Energy and Power

Sterilization Services Market

Sterilization Services Market Size, Share, Growth & Industry Analysis, By Method [Ethylene Oxide Sterilization, Gamma Radiation Sterilization, Electron Beam Sterilization, Steam Sterilization, Hydrogen Peroxide Sterilization], By End Use Industry, By Mode of Delivery, By Service Type, and Regional Analysis, 2024-2031

Pages : 160

Base Year : 2023

Release : February 2025

Report ID: KR461

Market Definition

The market involves processes designed to eliminate harmful microorganisms from various products and materials. These services ensure safety, quality, and compliance across multiple industries, focusing on infection control, product integrity, and meeting stringent regulatory standards for public health and consumer protection.

Sterilization Services Market Overview

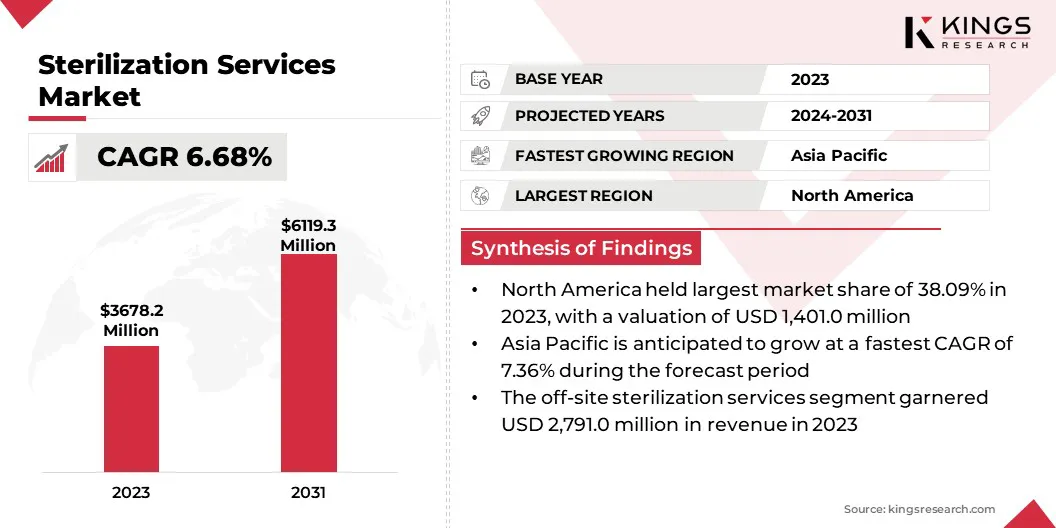

The global sterilization services market size was valued at USD 3,678.2 million in 2023, which is estimated to be valued at USD 3,892.7 million in 2024 and reach USD 6,119.3 million by 2031, growing at a CAGR of 6.68% from 2024 to 2031. Growing awareness of patient safety and the need to prevent hospital-acquired infections (HAIs) is driving the demand for high-quality sterilization services, ensuring safer healthcare environments and improved patient outcomes across healthcare settings.

Major companies operating in the sterilization services industry are STERIS, E-BEAM Services, Inc, Europlaz, Sotera Health Company, BGS Beta-Gamma-Service GmbH & Co., Avantti Medi Clear, Prince Sterilization Services, LLC, Servizi Italia Spa, Medistri SA, Steripure, CRETEX Medical, Scapa, Midwest Sterilization Corporation, Microtrol Sterilisation Services Pvt Ltd., and ClorDiSys Solutions Inc.

The market is evolving rapidly, driven by the increasing need for effective infection control in healthcare settings. Healthcare systems prioritize patient safety, which is increasing the demand for professional sterilization services across hospitals, clinics, pharmaceutical, and biotechnology sectors.

These services are essential in maintaining the highest standards of hygiene and preventing cross-contamination. The market is marked by a variety of service providers offering advanced sterilization technologies to meet the growing expectations for safe and effective healthcare environments.

- In September 2024, BGS US advanced sterilization with state-of-the-art electron accelerator technology in Pittsburgh. Set to open in 2025, the facility aims to enhance e-beam sterilization capacity, addressing the demand for efficient, automated sterilization solutions in the U.S.

Key Highlights:

- The sterilization services industry size was valued at USD 3,678.2 million in 2023.

- The market is projected to grow at a CAGR of 6.68% from 2024 to 2031.

- North America held a market share of 38.09% in 2023, with a valuation of USD 1,401.0 million.

- The Ethylene Oxide (EtO) sterilization segment garnered USD 1,571.7 million in revenue in 2023.

- The healthcare & medical devices segment is expected to reach USD 3,129.2 million by 2031.

- The on-site sterilization services segment is anticipated to register a CAGR of 7.31% during the forecast period.

- The contract sterilization services segment is expected to hold a market share of 69.58% in 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.36% during the forecast period.

Market Driver

“COVID-19 Impact: Boosting Sterilization Demand in Healthcare”

The COVID-19 pandemic has significantly heightened the awareness of sterilization and sanitation, particularly within healthcare settings.

- According to the World Health Organization (WHO), the total number of cumulative deaths from COVID-19 reached 7.1 million, with the majority of fatalities occurring in individuals aged 65 and older.

The urgent need to prevent the spread of infectious diseases has driven a surge in demand for sterilization services across hospitals, clinics, and other medical facilities. Healthcare providers focus on ensuring safety and reducing the risk of cross-contamination, leading to a marked increase in the adoption of advanced sterilization technologies, further accelerating the growth of the sterilization services market.

- In May 2023, Boulder Sterilization introduced contract chlorine dioxide (CD) sterilization services, becoming the only sterilizer globally to offer both CD and EtO technologies. This innovation enhances flexibility, speed, and cost-efficiency in meeting urgent sterilization demands.

Market Challenge

“Environmental Concerns and the Shift to Sustainable Sterilization Solutions”

EtO sterilization faces increasing scrutiny, due to its environmental impact, forcing the sterilization services market to seek greener alternatives.

- In January 2023, Sotera Health Company announced that its subsidiaries reached agreements to settle over 870 EtO cases, agreeing to pay USD 408 million. The settlement aims to resolve legal challenges while enabling the company to focus on its mission of safeguarding global health.

Solutions such as chlorine dioxide (CD) and e-beam sterilization are emerging as viable options, offering environmentally friendly and effective alternatives. Companies must invest in these sustainable technologies to meet regulatory requirements, reduce environmental harm, and provide safe sterilization services without compromising performance. Continuous innovation and adaptation to eco-friendly methods are essential for long-term growth and sustainability in the market.

Market Trend

“Technological Advancements in Sterilization Services”

The sterilization services market is undergoing significant technological advancements, including automation and enhanced monitoring systems. These innovations are improving efficiency, reducing human error, and accelerating turnaround times for medical device sterilization. With the growing demand for faster and more reliable sterilization processes, these technologies play a key role in enhancing productivity while ensuring high-quality standards.

The integration of advanced systems helps companies meet regulatory requirements and maintain the safety of products, further driving growth in the market.

- In Oct 2024, AptarGroup, Inc. secured a U.S. Federal Government contract to advance its ActivShield sterilization technology. This innovative, power-free solution sterilizes medical devices in remote settings, reducing reliance on traditional methods and offering a versatile alternative to EtO.

Sterilization Services Market Report Snapshot

|

Segmentation |

Details |

|

By Method |

Ethylene Oxide (EtO) Sterilization, Gamma Radiation Sterilization, Electron Beam (E-Beam) Sterilization, Steam Sterilization (Autoclaving), Hydrogen Peroxide Sterilization |

|

By End Use Industry |

Healthcare & Medical Devices, Pharmaceutical & Biotechnology, Food & Beverage, Industrial & Others |

|

By Mode of Delivery |

Off-Site Sterilization Services, On-Site Sterilization Services |

|

By Service Type |

Contract Sterilization Services, In-house Sterilization Services |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Method [Ethylene Oxide (EtO) Sterilization, Gamma Radiation Sterilization, Electron Beam (E-Beam) Sterilization, Steam Sterilization (Autoclaving), and Hydrogen Peroxide Sterilization]: The Ethylene Oxide (EtO) sterilization segment earned USD 1,571.7 million in 2023, due to its broad applications in medical device sterilization.

- By End Use Industry (Healthcare & Medical Devices, Pharmaceutical & Biotechnology, Food & Beverage, Industrial & Others): The healthcare & medical devices segment held 56.09% share of the market in 2023, due to the growing demand for sterilized medical products and devices.

- By Mode of Delivery (Off-site Sterilization Services, On-site Sterilization Services): The off-site sterilization services segment is projected to reach USD 4,574.5 million by 2031, owing to the increasing outsourcing of sterilization services for cost efficiency and scalability.

- By Service Type (Contract Sterilization Services, In-house Sterilization Services): The in-house sterilization services segment is anticipated to register a CAGR of 6.81% during the forecast period, due to the rising demand for streamlined, internal sterilization processes in healthcare and industrial sectors.

Sterilization Services Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 38.09% market share in 2023, with a valuation of USD 1,401.0 million. North America is the dominant region in the sterilization services market, driven by advanced healthcare infrastructure, strict regulatory standards, and high demand for sterilized medical devices. The region’s well-established healthcare and pharmaceutical industries, particularly in the U.S. and Canada, require effective sterilization methods like EtO and gamma radiation.

.webp)

Additionally, ongoing technological advancements and rising concerns about infection control contribute to the market growth. With a focus on safety and quality, North America remains the leader in sterilization services globally.

- In Oct 2024, STERIS announced the construction of a new electron beam processing facility in Edmonton, Alberta, Canada dedicated to processing cannabis products. This expansion supports growing demand in Canada and reinforces STERIS's commitment to providing global, technology-neutral sterilization services.

The sterilization services industry in Asia Pacific is poised for significant growth over the forecast period at a CAGR of 7.36%. Asia Pacific is the fastest-growing region in the market, fueled by increasing healthcare investments, rising healthcare access, and rapid urbanization. Countries like China, India, and Japan are registering a surge in medical device production and pharmaceutical industries, driving the demand for sterilization services.

The region also benefits from a growing focus on infection control and safety standards, alongside cost-effective sterilization solutions. The sterilization market in Asia Pacific is projected to expand significantly over the coming years as economic development accelerates.

- In July 2024, STERIS announced a new EtO processing facility in Singapore through a partnership with TOMOE SHOKAI CO., Ltd. This facility expands STERIS's global network, offering enhanced technology-neutral processing options and supporting medical device manufacturing across the APAC region.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) is responsible for protecting public health by ensuring the safety, efficacy, and security of human and veterinary drugs, biological products, and medical devices; and by ensuring the safety of our nation's food supply, cosmetics, and products that emit radiation.

- The European Medicines Agency (EMA) is a decentralised agency of the European Union (EU). It is responsible for the scientific evaluation, supervision and safety monitoring of medicines.

- In India, the Central Drugs Standard Control Organization (CDSCO) has regulatory control over the import of drugs, approval of new drugs, clinical trials, and regulation of medical devices, including those requiring sterilization.

Competitive Landscape:

The global sterilization services market is characterized by a large number of participants, including established corporations and rising organizations. Competitors in the market are forming strategic partnerships to expand service offerings and enhance technological capabilities. These collaborations often involve funding from private equity firms to support innovation, infrastructure development, and market expansion.

Companies aim to meet growing demand, improve efficiency, and offer diverse sterilization solutions across various industries globally by combining their expertise and resources.

- In June 2024, Vance Street Capital partnered with Prince Sterilization Services to support growth in pharmaceutical and medical device sterilization. The strategic partnership enhances Prince's eco-friendly offerings, including VHP sterilization. Funding from Apogem Capital and Bank of Montreal supports expanded capabilities and market expansion.

List of Key Companies in Sterilization Services Market:

- STERIS

- E-BEAM Services, Inc

- Europlaz

- Sotera Health Company

- BGS Beta-Gamma-Service GmbH & Co.

- Avantti Medi Clear

- Prince Sterilization Services, LLC

- Servizi Italia Spa

- Medistri SA

- Steripure

- CRETEX Medical

- Scapa

- Midwest Sterilization Corporation

- Microtrol Sterilisation Services Pvt Ltd.

- ClorDiSys Solutions Inc

Recent Developments (Acquisition)

- In March 2023, Getinge acquired 100% of Ultra Clean Systems Inc., a U.S.-based manufacturer of ultrasonic cleaning technologies. The acquisition expands Getinge's sterile reprocessing offerings in North America and enhances service continuity for robotic surgery instrument decontamination.

- In June 2023, STERIS announced the acquisition of surgical instrumentation, laparoscopic instrumentation, and sterilization container assets from Becton, Dickinson and Company for USD 540 million. This acquisition strengthens STERIS's healthcare product offerings, enhancing its value to healthcare customers in the operating room and sterile processing departments.

- In January 2024, Allentown acquired ClorDiSys to expand its presence in the global biomedical research and life science markets. The acquisition enhances Allentown’s decontamination, disinfection, and sterilization services, aligning with its commitment to innovation and customer-focused solutions in life sciences.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years

.webp)