Buy Now

System Integrator Market Size, Share, Growth & Industry Analysis, By Service (Infrastructure Integration, Application Integration, Consulting), By End User (Oil & Gas, Automotive, Aerospace & Defense, Healthcare, Energy & Power, Chemical, Others), and Regional Analysis, 2025-2032

Pages: 150 | Base Year: 2024 | Release: July 2025 | Author: Sharmishtha M.

System integrators design and implement complex IT solutions by combining hardware, software, networking, and storage components into a unified system. Their expertise ensures seamless interoperability and optimized performance across various technologies and platforms.

The market covers a wide range of services, including consulting, infrastructure integration, application integration, and data management. These solutions are used across manufacturing, energy, defense, healthcare, and telecommunications industries to streamline operations, improve efficiency, and support digital transformation initiatives.

System Integrator Market Overview

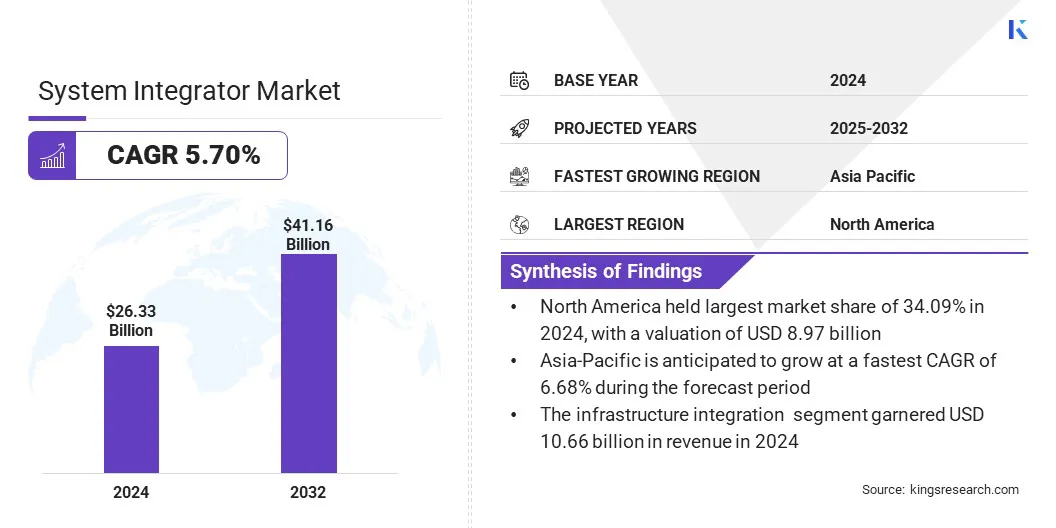

The global system integrator market size was valued at USD 26.33 billion in 2024 and is projected to grow from USD 27.78 billion in 2025 to USD 41.16 billion by 2032, exhibiting a CAGR of 5.70% during the forecast period.

Market growth is fueled by the increasing need for cohesive information technology ecosystems across industries such as manufacturing, healthcare, energy, and telecommunications. Increasing enterprise focus on optimizing operational efficiency, enhancing interoperability, and enabling seamless data flow is driving the adoption of system integration services.

Key Highlights

Major companies operating in the system integrator market are Accenture, NTT DATA Group Corporation, The RoviSys Company, Prime Controls, LP, Deloitte, TATA Consultancy Services Limited, Quad Plus, Infosys Limited, IBM, ANDRITZ, Wunderlich-Malec Engineering, Inc., John Wood Group PLC, ATS Corporation, Tesco Controls, and Capgemini.

The growing emphasis on digital transformation, automation, and real-time data analytics is supporting market expansion. Continuous advancements in cloud computing, industrial Internet of Things (IoT), artificial intelligence, and increasing investments in smart infrastructure projects are also accelerating market development.

The growing emphasis on digital transformation, automation, and real-time data analytics is supporting market expansion. Continuous advancements in cloud computing, industrial Internet of Things (IoT), artificial intelligence, and increasing investments in smart infrastructure projects are also accelerating market development.

Market Driver

Increasing Complexity of Enterprise IT Environments

The progress of the system integrator market is propelled by the growing complexity of enterprise IT environments across industries. Organizations manage and expand a mix of applications, platforms, and infrastructures that span on-premises systems, cloud services, and hybrid models. They also coordinate with multiple vendors, technologies, and data sources to maintain seamless operations and support business agility.

This shift is further supported by the rising need for real-time data accessibility, enhanced cybersecurity, and compliance. The increasing complexity of technology ecosystems is compelling organizations to engage system integrators that can deliver comprehensive, secure, and scalable integration solutions, thereby accelerating market expansion.

Market Challenge

Complexities in Ensuring Seamless Integration Across Multiple Vendors

The system integrator market is influenced by the complexities involved in achieving seamless integration across multiple vendors. Organizations often operate diverse technology stacks sourced from various hardware, software, and service providers, each with unique compatibility and interoperability requirements.

Inconsistencies in protocols, frequent vendor-specific updates, and differing architectural frameworks contribute to integration difficulties. These complications can disrupt system performance, increase project timelines, and elevate operational risks.

To manage these complexities, system integrators are developing standardized integration frameworks and employing advanced middleware solutions. They are also enhancing cross-platform expertise, adopting automation tools, and establishing strong vendor partnerships to ensure alignment across systems.

Additionally, continuous monitoring, proactive maintenance, and adaptive integration strategies are being utilized to sustain long-term interoperability and system efficiency.

Proliferation of IoT/IIoT & Edge Computing Integration

The market is being shaped by the proliferation of Internet of Things (IoT) and Industrial Internet of Things (IIoT) technologies that enable real-time monitoring, automation, and data-driven decision-making. Industries such as manufacturing, healthcare, and energy are adopting edge computing to process data closer to devices, reduce latency, and improve responsiveness.

Enterprises are integrating large networks of sensors and connected equipment, creating complex data flows that demand seamless and secure system coordination. In response, system integrators are delivering advanced integration solutions that combine IoT platforms, edge infrastructure, and centralized systems into scalable architectures to meet evolving business needs.

|

Segmentation |

Details |

|

By Service |

Infrastructure Integration, Application Integration, and Consulting |

|

By End User |

Oil & Gas, Automotive, Aerospace & Defense, Healthcare, Energy & Power, Chemical, and Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

.webp) The North America system integrator market share stood at 34.09% in 2024, valued at USD 8.97 billion. This dominance is attributed to the region’s advanced technology infrastructure, strong adoption of digital transformation initiatives, and substantial investments in automation and smart industry solutions.

The North America system integrator market share stood at 34.09% in 2024, valued at USD 8.97 billion. This dominance is attributed to the region’s advanced technology infrastructure, strong adoption of digital transformation initiatives, and substantial investments in automation and smart industry solutions.

The presence of major system integrators and a well-established network of technology providers enhance the delivery of comprehensive integration services. Regulatory standards supporting data security, interoperability, and system reliability further strengthen market activity.

Furthermore, the growing focus on cybersecurity, cloud integration, and real-time data analytics drives innovation and adoption of system integration solutions across industries.

The Asia-Pacific system integrator industry is set to grow at a CAGR of 6.68% over the forecast period. This growth is attributed to rapid industrialization, expanding manufacturing capabilities, and the increasing adoption of automation technologies across key sectors.

The rising demand for digital infrastructure driven by growing small and medium-sized enterprises and emerging technology hubs is further accelerating market development. Government initiatives aimed at modernizing industries, enhancing energy efficiency, and promoting smart city projects are creating a strong demand for system integration services.

Collaborations between global technology providers, local system integrators, and research institutions, along with advancements in IoT and edge computing technologies are strengthening integration capabilities and supporting regional market growth.

The system integrator industry consists of a broad range of established multinational companies and specialized regional players. These players are actively working to broaden their service offerings and expand their global presence through innovation, diversification, and strategic acquisitions.

Leading companies are heavily investing in research and development to enhance integration capabilities across emerging technologies such as cloud computing, artificial intelligence, industrial Internet of Things (IIoT), and cybersecurity. They are also developing industry-specific solutions tailored to sectors like manufacturing, healthcare, energy, and automotive to address complex integration needs and regulatory requirements.

Moreover, firms are forming partnerships with technology providers, software vendors, and consulting firms to strengthen service offerings, improve operational efficiency, and accelerate market expansion.

Frequently Asked Questions