Buy Now

Stacker Crane Market Size, Share, Growth & Industry Analysis, By Type (Single-Column Stacker Crane, Double-Column Stacker Crane), By Load Capacity, By Operation Mode, By End-User Industry, and Regional Analysis, 2024-2031

Pages: 150 | Base Year: 2023 | Release: March 2025 | Author: Sharmishtha M.

The market involves automated systems used for storing and retrieving materials in warehouses and distribution centers. These cranes enhance efficiency by automating storage processes, reducing labor costs, and improving space utilization.

They are integral to automated storage and retrieval systems (ASRS), optimizing storage space, increasing efficiency, and streamlining material handling processes in various sectors, including logistics and manufacturing.

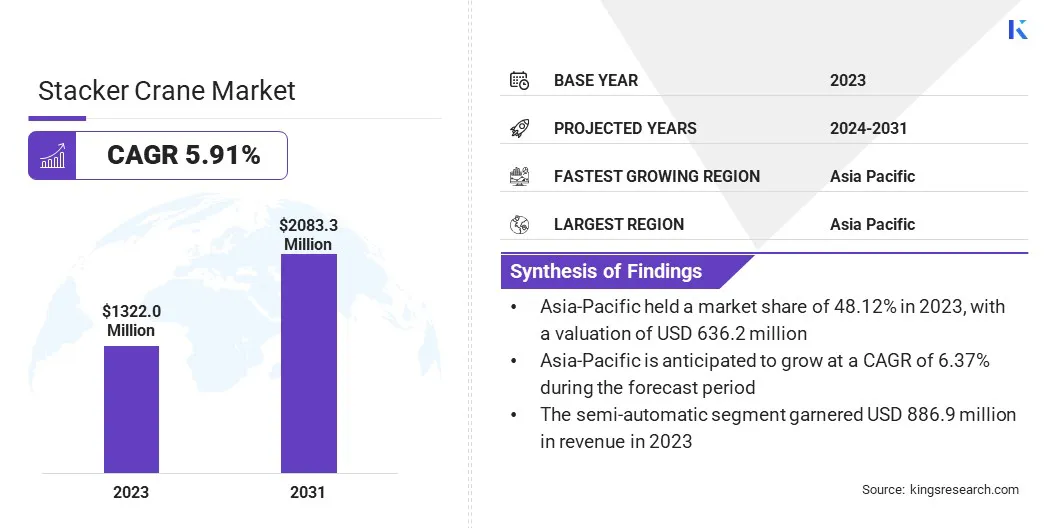

Global stacker crane market size was valued at USD 1,322.0 million in 2023, which is estimated to be valued at USD 1,393.5 million in 2024 and reach USD 2,083.3 million by 2031, growing at a CAGR of 5.91% from 2024 to 2031.

Labor cost reduction is a key factor driving the growth of the market. Automation minimizes the need for manual labor, reducing personnel costs while enhancing operational efficiency, speed, and accuracy in material handling, leading to higher productivity in warehouses and distribution centers.

Major companies operating in the global stacker crane industry are Daifuku Co., Ltd., Murata Machinery USA, Swisslog Holding, Mecalux, S.A, American Crane & Equipment Corporation, ME-JAN d.o.o., Jungheinrich AG, Demag Cranes & Components GmbH, Kardex, Alstef Group, ATS Group, MIAS, Körber AG, Toyota Industries Corporation, ElectroMech Material Handling Systems (India) Pvt. Ltd., and others.

The market is rapidly evolving as businesses increasingly adopt automated solutions for material handling. These advanced systems, designed to optimize storage and retrieval processes, offer enhanced operational efficiency, precision, and scalability.

As industries focus on improving warehouse management and reducing manual labor, stacker cranes are becoming essential in modern logistics and distribution centers. The market witnesses a notable shift toward automation, with increased demand for faster, more reliable solutions to meet the needs of various sectors, including e-commerce and manufacturing.

Market Driver

"Growth of E-Commerce"

The growth of e-commerce is fueling the expansion of the stacker crane market, rising demand for faster and more efficient warehousing solutions.

As e-commerce companies expand their operations to meet increasing customer expectations for quick deliveries, the need for automated systems, such as stacker cranes, has surged.

These cranes enhance storage efficiency, reduce retrieval times, and optimize warehouse space, allowing companies to handle large inventories swiftly. As the e-commerce sector continues to grow, the demand for advanced automated material handling solutions, including stacker cranes, is estimated to rise.

Market Challenge

"Ensuring System Reliability"

A major challenge hampering the growth of the stacker crane market is maintaining system reliability and minimizing downtime. As stacker cranes are vital for continuous warehouse operations, even minor malfunctions can cause significant disruptions.

This challenge can be addressed through integrating predictive maintenance technologies with IoT sensors and data analytics to monitor crane performance in real time.

By identifying potential issues before they occur, businesses can schedule maintenance proactively, reducing unplanned downtime, improving system reliability, and increasing overall efficiency.

Market Trend

"Surging Adoption of Automated Stacker Cranes"

Automation in stacker cranes is transforming industries like e-commerce and manufacturing by enhancing warehouse efficiency and reducing labor costs. Automated systems streamline storage and retrieval processes, improving throughput, minimizing errors, and optimizing space utilization.

These cranes speed up inventory handling, enabling faster order fulfillment and production timelines. Additionally, they offer scalability, supporting business growth without adding labor. As AI and sensors advance, stacker cranes will become even more efficient, with predictive maintenance and improved decision-making capabilities.

|

Segmentation |

Details |

|

By Type |

Single-Column Stacker Crane, Double-Column Stacker Crane |

|

By Load Capacity |

Light-Duty (Up to 500 kg), Medium-Duty (500 kg – 2,000 kg), Heavy-Duty (Above 2,000 kg) |

|

By Operation Mode |

Semi-Automatic, Fully Automatic |

|

By End-User Industry |

Automotive, E-Commerce & Retail, Food & Beverage, Pharmaceuticals, Logistics & Warehousing, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific stacker crane market share stood at around 48.12% in 2023, valued at USD 636.2 million. This dominance is reinforced by rapid industrialization, urbanization, and expansion of e-commerce in key economies such as China, Japan, and India.

The region's manufacturing and logistics sectors are increasingly adopting automated solutions to streamline operations. Additionally, the growing need for efficient inventory management in industries such as automotive, electronics, and retail is creating a robust demand for stacker cranes.

Cost-effective manufacturing and technological advancements further position Asia-Pacific as the largest market for stacker cranes.

North America stacker crane industry is likely to grow at a CAGR of 5.89% over the forecast period. This rapid growth is bolstered by advancements in automation and the expansion of e-commerce. The demand for efficient warehousing solutions in industries such as logistics, retail, and automotive is fueling regional market growth.

Additionally, the region's increasing focus on reducing labor costs and improving warehouse productivity through automation is accelerating adoption. Investments in smart warehouses and infrastructure upgrades are propelling the demand for stacker cranes in North America.

In the stacker crane industry, companies are forming strategic partnerships to enhance technological capabilities and expand market reach.

These collaborations focus on integrating automation, improving crane efficiency, and offering innovative solutions for various industries, reducing operational costs, boosting productivity, and meeting the growing demand for advanced material handling systems in logistics and warehousing sectors.

Recent Developments (Partnership)

Frequently Asked Questions