Buy Now

Transparent Solar Cells Market Size, Share, Growth & Industry Analysis, By Type (Thin-film Photovoltaics (TPV), Polymer Solar Cell, Others), By Transparency (Partial, Full), By Application (Building Integrated Photovoltaics (BIPV), Automobile) and Regional Analysis, 2025-2032

Pages: 170 | Base Year: 2024 | Release: July 2025 | Author: Versha V.

Transparent solar cells are photovoltaic devices that generate electricity from sunlight while allowing visible light to pass through. This dual functionality makes them ideal for integration into glass surfaces without obstructing visibility.

The technology includes both organic and inorganic cell types, enabling power generation through clear or semi-clear panels. Manufacturers and system integrators are targeting applications in commercial buildings, automotive glass, and portable electronics by embedding these cells into windows and structural elements.

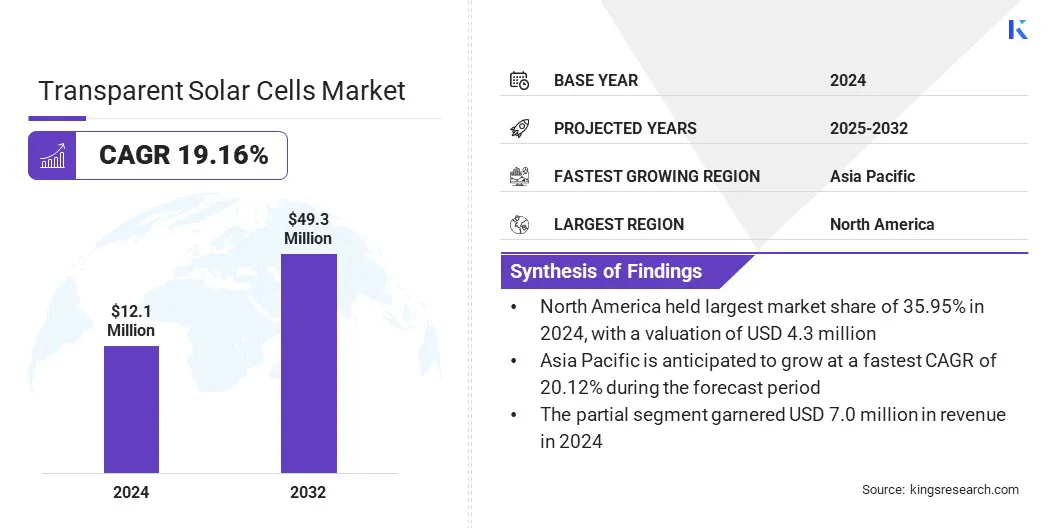

The global transparent solar cells market size was valued at USD 12.1 million in 2024 and is projected to grow from USD 14.4 million in 2025 to USD 49.3 million by 2032, exhibiting a CAGR of 19.16% during the forecast period.

The market is witnessing significant growth, driven by the rising demand for clean energy integration in modern infrastructure. The increasing adoption of building-integrated photovoltaics (BIPV) in commercial and institutional buildings is a key factor fueling market expansion.

Major companies operating in the transparent solar cells market are Ubiquitous Energy, SolarWindow Technologies, Inc., Onyx Solar Group LLC, Polysolar Ltd, Heliatek GmbH, BRITESOLAR, SHARP CORPORATION, GLAShern, SolarScape Enterprises LLP, Solar First Energy Technology Co., Ltd., Hanergy, Solaronix SA, AGC Group, Qcells, and Tata Group.

|

Segmentation |

Details |

|

By Type |

Thin-film Photovoltaics (TPV), Polymer Solar Cell, Others |

|

By Transparency |

Partial, Full |

|

By Application |

Building Integrated Photovoltaics (BIPV), Automobile, Consumer Electronics, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America accounted for a substantial market share of 35.95% in 2024 in the transparent solar cells market, with a valuation of USD 4.3 million. The region leads the global market due to strong R&D activity and a well-established ecosystem of research institutions, universities, and startups focused on advancing transparent solar technologies.

The U.S. drives innovation through active collaborations and prototype development. Additionally, significant investments from major technology companies in sustainable infrastructure further accelerate deployment.

These factors collectively support large-scale adoption and reinforce North America's dominant position in the transparent solar cell industry.

The transparent solar cells industry in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 20.12% over the forecast period. The growth is driven by the rising adoption of building-integrated photovoltaics (BIPV) in commercial and institutional buildings.

Countries across the region are integrating energy-generating materials into new construction to improve energy efficiency and lower reliance on conventional power sources.

Demand for transparent solar technologies is rising in urban areas, where contemporary architectural designs increasingly emphasize sustainability. Developers of commercial and institutional buildings are integrating transparent solar glazing into facades, skylights, and curtain walls to support energy efficiency goals.

Building-integrated photovoltaics (BIPV) are becoming a priority in these projects to meet green building standards and optimize available surface area for power generation. These trends are accelerating the adoption of transparent solar technologies and contributing to market growth across the region.

Advancements in transparent and semi-transparent solar cell technologies, particularly in terms of cell transparency and energy conversion efficiency, make them suitable for integration into windows and building facades. Additionally, their growing use in automotive displays and portable electronics is contributing to market growth.

Government Policies Promoting Integration of Advanced Solar Technologies

The market is gaining momentum due to strong government incentives and evolving regulatory frameworks that promote clean energy integration within urban infrastructure. These policies promote clean energy integration by supporting next-generation technologies such as transparent and lightweight photovoltaics.

Moreover, governments are increasingly offering tax incentives, installation subsidies, and net-zero building mandates to accelerate deployment of transparent solar technologies.

This support is encouraging the integration of building-integrated solar systems into commercial and residential projects. As a result, transparent solar technologies are gaining wider acceptance across modern urban developments.

Low Power Conversion Limits Large-Scale Application

A major challenge in the transparent solar cells market is the lower power conversion efficiency compared to traditional silicon-based panels. Maintaining transparency limits visible light absorption, reducing energy output. To address this, market players are actively investing in advanced material development and tandem cell architectures.

Companies and research institutions are focusing on perovskite-based tandem structures that combine a transparent perovskite layer with an additional absorber, such as an organic or thin-film material. This design captures a broader spectrum of sunlight, including infrared, to improve efficiency without compromising transparency.

Industry players are also optimizing transparent electrode materials and refining deposition techniques to enhance scalability and performance. These efforts are helping close the efficiency gap and support wider adoption of transparent solar technologies in building-integrated and space-constrained applications.

Increased Use of Transparent Solar Panels in Sustainable Residential Buildings

The market is growing due to the rising adoption of building-integrated photovoltaics (BIPV) in sustainable residential construction. Transparent solar panels are being integrated into windows, building exteriors, and balcony railings to support clean energy generation without compromising natural light or design aesthetics.

These systems help reduce grid dependence while aligning with energy-efficiency standards in modern housing. Governments and developers are prioritizing low-emission construction, which boosts demand for BIPV technologies.

Transparent solar cells enable energy generation within the structural components of homes, offering an efficient solution for space-constrained urban settings.

Companies in the transparent solar cells market are focusing on strategic collaborations and technology development to enhance product performance. Key players are partnering with universities, research institutes, and material technology firms to co-develop advanced cell architectures that improve both transparency and energy efficiency.

These collaborations help accelerate prototype development and bring solutions to market faster. In parallel, companies are investing in R&D to optimize materials, lower manufacturing costs, and facilitate seamless integration with glass and other building components.

Such efforts are driving commercialization and expanding applications in construction, automotive, and consumer electronics sectors.

Frequently Asked Questions