Buy Now

Substation Automation Market Size, Share, Growth & Industry Analysis, By Component (Hardware, Software, Service), By Type (Transmission Substation, Distribution Substation), By Technology (New, Retrofit), By End-use Industry (Utilities, Data Centers & Cloud Campuses, Oil & Gas, Mining, Transportation), and Regional Analysis, 2025-2032

Pages: 210 | Base Year: 2024 | Release: July 2025 | Author: Sunanda G.

Substation automation systems are digital platforms that manage, control, and protect electrical substations using intelligent electronic devices, communication networks, and advanced software. These systems enable real-time monitoring, remote operation, and data-driven decision-making, improving the efficiency and safety of power grid operations.

The market focuses on the formulation of digital substations, advanced protection schemes, and cybersecurity measures. Substation automation is widely used in power transmission networks, industrial plants, and renewable energy integration, ensuring operational efficiency, reduced downtime, and enhanced grid resilience through automation, remote operation, and predictive maintenance solutions.

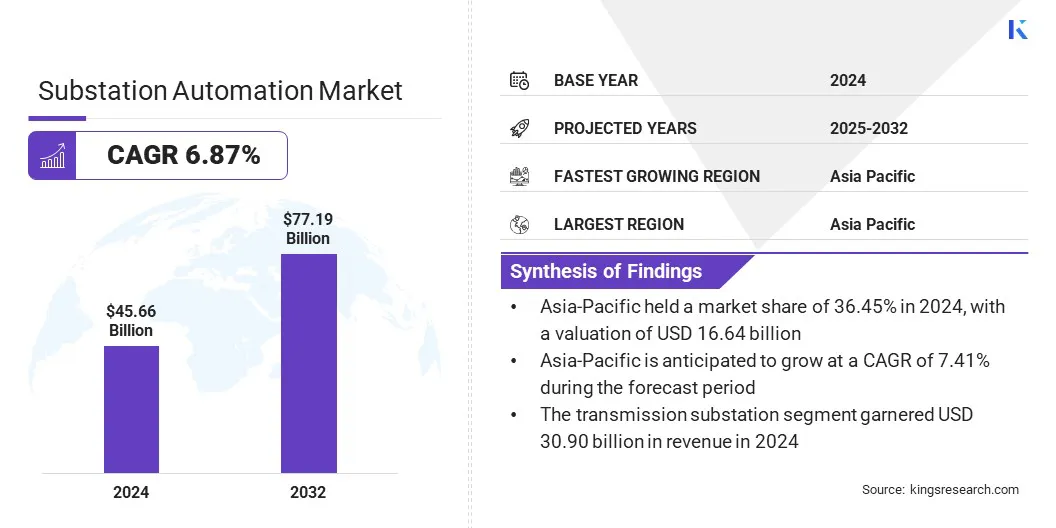

The global substation automation market size was valued at USD 45.66 billion in 2024 and is projected to grow from USD 48.47 billion in 2025 to USD 77.19 billion by 2032, exhibiting a CAGR of 6.87% during the forecast period.

The market is driven by increasing investments in grid modernization and the integration of renewable energy sources. Utilities are adopting advanced digital solutions to enhance grid reliability, efficiency, and security. Additionally, the rising focus on cybersecurity in energy infrastructure is accelerating the deployment of automation technologies, ensuring secure and resilient power distribution systems in response to evolving threats and regulatory requirements.

Major companies operating in the substation automation market are ABB, Schneider Electric SE, Siemens, General Electric, Hitachi Energy Ltd., Yokogawa Electric Corporation, Rockwell Automation, Inc., Cisco, Schweitzer Engineering Laboratories, Inc., Eaton, Mitsubishi Electric Corporation, Honeywell International Inc., Trilliant Holdings Inc., Alstom SA, and S&C Electric Company.

Substation Automation Market Report Scope

Substation Automation Market Report Scope|

Segmentation |

Details |

|

By Component |

Hardware, Software, and Service |

|

By Type |

Transmission Substation, and Distribution Substation |

|

By Technology |

New, and Retrofit |

|

By End-use Industry |

Utilities, Data Centers & Cloud Campuses, Oil & Gas, Mining, Transportation, and Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted substation automation market share stood around 36.45% in 2023, with a valuation of USD 16.64 billion. The market in the region is registering rapid growth, due to large-scale investments in power infrastructure by governments in China, India, Indonesia, Vietnam, and the Philippines.

Expanding industrial zones, urban developments, and electrification of rural areas require modernized substations with automation, remote monitoring, and real-time data analytics. National initiatives such as China’s Belt and Road Initiative (BRI) and India’s Revamped Distribution Sector Scheme (RDSS) are accelerating the deployment of automated substations to ensure efficient and reliable power transmission.

Furthermore, countries like Japan, South Korea, China, and Singapore are leading in smart manufacturing and Industry 4.0, driving the demand for automated power substations. With manufacturing hubs integrating AI, IoT, and cloud computing, automated substations help optimize power usage, reduce downtime, and enhance operational resilience.

The substation automation industry in North America is poised for significant growth at a robust CAGR of 7.03% over the forecast period. The market is fueled by the demand for cyber-secure digital substations that enhance grid reliability and data security in the region.

The substation automation industry in North America is poised for significant growth at a robust CAGR of 7.03% over the forecast period. The market is fueled by the demand for cyber-secure digital substations that enhance grid reliability and data security in the region.

North America’s critical power infrastructure is increasingly vulnerable to cyberattacks, prompting utilities to integrate secure substation automation technologies. Additionally, the increasing adoption of IoT, AI, and cloud-based analytics is reshaping the market in North America.

Smart grid initiatives encourage the deployment of digital substations equipped with intelligent sensors, automated switching systems, and remote diagnostics. 5G connectivity and edge computing are further improving real-time grid monitoring, predictive maintenance, and fault detection, driving substantial investments in automated substation solutions.

The growing shift toward smart grids is driving the market. Utilities are adopting automation technologies to enable real-time monitoring, data-driven decision-making, and improved operational efficiency. Smart grids require advanced automation solutions to enhance power distribution, optimize load management, and ensure uninterrupted electricity supply.

Governments and regulatory bodies are investing in smart grid projects, further accelerating the deployment of substation automation solutions to modernize energy infrastructure and enhance overall grid performance.

Adoption of Digital Substations

The shift from traditional substations to digital substations is accelerating the growth of the substation automation market. Digital substations replace conventional copper wiring with fiber-optic communication, enhancing reliability and reducing operational costs. Digital substations improve real-time monitoring, asset management, and fault detection, enhancing power system efficiency.

Utilities and industrial operators are increasingly adopting digital solutions to improve operational resilience, minimize maintenance costs, and enhance the flexibility of energy networks in response to evolving power demands.

Cybersecurity Risks in Substation Automation

A significant challenge in the growth of the substation automation market is the increasing risk of cyber threats targeting critical power infrastructure. Such vulnerabilities to cyberattacks pose a serious threat to grid stability and security as substations become more digitalized and interconnected.

Companies are implementing advanced cybersecurity solutions, including encryption, multi-layered authentication, and intrusion detection systems. Compliance with regulatory cybersecurity frameworks such as NERC CIP and IEC 62443 is also being prioritized. Additionally, organizations are investing in AI-driven threat detection and real-time monitoring to enhance resilience against evolving cyber threats.

Modernization of Aging Power Infrastructure

Modernization of aging power infrastructure is accelerating the adoption of substation automation systems by replacing outdated equipment with intelligent, digital solutions. Utilities are upgrading legacy substations to improve grid reliability, enable predictive maintenance, and integrate renewable energy sources. These upgrades enhance operational efficiency and support the transition to smarter, more resilient energy networks.

The trend also aligns with global efforts to future-proof power infrastructure against rising demand and evolving grid challenges. Automated substations play a critical role in ensuring a stable electricity supply, supporting economic growth and meeting the increasing demand for efficient power distribution.

The substation automation industry is characterized by market players that are actively adopting strategies focused on advancements in digital substation technology to enhance grid efficiency, reliability, and automation.

By integrating next-generation process interface units and modular digital solutions, companies are streamlining substation operations, reducing infrastructure complexity, and improving interoperability. These innovations are accelerating the shift toward fully digital substations, reinforcing their role in modern grid infrastructure. As a result, such strategic advancements are significantly contributing to the growth of the market.

Frequently Asked Questions