Energy and Power

Tubular Solar Collector Market

Tubular Solar Collector Market Size, Share, Growth & Industry Analysis, By Type (Evacuated tube collectors, Air-type vacuum-tube solar collectors), By Application (Residential, Commercial, Industrial), and Regional Analysis, 2024-2031

Pages : 180

Base Year : 2023

Release : February 2025

Report ID: KR1398

Market Definition

The tubular solar collector market encompasses the production, distribution, and application of solar thermal systems utilizing cylindrical tubes to convert solar energy into heat.

These collectors typically consist of evacuated glass tubes that absorb solar radiation and transfer the captured thermal energy to a heat transfer fluid, such as water or air. The vacuum between the inner and outer tubes minimizes heat loss, thereby enhancing efficiency, particularly in low-light conditions and colder climates.

Tubular Solar Collector Market Overview

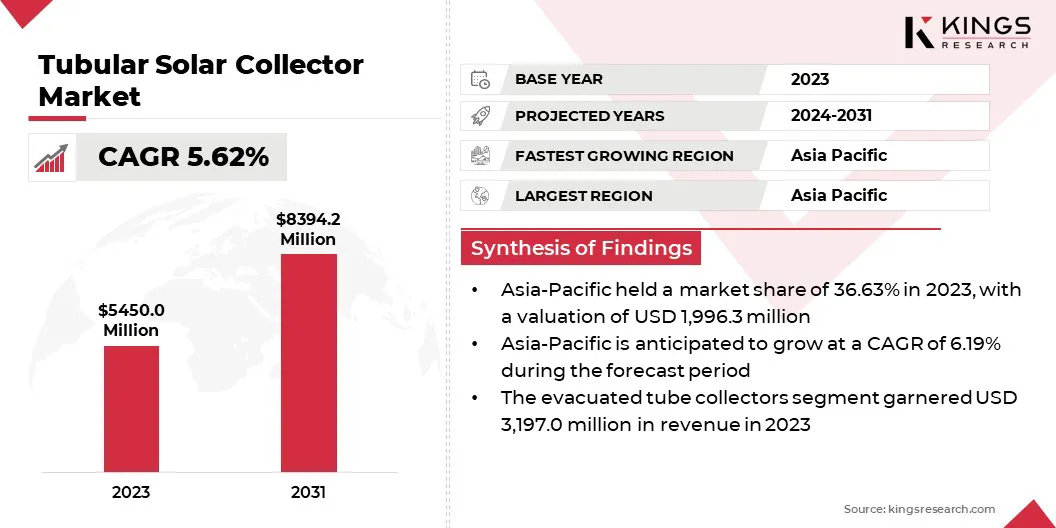

The global tubular solar collector market size was valued at USD 5,450.0 million in 2023 and is projected to grow from USD 5,724.1 million in 2024 to USD 8,394.2 million by 2031, exhibiting a CAGR of 5.62% during the forecast period.

This growth is attributed to the increasing adoption of solar thermal systems across residential, commercial, and industrial sectors, supported by the global transition to renewable energy sources and energy-efficient technologies.

This expansion is further stimulated by several key factors, including the implementation of government incentives and subsidies, ongoing advancements in solar technology, and growing environmental awareness, fostering carbon reduction and sustainable energy solutions.

Major companies operating in the global tubular solar collector Industry are TVP Solar, Sunmaster, Solar Solutions LLC, Thermomax Marketing Group, SunMaxx Solar, Solarbayer, Jiangsu SolarEast Energy Storage Technology Co. LTD, Sunmaxx PVT GmbH, SolarWinds Worldwide, sunrain, Solimpeks, Apex Solar, SCHOTT, Solimpeks, First Solar, and others.

The increasing integration of solar thermal systems with other renewable technologies, such as solar photovoltaic (PV) systems, is anticipated to bolster market growth. The demand for high-efficiency, low-maintenance solar collectors, along with a notable trend toward smart energy solutions, fosters continuous innovation within the industry.

- In July 2024, Consolar Solare Energiesysteme GmbH, a leader in high-efficiency solar technology, secured a U.S. patent for its SOLINK PVT heat pump collector. Already patented in Germany, Europe, and China, this innovative air-brine collector optimizes heat pump performance, reinforcing Consolar’s commitment to advancing sustainable energy technologies globally.

Key Highlights

- The global tubular solar collector market size was recorded at USD 5,450.0 million in 2023.

- The market is projected to grow at a CAGR of 5.62% from 2024 to 2031.

- Asia-Pacific held a share of 36.63% in 2023, valued at USD 1,996.3 million.

- The commercial segment garnered USD 2,589.8 million in revenue in 2023.

- The evacuated tube collectors segment is expected to reach USD 4,793.2 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 6.19% over the forecast period.

Market Driver

"Advancements in Solar Technology"

Advancements in solar technology is propelling the growth of the tubular solar collector market by enhancing the efficiency, performance, and cost-effectiveness. Innovations in materials, such as advanced selective coatings, have improved heat capture and retention, while enhanced insulation techniques reduce heat loss and increase thermal efficiency.

Improvements in manufacturing have lowered production costs, making solar thermal solutions more competitive. The integration of smart technologies, such as sensors and automated controllers, optimizes energy collection and distribution, further improving system performance.

Hybrid systems combining solar thermal and photovoltaic technologies offer greater flexibility and energy independence. These ongoing advancements make tubular solar collectors an efficient, affordable, and versatile solution for various applications.

- For instance, in April 2024, Lock Joint Tube, a leading U.S. steel tube manufacturer, expanded production at its Temple, Texas facility to meet rising demand for solar tubes. The company integrated a state-of-the-art OTO tube mill from Fives, enhancing performance across diverse applications.

Market Challenge

"Intermittent Energy Production"

Intermittent energy production presents a significant challenge to the growth of the tubular solar collector market, as their performance depends on sunlight, which varies with the time of day, weather, and seasons.

Reduced solar irradiance, such as during cloudy conditions, lowers efficiency limits energy capture. Furthermore, these systems cannot generate energy during the night, necessitating energy storage for a stable supply.

Seasonal variations further impact performance, particularly in, when heating demand increases while solar energy availability diminishes. This imbalance underscores the need for supplementary systems or energy storage solutions to ensure reliable energy supply.

To address intermittent energy production in tubular solar collectors, integrating energy storage solutions is key. Thermal energy storage (TES) systems, such as water tanks or phase change materials (PCMs), store excess heat for use during cloudy days or at night, ensuring a consistent energy supply.

Hybrid systems combining tubular solar collectors with photovoltaic (PV) panels offer enhanced reliability by generating both thermal and electrical energy. The use of smart controllers can further optimize energy distribution based on weather conditions, demand, and available storage, improving overall system performance. These strategies enhance energy stability and reliability despite solar intermittency.

Market Trend

"Integration of Hybrid Solar Systems"

A major trend in the tubular solar collector market is the integration of hybrid solar systems, which combine solar thermal technology with photovoltaic (PV) panels. This integration enables the simultaneous generation of both thermal energy and electrical energy, providing a more comprehensive and flexible renewable energy solution.

Hybrid systems enhance overall energy efficiency by addressing both thermal and electrical energy needs, making them highly suitable for residential, commercial, and industrial applications.

By integrating both technologies, these systems offer increased energy independence, reduce reliance on grid power, and improve performance, particularly in regions with variable energy demand.

Furthermore, the combination of solar thermal and PV technologies in a single system optimizes space utilization and lowers installation costs, fostering broader adoption in the market.

- In August 2024, Zhejiang Kesun New Energy Co., Ltd. and Midea Group announced a strategic collaboration focused on the development of PVT (Photovoltaic Thermal) hybrid solar panels. This partnership aims to foster innovation in clean energy technology, combining solar power generation with thermal energy solutions to enhance efficiency. The collaboration leverages Kesun’s solar expertise and Midea's advanced technology to create cutting-edge solutions for sustainable energy use.

Tubular Solar Collector Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Evacuated tube collectors, Air-type vacuum-tube solar collectors |

|

By Application |

Residential, Commercial, Industrial |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Type (Evacuated Tube Collectors, Air-Type Vacuum-Tube Solar Collectors ): The evacuated tube collectors segment earned USD 3,197.0 million in 2023, mainly due to high efficiency, adaptability to various climates, versatile applications, and ongoing technological advancements improving performance and cost-effectiveness.

- By Application (Residential, Commercial, and Industrial): The commercial segment held a share of 47.52% in 2023, largely attributed to the growing demand for energy-efficient solutions in large-scale buildings, government incentives for renewable energy adoption, and the cost-saving benefits of solar collectors in commercial establishments.

Tubular Solar Collector Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific tubular solar collector market captured a substantial share of around 36.63% in 2023, valued at USD 1,996.3 million. This dominance is attributed to the region’s rapid industrialization, increasing government support for renewable energy, and favorable climatic conditions.

Countries such as China, India, and Japan have been at the forefront of adopting sustainable energy solutions, supported by a growing awareness of the environmental benefits of solar energy.

Substantial investments in solar infrastructure, coupled with government incentives, tax rebates, and energy policies aimed at reducing carbon emissions, have significantly contributed to regional market expansion. The growing middle-class population and the rising demand for off-grid solutions in remote areas are further expected to boost regional market growth in the region.

Europe tubular solar collector Industry is set to grow at a CAGR of 5.82% over the forecast period. This growth is fostered by the region’s strong government policies supporting renewable energy, increasing investments in clean technologies, and a concerted effort to achieve carbon neutrality.

Europe's commitment to reducing greenhouse gas emissions, along with favorable regulatory frameworks and incentives for solar energy adoption, is further stimulating demand for efficient solar heating solutions. The region's growing emphasis on energy efficiency and technological innovation is anticipated to contribute to the continued expansion of the domestic market.

- For instance, in March 2024, SunMaxx announced that its FlowMaxx flexible solar line set received NSF-61 certification. As an industry standard, FlowMaxx delivers high performance, cost efficiency, and seamless installation for solar hot water systems worldwide, reinforcing SunMaxx's commitment to quality and innovation in solar technology.

Regulatory Frameworks

- International Standards and Certifications, ISO 9806:2017 specifies test methods for assessing the durability, reliability, safety and thermal performance of fluid heating solar collectors. The test methods are applicable for both laboratory testing and in situ testing.

- The European Solar Thermal Industry Federation (ESTIF) defines the Solar Keymark as a voluntary third-party certification for solar thermal products, ensuring compliance with European standards and additional requirements

- International Energy Agency (IEA) Solar Heating and Cooling (SHC) Technology Collaboration Programme promotes solar thermal energy adoption and facilitates Australia’s participation in the initiative.

- The Solar Rating & Certification Corporation (SRCC), supported by the U.S. Department of Energy (DOE), develops and implements nationally recognized third party certification and rating programs for solar water heating (SWH) collectors and systems while disseminating relevant technical information.

Competitive Landscape

The global tubular solar collector market is characterized by a number of participants, including both established corporations and emerging players. To gain a competitive edge in continuously evolving market, industry participants are focusing on continuous innovation, technological advancements, and strategic partnerships.

Leading companies are investing significantly in research and development to enhance the efficiency and cost-effectiveness of their products, while expanding into emerging markets. Furthermore, organizations are capitalizing on government incentives, expanding their distribution networks, and adopting sustainable practices to meet the increasing demand for renewable energy solutions.

The growing emphasis on environmental sustainability, coupled with regulatory pressures, is allowing firms to differentiate themselves through high-performance, eco-friendly products and solutions.

List of Key Companies in Tubular Solar Collector Market:

- TVP Solar

- Sunmaster

- Solar Solutions LLC

- Thermomax Marketing Group

- SunMaxx Solar

- Solarbayer

- Jiangsu SolarEast Energy Storage Technology Co. LTD

- Sunmaxx PVT GmbH

- SolarWinds Worldwide

- sunrain

- Solimpeks

- Apex Solar

- SCHOTT

- Solimpeks

- First Solar

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In January 2025, Sungrow Power unveiled its next-generation commercial and industrial (C&I) solar solution SG150CX at the World Future Energy Summit (WFES) 2025 in Abu Dhabi. The new solutions are designed to improve energy efficiency and support sustainability in the MENA region. It supports the transition to a sustainable energy with scalable, high-performance solar systems for large-scale commercial and industrial applications.

- In November 2024, Viessmann Generations Group acquired ISOPLUS, a leading manufacturer of solar thermal products and insulation solutions, from Egeria. This acquisition strengthens Viessmann's presence in the solar thermal market, particularly in tubular solar collectors.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years

.webp)