Buy Now

Space Mining Market Size, Share, Growth & Industry Analysis, By Asteroid (C-type, S-type, M-type, Others), By Mission Phase (Spacecraft Design & Engineering, Launch Services, Mining Operations & Logistics), By Application (Construction, Extraterrestrial Commodity, Resource Harvesting) and Regional Analysis, 2025-2032

Pages: 170 | Base Year: 2024 | Release: July 2025 | Author: Versha V.

Space mining refers to the extraction of valuable resources such as metals, minerals, and water from celestial bodies, including asteroids, the Moon, and other planets. The market includes technologies, equipment, and services used to identify, extract, and process resources beyond Earth.

It covers spacecraft, robotic systems, remote sensing instruments, and material handling units. It includes both public agencies and private firms engaged in commercial space activity, with applications in in-space resource utilization and potential material transport to Earth.

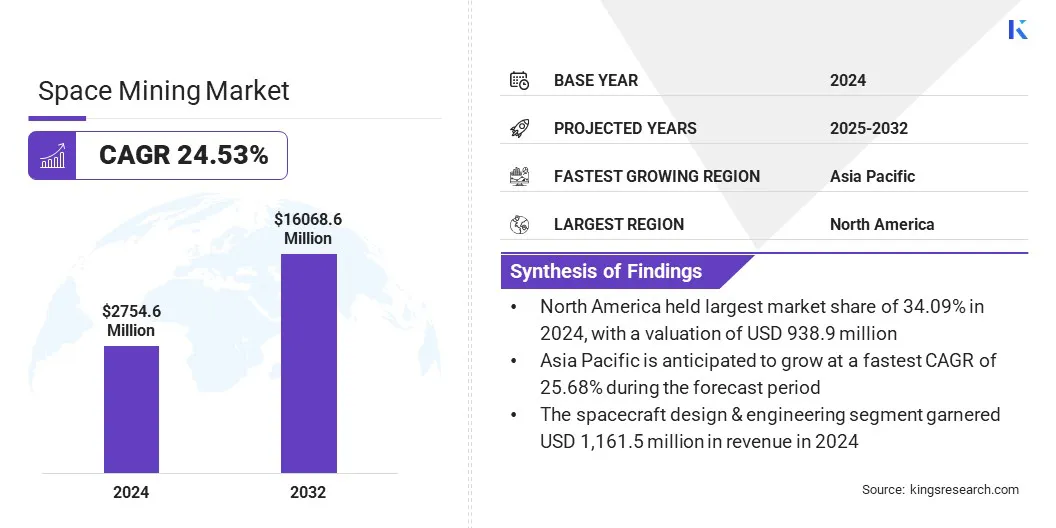

The global space mining market size was valued at USD 2,754.6 million in 2024 and is projected to grow from USD 3,411.8 million in 2025 to USD 16,068.6 million by 2032, exhibiting a CAGR of 24.53% during the forecast period.

This growth is mainly fueled by rising interest in extracting valuable resources such as platinum, rare earth elements, and water from asteroids and other celestial bodies. Additionally, the growing investments by private space companies and national space agencies are accelerating technology development for off-Earth mining missions.

Major companies operating in the space mining market are Moon Express, ispace, Asteroid Mining Corporation, OffWorld, Inc., Trans Astronautica Corporation, AstroForge, Karman+, Helios Project Ltd, Eartheye Space, Interlune Corporation, SolSys Mining, SpaceGold Corporation, SpaceTIS, USN Solar Sky Mining, and NASA.

|

Segmentation |

Details |

|

By Asteroid |

C-type, S-type, M-type, Others |

|

By Mission Phase |

Spacecraft Design & Engineering, Launch Services, Mining Operations & Logistics |

|

By Application |

Construction, Extraterrestrial Commodity, Resource Harvesting, Fuel Mining, 3D Printing, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America space mining market accounted for a substantial share of 34.09% in 2024, valued at USD 938.9 million. This dominance is supported by its strong aerospace infrastructure and the active involvement of private space companies.

U.S.-based firms are advancing asteroid mining technologies by investing in in-orbit servicing, propulsion development and resource extraction systems. Several companies are collaborating with aerospace manufacturers to accelerate the design and deployment of mission-ready platforms.

These efforts support early-stage demonstration missions focused on extracting valuable materials from near-Earth asteroids, strengthening North America’s prominence in space mining initiatives.

The Asia-Pacific space mining industry is expected to register the fastest CAGR of 25.68% over the forecast period. This growth is fueled by increasing collaborations aimed at asteroid and lunar resource exploration.

The regional market further benefits from joint efforts among technology firms, research institutions, and emerging space companies to develop mining technologies for the Moon and near-Earth asteroids.

Countries such as Japan, China, and South Korea are investing in joint ventures to advance robotic mining systems, in-situ resource utilization, and mission planning capabilities.

These collaborations enhance knowledge sharing and accelerate technology development, enabling faster progress toward commercial space mining. The growing focus on lunar and asteroid resource projects is propelling regional market expansion.

Supportive government policies and international collaborations are promoting the commercialization of space resources, thereby supporting market growth.

National space laws that define extraction and ownership rights are promoting private investment, while public funding for research and technology development is enhancing exploration capabilities.

This coordinated approach fosters a stable environment for commercial activity, with government leadership and international cooperation playing a key role in advancing space mining operations.

Depletion of Terrestrial Resources

The expansion of the market is boosted by the depletion of critical terrestrial resources. Industries such as aerospace, electronics, and renewable energy rely on minerals like platinum, cobalt, and rare earth elements, whose global reserves are declining amid rising demand.

Terrestrial mining faces mounting challenges, including high operational costs, strict environmental rules, and geopolitical uncertainty.

In response, companies and governments are exploring extraterrestrial sources, with the Moon and asteroids offering significant deposits of high-value metals. Space mining provides a viable solution to future shortages and is attracting investment in enabling technologies.

Limited In-Situ Resource Utilization (ISRU) Capabilities

A major challenge hindering the progress of the space mining market is the limited advancement of in-situ resource utilization (ISRU) systems. These technologies, essential for extracting water, oxygen, and other materials from lunar or asteroid surfaces, remain unproven in actual space conditions and require further testing.

The extreme space environment, charaterized by low gravity, high radiation, and severe temperature fluctuations, adds complexity to operations. To address this challenge, companies and space agencies are deploying ISRU technologies during early exploration missions to locations such as the lunar surface and near-Earth asteroids.

These efforts help test essential capabilities and establish reliability for future large-scale resource extraction across multiple celestial bodies.

Collaborative Missions Among Private Companies

The market is experiencing a rising trend toward collaborative missions between private companies. Companies are entering partnerships to share technical capabilities and reduce the cost of space exploration. These collaborations support faster deployment of resource extraction technologies on the Moon and asteroids.

Companies are leveraging joint missions to validate equipment, test mobility systems, and prepare for future large-scale operations. This coordinated approach is strengthening the commercial space ecosystem and improving mission efficiency.

Companies operating in the space mining market are aligning with national space laws and international frameworks that support commercial mining beyond Earth orbit. Governments are establishing legal frameworks to promote private sector participation in off-Earth mining.

Additionally, companies are securing investments from both private and public sources. These funds support the development of extraction systems, mission planning, and infrastructure for in-situ resource utilization.

Regulatory alignment and strategic funding enable companies to build capabilities and prepare for sustained space mining operations.

Frequently Asked Questions