Healthcare Medical Devices Biotechnology

Veterinary Diagnostics Market

Veterinary Diagnostics Market Size, Share, Growth & Industry Analysis, By Type (Consumables, Reagents & Kits), By Animal Type (Cattle, Canine, Feline, Caprine, Porcine, Ovine, Avian, Others), By Testing Type, By Disease, By End Use, and Regional Analysis, 2024-2031

Pages : 230

Base Year : 2023

Release : February 2025

Report ID: KR1327

Market Definition

Veterinary diagnostics involves the use of various tools and technologies, such as laboratory tests, imaging (X-rays, ultrasound, MRI), and clinical exams, to identify health conditions, diseases, and injuries in animals.

It helps veterinarians assess an animal's health and make informed decisions about treatment and care through the analysis of biological samples like blood, urine, and tissues.

Veterinary Diagnostics Market Overview

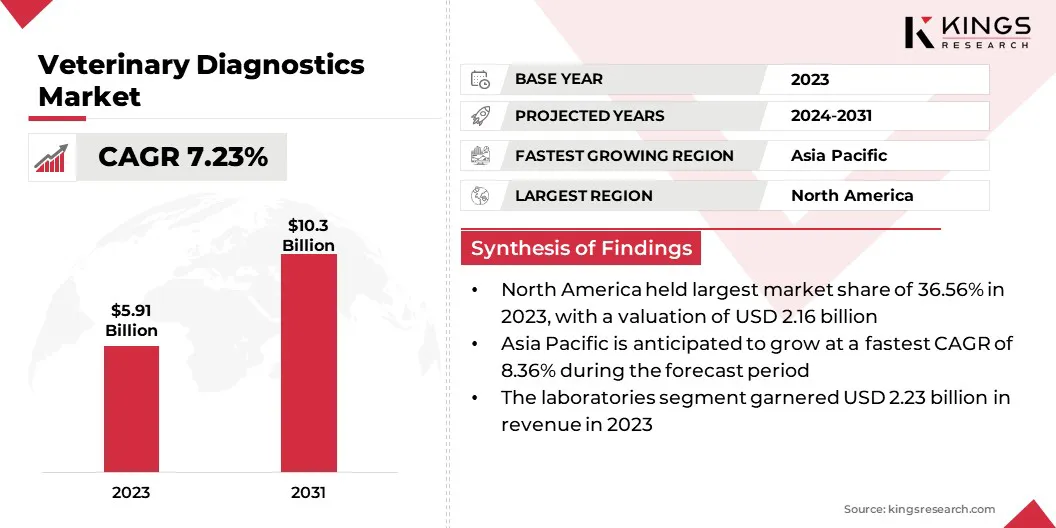

The global veterinary diagnostics market size was valued at USD 5.91 billion in 2023 and is projected to grow from USD 6.31 billion in 2024 to USD 10.30 billion by 2031, exhibiting a CAGR of 7.23% during the forecast period.

The market is expanding, due to the increasing pet ownership and surging investment in pet welfare. Advancements in diagnostics, rising incidence of animal diseases, and increasing medication rate are driving the market.

Ongoing advancements in veterinary diagnostic technologies, including molecular diagnostics, imaging modalities, and point-of-care testing, have enhanced the accuracy and efficiency of animal disease diagnosis.

Major companies operating in the veterinary diagnostics market are Agrolabo S.p.A., Antech Diagnostics, Inc., Embark Veterinary, Inc., Esaote SpA, FUJIFILM Corporation, IDEXX Laboratories, Inc., Innovative Diagnostics SAS, Thermo Fisher Scientific Inc., Virbac, Zoetis Services LLC, Heska Corporation, Avante Animal Health, Randox Laboratories Ltd., Biomerieux, and Meridian Bioscience.

Ongoing advancements in veterinary diagnostic technologies, including molecular diagnostics, imaging techniques, and point-of-care testing, have enhanced the ability to diagnose animal diseases. These innovations improve diagnostic accuracy and speed, driving the market as veterinarians and pet owners increasingly seek cutting-edge solutions for comprehensive healthcare.

The development and adoption of point-of-care diagnostic tools, which deliver rapid, on-site results, spurred market growth. These tools facilitate prompt decision-making in veterinary practices, enabling timely and effective treatment, thereby improving animal health outcomes. Companies in the market are collaborating in terms of diagnosis of veterinary diseases.

- For instance, in February 2024, Blacksmith, a prominent biopharmaceutical company specializing in the discovery and development of therapies targeting metalloenzymes, collaborated with Zoetis, to discover and develop innovative antibiotics for animal health applications.

Key Highlights:

- The veterinary diagnostics market size was valued at USD 5.91 billion in 2023.

- The market is projected to grow at a CAGR of 7.23% from 2024 to 2031.

- North America held a market share of 36.56% in 2023, with a valuation of USD 2.16 billion.

- The consumables, reagents & kits segment garnered USD 3.14 billion in revenue in 2023.

- The canine segment is expected to reach USD 3.56 billion by 2031.

- The pathology segment secured the largest revenue share of 24.47% in 2023.

- The infectious segment is poised for a robust CAGR of 8.42% through the forecast period.

- The laboratories segment is expected to reach USD 3.90 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.36% during the forecast period.

Market Driver

"Rising Prevalence of Zoonotic Diseases"

The rising prevalence of zoonotic diseases is propelling the veterinary diagnostics market. The World Health Organization (WHO) estimates that approximately 60% of emerging infectious diseases originate from animals, emphasizing the crucial need for robust animal health monitoring to protect public health.

Zoonotic diseases, such as rabies, Lyme disease, brucella, and salmonella, highlight the significant risks associated with animal-to-human transmission, spurring the demand for advanced veterinary diagnostics.

- In 2024, according to scientists at the U.S. Centers for Disease Control and Prevention (CDC), over 60% of known infectious diseases in humans are transmitted from animals, including those caused by bacteria, viruses, and parasites. Veterinary diagnostics are essential for the early detection and management of diseases, enabling proactive health interventions to mitigate zoonotic risks and enhance overall health outcomes for both animals and humans.

Market Challenge

"High Costs Associated with Diagnostic Tests"

The high costs associated with diagnostic tests pose a significant challenge to the market. Advanced diagnostic tools such as PCR testing, imaging modalities (MRI, CT scans), and specialized blood tests require sophisticated equipment and expertise, leading to increased operational costs for veterinary clinics and laboratories.

These high expenses can be a burden for pet owners, livestock farmers, and even veterinary service providers, potentially limiting the accessibility and adoption of crucial diagnostic procedures.

Solutions such as insurance coverage for pet healthcare and the development of cost-effective point-of-care diagnostic tools can help reduce financial strain. Furthermore, technological advancements, including AI-driven diagnostics and portable testing devices, can enhance efficiency and drive cost reductions over time.

Fostering strategic collaborations between veterinary institutions, diagnostic companies, and research organizations can further accelerate innovation and improve affordability within the market.

Market Trend

"Favorable Government Support to Accelerate Adoption"

Favorable government support and heightened awareness among livestock owners drive the demand for animal disease diagnostic tests and kits, which is expected to accelerate the market growth.

Educational programs and awareness campaigns led by government entities can also help veterinarians understand the benefits of modern diagnostic technologies, ensuring their widespread adoption.

Additionally, select government-funded laboratories are advancing their capabilities for early disease detection. Financial incentives, such as subsidies, grants, and tax breaks for veterinary clinics and diagnostic labs, can reduce the financial burden on businesses, enabling them to access and implement advanced diagnostic solutions.

- For instance, in November 2023, the Michigan State University Veterinary Diagnostic Laboratory was chosen to strengthen diagnostic capabilities for the early identification of emerging diseases in the Midwest. This collaboration is supported by funding from the U.S. Department of Agriculture (USDA) Animal and Plant Health Inspection Service (APHIS).

Veterinary Diagnostics Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Consumables, Reagents & Kits, Instruments & Devices |

|

By Animal Type |

Cattle, Canine, Feline, Caprine, Porcine, Ovine, Avian, Others |

|

By Testing Type |

Analytical Services, Diagnostics Imaging, Bacteriology, Pathology, Molecular Diagnostics, Parasitology, Immunoassays, Serology, Virology |

|

By Disease |

Infectious, Non-infectious, Hereditary, Congenital and Acquired Diseases, General Ailments, Structural and Functional Diseases |

|

By End Use |

Laboratories, Veterinary Hospitals and Clinics, Point-Of-Care/In-House Testing, Research Institutes and Universities |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Consumables, Reagents & Kits, Instruments & Devices): The consumables, reagents & kits segment earned USD 3.14 billion in 2023, due to rising frequency and substantial increase in spending on veterinary tests and services globally. Additionally, the surging prevalence of animal diseases, rising disposable income, and focus on developing diagnostics kits and advanced reagents drive the segment.

- By Animal Type (Cattle, Canine, Feline, Caprine, Porcine, Ovine, Avian, Others): The canine segment held 35.52% share of the market in 2023, owing to increasing pet ownership, rising demand for advanced diagnostics, and growing awareness of animal health.

- By Testing Type (Analytical Services, Diagnostics Imaging, Bacteriology, Pathology, Molecular Diagnostics, Parasitology, Immunoassays, Serology, Virology): The pathology segment is projected to reach USD 2.48 billion by 2031, owing to their extensive offering for a comprehensive range of diagnostic options such as specialist testing, imaging, and battery of laboratory.

- By Disease (Infectious, Non-infectious, Hereditary, Congenital and Acquired Diseases, General Ailments, Structural and Functional Diseases): The non-infectious segment held 27.19% share of the market in 2023, due to advancements in diagnostics leveraging innovative technology for the early detection of animal diseases.

- By End Use (Laboratories, Veterinary Hospitals and Clinics, Point-Of-Care/In-House Testing, Research Institutes and Universities): The laboratories segment earned USD 2.23 billion in 2023, owing to the stringent guidelines for data reliability and high standard of diagnostic procedures.

Veterinary Diagnostics Market Regional Analysis

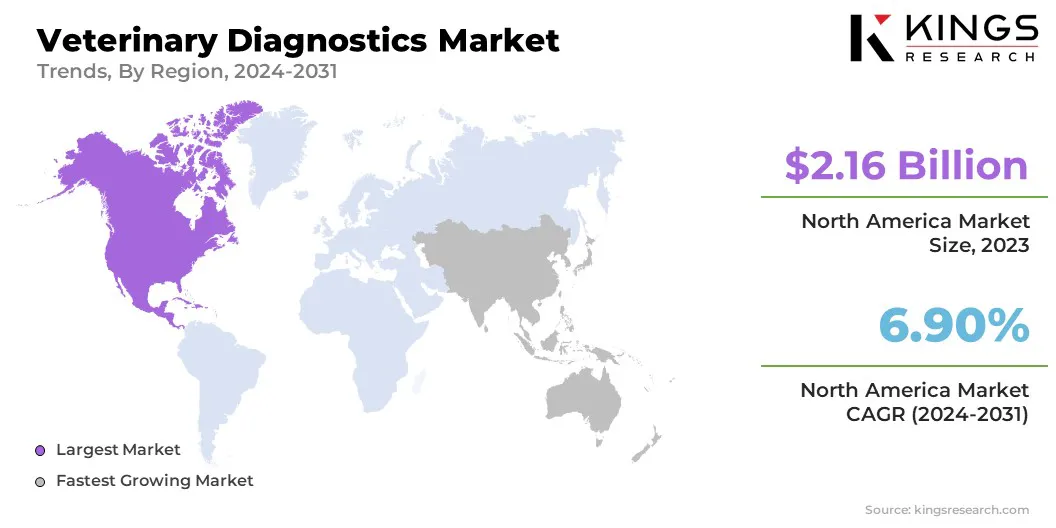

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 36.56% share of the veterinary diagnostics market in 2023, with a valuation of USD 2.16 billion. Increasing pet ownership and advancements in diagnostics technologies are driving the market in the region. The growing awareness of animal health and welfare has driven pet owners to pursue enhanced medical care for their pets.

The veterinary diagnostics industry is being revolutionized by advanced technologies, including molecular diagnostic testing, imaging, and rapid diagnostics. These innovations enable the timely and precise identification of animal diseases, leading to better treatment outcomes. Companies in the market are launching testing and diagnostics kits to cure animal diseases.

- For instance, in June 2023, IDEXX Laboratories, Inc. launched the IDEXX Cystatin B test, the first veterinary diagnostic tool to detect kidney injury in cats and dogs. The company also announced its intention to launch the test in Europe in 2024.

The prevalence of veterinary diseases has surged in the region, with concerns rising over the growing incidence of conditions such as rabies, Lyme disease, and heartworm.

This has driven the demand for diagnostic and testing services for animals. Veterinary clinics and animal hospitals are making significant investments in advanced diagnostic equipment to ensure the delivery of reliable and accurate test results for pet owners.

The veterinary diagnostics market in Asia Pacific is poised for significant growth at a robust CAGR of 8.36% over the forecast period. The increasing demand for enhanced animal healthcare and supporting government initiatives are fostering the growth of the market in the region.

The rising awareness among pet owners and livestock farmers regarding the importance of early disease detection and preventive care led to a surge in the adoption of diagnostic technologies. Furthermore, the expanding livestock industry, coupled with the growing prevalence of zoonotic diseases, accelerated the need for efficient veterinary diagnostic tools.

Governments across the region are actively promoting animal health initiatives through funding, policy frameworks, and collaborations with private sector players, and product launches fostering innovation and accessibility of diagnostic solutions.

- For instance, in 2023, the Government of India’s Central Institute for Research on Buffaloes introduced the Preg-D Kit, an advanced early pregnancy diagnostic test utilizing a urine-based detection method.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the Code of Federal Regulations (CFR) establishes regulatory guidelines for veterinary biologics, encompassing standards for the production, testing, and approval of diagnostic products utilized in veterinary medicine.

- In the U.S., the American Association of Veterinary Laboratory Diagnosticians (AAVLD) sets standards for accredited veterinary medical diagnostic laboratories, emphasizing quality control protocols and accreditation criteria to ensure the delivery of precise and dependable test results for animals.

- In Europe, the European Medicines Agency (EMA) oversees the regulation of veterinary medicines within the European Union (EU). The Veterinary Medicinal Products Regulation (Regulation (EU) 2019/6), effective from January 28, 2022, aims to simplify the regulatory environment, stimulate the development of innovative veterinary medicines, and enhance EU action against antimicrobial resistance.

- In India, the Central Drugs Standard Control Organization (CDSCO) oversees the regulation of medical devices, including veterinary diagnostic kits. The organization has issued guidance documents detailing the approval processes for in-vitro diagnostic products (IVDs) intended for use in animals. These documents outline the requirements for import, manufacture, and distribution of veterinary diagnostic kits.

- India's Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data or Information) Rules set standards for the protection of sensitive personal data, directly influencing veterinary diagnostics practices within the country.

Competitive Landscape:

The veterinary diagnostics market is characterized by a large number of participants, including both established corporations and rising organizations. Key players in the market are making substantial investments in research and development (R&D) to enhance their product portfolios, fostering the market growth.

Companies are engaging in strategic initiatives to strengthen their market presence, including new product launches, contractual agreements, mergers and acquisitions, increased investments, and expanding their presence and collaborations with other organizations.

The veterinary diagnostics sector must focus on delivering cost-effective solutions to remain competitive and thrive in an evolving market landscape.

- For instance, in November 2023, Antech Diagnostics opened its advanced reference laboratory in Warwick. This milestone marks the launch of Antech’s first comprehensive and flexible portfolio in the UK, offering reference laboratory services, in-house diagnostics, advanced imaging, and innovative software solutions.

List of Key Companies in Veterinary Diagnostics Market:

- Agrolabo S.p.A.

- Antech Diagnostics, Inc.

- Embark Veterinary, Inc.

- Esaote SpA

- FUJIFILM Corporation

- IDEXX Laboratories, Inc.

- Innovative Diagnostics SAS

- Thermo Fisher Scientific Inc.

- Virbac

- Zoetis Services LLC

- Heska Corporation

- Avante Animal Health

- Randox Laboratories Ltd.

- Biomerieux

- Meridian Bioscience

Recent Developments (Partnership/New Product Launch)

- In September 2024, Zoetis Inc. launched Vetscan OptiCell, an innovative cartridge-based hematology analyzer that utilizes AI-driven technology to provide accurate Complete Blood Count (CBC) analysis at the point of care. This solution delivers laboratory-quality results while enhancing time, cost, and space efficiencies for veterinary clinics.

- In July 2024, EKF Diagnostics unveiled the Biosen C-Line, an advanced glucose and lactate analyzer engineered for improved usability. Equipped with a touchscreen interface and advanced connectivity features, it seamlessly integrates with hospital and laboratory IT systems through EKF Link. This device delivers highly accurate glucose and lactate measurements, making it an essential tool for clinical applications, such as diabetes management, as well as for elite sports teams monitoring lactate production during training.

- In March 2023, QIAGEN N.V. partnered with Servier to develop a companion diagnostic test for TIBSOVO, an isocitrate dehydrogenase-1 (IDH1) inhibitor. This solution was introduced for the treatment of Acute Myeloid Leukemia (AML), a form of blood cancer. As part of the collaboration, QIAGEN is responsible for the development and validation of a real-time in vitro PCR test, designed to detect IDH1 gene mutations in AML patients using whole blood and bone marrow aspirates.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years

.webp)