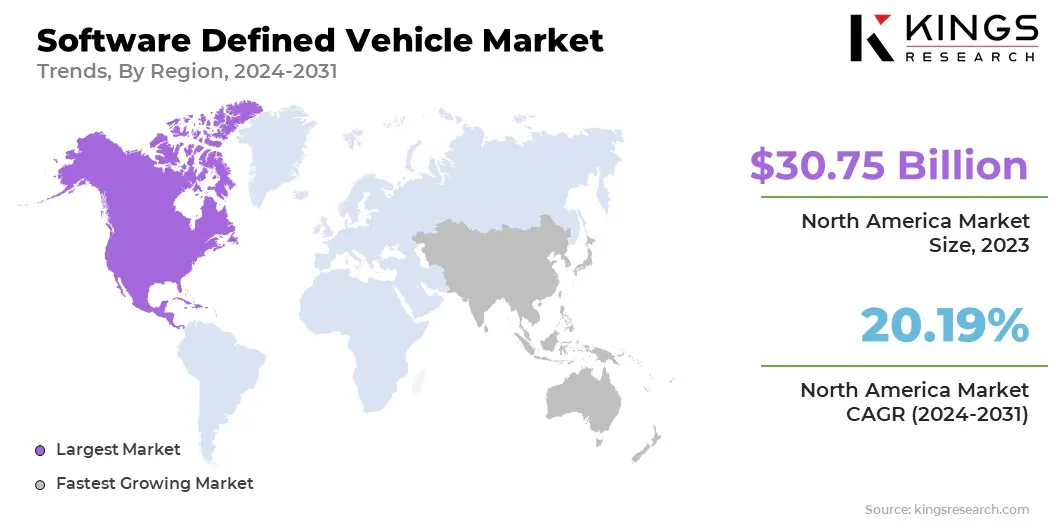

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America software defined vehicle market captured a share of around 33.16% in 2023, valued at USD 30.75 billion. This expansion is attributed to the rapid adoption of advanced automotive technologies, including EVs, autonomous driving systems, and connected car solutions.

The regional market benefits from a strong presence of leading automotive manufacturers, technology companies, and a supportive regulatory framework fostering vehicle software innovation.

The increasing consumer demand for enhanced safety features, real-time software updates, and personalized driving experiences further boosts regional market growth. Major industry players such as Tesla, General Motors, and Ford are making substantial investments in software defined vehicle technologies, reinforcing North America's prominent position in theglobal market.

Asia-Pacific software defined Industry is likely to grow at a robust CAGR of 20.99% over the forecast period. This growth is propelled by the region's strong automotive manufacturing base, increasing demand for EVs, and the rapid expansion of connected and autonomous vehicle technologies.

The presence of major automotive markets, such as China, Japan, and South Korea, coupled with significant investments from both domestic and global automakers, is boosting the adoption of software defined vehicles.

Advancements in smart infrastructure, improvements in 5G connectivity, and government initiatives promoting green and smart transportation are contributing to the regional market growth.

- In May 2024, NIO Inc. and FAW Group Corporation formed a strategic partnership to advance next-generation EVs and software defined vehicle technologies. The partnership leverages NIO's expertise in electric vehicle design and technology, along with FAW Group's strenghth in manufacturing and supply chain management.

Regulatory Frameworks

- The SAE J3016 standard, established by the Society of Automotive Engineers (SAE), defines automation levels in driving systems, providing a standardized approach for categorizing autonomous driving systems based on the division of control between the human driver and automated systems.

- The UNECE WP.29, operating under the United Nations Economic Commission for Europe (UNECE), develops and maintains international regulations on vehicle safety, environmental performance, and technical standards to harmonize global automotive regulations.

- The ISO 26262 standard ensures automotive systems meet safety requirements by addressing potential risks related to malfunctioning components that could lead to hazards.

- The European Data Protection Board (EDPB) Guidelines 2020 on Connected Vehicles provide detailed insights into the data protection requirements that organizations must follow when handling personal data in the context of connected vehicles.

Competitive Landscape

The global software defined vehicle market is characterized by a number of participants, including both established corporations and emerging players. Traditional automotive industry leaders are at the forefront, integrating advanced software technologies to enhance vehicle connectivity, autonomous capabilities, and driver assistance systems.

These companies are making substantial investments in research and development (R&D) to strengthen their competitive positions and are increasingly forming strategic partnerships with technology firms to incorporate innovations in AI, machine learning, cybersecurity, and data analytics.

Moreover, a growing number of specialized startups and technology firms are entering the market, focusing on areas such as autonomous driving, vehicle electrification, and software platform integration. These new entrants are offering innovative, disruptive solutions that challenge traditional automotive practices.

- In February 2025, Volkswagen Group expanded its global collaboration with CGI, a leading IT and business consulting firm, to enhance its software development capabilities. This move strengthens the Volkswagen Group’s long-term capabilities to strenghthen its IT infrastructure.

List of Key Companies in Software Defined Vehicle Market:

- Tesla

- Li Auto Inc

- NIO

- Rivian

- XPENG INC

- Zeekr

- Aptiv

- Ford Motor Company

- General Motors

- Marelli Holdings Co., Ltd.

- Volkswagen Group

- Mobileye

- TOYOTA MOTOR CORPORATION.

- Stellantis NV

- Qualcomm Technologies, Inc

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In February 2025, General Motors completed its acquisition of GM Cruise Holdings LLC following approval from the Cruise Board of Directors. GM will integrate Cruise technology into ita Super Cruise assisted driving system, enabling hands-free driving across 750,000 miles of North American roads.

- In October 2024, NIO, a leader in the premium smart EV sector, partnered with Abu Dhabi based CYVN Holdings, a leading investor in smart and advanced mobility, to launch NIO MENA. The collaboration marks NIO’s entry into the Middle East and North Africa (MENA) region, aiming to introduce cutting-edge electric vehicle solutions aligned with regional sustainability goals.

- In September 2024, XPENG Motors appointed Pioneer Motors, a subsidiary of Qatar's Almana Group, as the exclusive distributor for Qatar. This agreement advances XPENG’s global expansion strategy, following its entry into the Europe, Middle Eastern, Asia-Pacific, and Africa. The XPENG G6, G9, and P7 are expected to launch in the Qatari market by late 2024.

- In June 2024, Rivian and Volkswagen Group announced plans for a joint venture to develop next generation software defined vehicle platforms for future electric vehicles. This collaboration will leverage Rivian’s expertise in software and electrical architecture to create an advanced vehicle technology platform.

- In June 2023, Marelli partnered with Indy Autonomous Challenge to supply connectivity colutions for autonomous race cars. Marelli will provide advanced automotive technologies, including sensors, control systems, and software solutions, to enhance high-speed autonomous racing capabilities.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)