Healthcare Medical Devices Biotechnology

Wearable Healthcare Devices Market

Wearable Healthcare Devices Market Size, Share, Growth & Industry Analysis, By Type (Diagnostic Devices, Therapeutic Devices), By Product (Fitness Trackers, Smartwatches, Smart Clothing, Hearables, Others), By Application (Sports and Fitness, Home Healthcare, Remote Patient Monitoring), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR182

Wearable Healthcare Devices Market Size

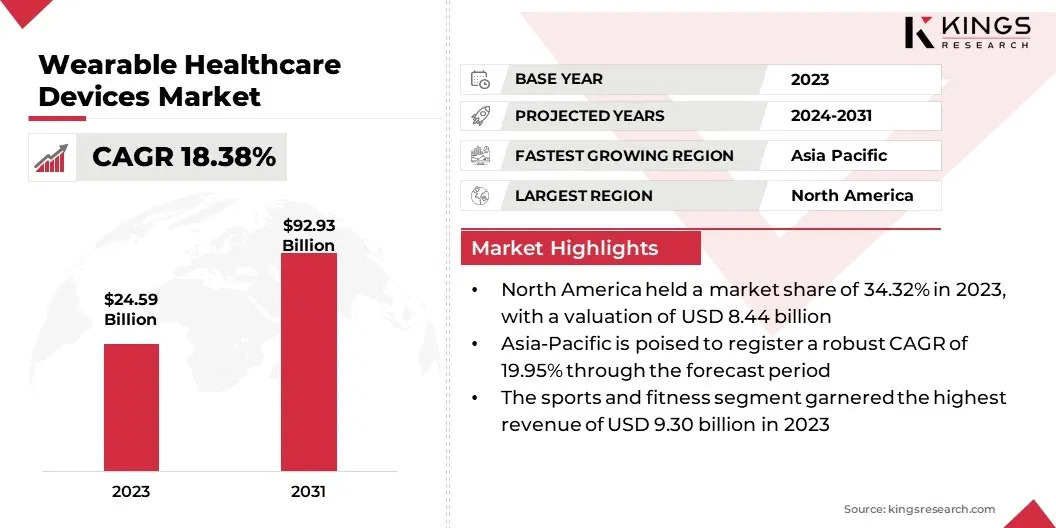

The global Wearable Healthcare Devices Market size was valued at USD 24.59 billion in 2023 and is projected to grow from USD 28.52 billion in 2024 to USD 92.93 billion by 2031, exhibiting a CAGR of 18.38% during the forecast period. Surging consumer demand for personalized healthcare and convergence with telemedicine are driving the growth of the market.

In the scope of work, the report includes services offered by companies such as Apple Inc, Alphabet Inc, Xiaomi, Sony Corporation, Samsung, Huawei Technologies Co, OMRON Healthcare, Inc., Koninklijke Philips N.V, Withings, Medtronic, and others.

The increasing focus on fitness and wellness among consumers presents a significant opportunity for the development of the wearable healthcare devices market. Consumers are becoming increasingly health-conscious, mainly due to a growing awareness of the importance of physical fitness, mental well-being, and preventive healthcare.

Wearable healthcare devices, such as fitness trackers, smartwatches, and heart rate monitors, have become integral tools for individuals aiming to achieve their fitness goals and maintain overall health. These devices enable users to monitor various health metrics in real-time, including steps taken, calories burned, sleep quality, and heart rate, thereby empowering them to make informed lifestyle decisions.

Additionally, the integration of features such as guided workouts, personalized fitness plans, and reminders for activity and hydration has enhanced the appeal of these devices. This shift toward proactive health management is supported by the proliferation of fitness and wellness apps, social media challenges, and corporate wellness programs, all of which promote regular use of wearable devices.

For manufacturers and developers, this trend offers a lucrative opportunity to expand their product portfolios by introducing innovative, user-friendly devices that cater to the growing demand for comprehensive fitness and wellness solutions.

Wearable healthcare devices are electronic devices designed for consumers to wear on their bodies, typically as accessories or embedded into clothing, to monitor and track health-related data. These devices have revolutionized the healthcare industry by enabling continuous, real-time monitoring of various physiological parameters beyond traditional clinical settings.

There are several types of wearable healthcare devices, including fitness trackers, smartwatches, wearable ECG monitors, wearable blood pressure monitors, and biosensors. Each type serves a unique purpose, including general fitness tracking and the continuous monitoring of specific medical conditions.

Products in this category often include devices such as Fitbit trackers, Apple Watches with ECG capabilities, and glucose monitoring systems for diabetes management. Applications of wearable healthcare devices are vast and varied, encompassing fitness and wellness, remote patient monitoring, chronic disease management, and mental health monitoring.

These devices provide critical data that healthcare professionals use for diagnosis, treatment planning, and early intervention, thus playing a crucial role in personalized healthcare. Their growing popularity reflects the increasing consumer demand for accessible, real-time health information, as well as the broader trend toward digital health.

Analyst’s Review

The wearable healthcare devices market is experiencing robust growth, mainly fueled by the convergence of technology and healthcare, which is revolutionizing the methods of collecting, analyzing, and utilizing health information. Key market players are focusing on several strategic imperatives to maintain and enhance their competitive positions.

Companies are increasingly investing in research and development to introduce innovative products with advanced features such as AI-driven analytics, improved sensor accuracy, and longer battery life. This continuous innovation is critical to meet the evolving needs of health-conscious consumers and healthcare providers.

Moreover, strategic partnerships and collaborations with technology firms, healthcare institutions, and insurance companies are playing a major role in this growth, allowing companies to expand their market reach and integrate their products into broader healthcare ecosystems.

Companies are becoming increasingly aware of the importance of data privacy and security, which is leading to significant investments in implementing robust data protection measures and ensuring compliance with regulatory standards across different regions.

As the market continues to grow, it is essential for companies to maintain agility by focusing on scalability and adaptability to address the diverse demands of a global consumer base. The emphasis on personalized healthcare solutions, supported by wearable devices, underscores the imperative for companies to remain at the cutting-edge of technological advancements and consumer trends to ensure sustained growth and market leadership.

Wearable Healthcare Devices Market Growth Factors

The rising prevalence of chronic diseases, such as diabetes, hypertension, and cardiovascular conditions, is boosting the demand for continuous health monitoring solutions. As global populations age and lifestyles become increasingly sedentary, the incidence of chronic diseases has surged, leading to a growing need for ongoing, real-time health monitoring.

Wearable healthcare devices have emerged as essential tools in managing these conditions by providing continuous tracking of vital signs and other health metrics, which is crucial for early detection and timely intervention.

- For instance, in May 2023, the World Health Organization (WHO) highlighted a concerning trend related to the rising prevalence of non-communicable diseases (NCDs). If this trend persists, by 2050, chronic conditions such as cardiovascular diseases, cancer, diabetes, and respiratory illnesses are projected to account for 86% of the 90 million annual deaths.

Continuous glucose monitors (CGMs) have become indispensable for individuals with diabetes, enabling them to manage their blood sugar levels more effectively. Additionally, wearable ECG monitors are increasingly used to detect arrhythmias and other cardiac issues before they develop into serious health problems.

The ability to monitor health continuously improves patient outcomes and reduces the burden on healthcare systems by preventing hospital admissions and facilitating remote patient management. This factor is expected to fuel the growth of the wearable healthcare devices market, as both healthcare providers and patients increasingly recognize the benefits of proactive, continuous health monitoring in managing chronic diseases.

Concerns over data privacy and security present a significant challenge impeding the development of the market. As these devices collect and transmit sensitive health data, including vital signs, activity levels, and even genetic information, there is an inherent risk of data breaches, unauthorized access, and misuse of personal health information.

These concerns are compounded by the growing integration of wearable devices with mobile apps, cloud services, and healthcare platforms, thereby increasing the potential attack surface for cyber threats.

For consumers, the concern regarding the potential exposure or misuse of their personal health data being may significantly impede the adoption of wearable healthcare devices, despite the benefits these devices offer.

Regulatory bodies worldwide are closely examining the data practices of companies in this sector and imposing stringent data protection regulations such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States.

To mitigate these challenges, companies are investing heavily in robust cybersecurity measures, including end-to-end encryption, secure data storage, and regular security audits. Furthermore, implementing transparent data policies and obtaining user consent for data usage are critical strategies to build consumer trust and ensure compliance with regulatory standards.

Wearable Healthcare Devices Market Trends

The integration of AI and machine learning (ML) into wearable healthcare devices represents a transformative trend, fundamentally redefining the capabilities of these technologies. By leveraging AI and ML, wearable devices are becoming increasingly capable of analyzing vast amounts of health data in real-time, thereby providing users with personalized insights, predictive analytics, and early warnings regarding potential health issues.

- For instance, in March 2024, Google unveiled several initiatives to integrate its AI models into healthcare. These initiatives include a tool designed to provide Fitbit users with insights derived from their wearables, as well as a partnership aimed at enhancing cancer and disease screenings in India.

AI algorithms detect subtle patterns in heart rate variability that may indicate the onset of a cardiac event, allowing for timely medical intervention. Machine learning models continuously learn from a user’s health data, thereby improving the accuracy of predictions and recommendations over time.

This trend is pertinent to the management of chronic disease management, as AI-powered wearables offer tailored health plans, medication reminders, and lifestyle recommendations tailored the user's unique health profile. Moreover, the integration of AI and ML enhances the ability of healthcare providers to remotely monitor patients, thereby reducing the need for in-person visits and enabling more efficient use of healthcare resources.

Segmentation Analysis

The global market is segmented based on type, product, application, and geography.

By Type

Based on type, the market is categorized into diagnostic devices and therapeutic devices. The diagnostic devices segment captured the largest wearable healthcare devices market share of 58.76% in 2023, largely attributed to the increasing demand for continuous and real-time health monitoring in clinical and non-clinical settings.

Diagnostic wearable devices, such as ECG monitors, blood pressure monitors, and glucose monitors, have become essential tools in the management of chronic diseases, which have seen a notable increase globally. The growing prevalence of conditions such as diabetes, cardiovascular diseases, and respiratory disorders has promptedn healthcare providers and patients to adopt wearable diagnostic devices for early detection and ongoing management of these conditions.

Furthermore, advancements in sensor technology and the miniaturization of electronic components have made these devices more accurate, portable, and user-friendly, thereby enhancing their appeal to both consumers and healthcare professionals.

The integration of these devices with digital health platforms allows for seamless data transmission to healthcare providers, facilitating remote patient monitoring and telemedicine services. This shift toward preventive healthcare and the proactive management of chronic diseases has played a pivotal role in the growth of the diagnostic devices segment.

By Product

Based on product, the market is classified into fitness trackers, smartwatches, smart clothing, hearables, and others. The fitness trackers segment is poised to record a staggering CAGR of 19.34% through the forecast period, primarily fueled by the growing consumer focus on health and wellness.

As a rising number of individuals become increasingly health-conscious, there is a rising demand for devices that provide real-time insights into their physical activity, sleep patterns, and overall well-being.

Fitness trackers, equipped with advanced sensors and algorithms, offer a comprehensive range of features, including heart rate monitoring, calorie tracking, and sleep analysis, making them increasingly popular among consumers of all age groups. The proliferation of fitness apps and the growing trend of gamification in fitness, where users are motivated by challenges, rewards, and social sharing, have boosted the adoption of these devices.

Additionally, the integration of fitness trackers with other smart devices and platforms, such as smartphones and health apps, enhances their functionality and user engagement. The increasing emphasis on preventive healthcare by both consumers and healthcare providers further contributes to the rapid growth of the segment, as fitness trackers are regarded as essential tools for maintaining a healthy lifestyle.

By Application

Based on application, the wearable healthcare devices market is divided into sports and fitness, home healthcare, and remote patient monitoring. The sports and fitness segment garnered the highest revenue of USD 9.30 billion in 2023, propelled by the rising interest in health and physical fitness, coupled with the widespread adoption of wearable devices.

The increasing prevalence of fitness-conscious lifestyles, driven by a greater awareness of the benefits of regular physical activity, has led to a surge in demand for wearable devices specifically designed for sports and fitness applications. These devices, which include fitness trackers, smartwatches, and heart rate monitors, provide users with real-time data on their workouts, performance, and recovery, thereby enhancing their exercise routines and overall athletic performance.

The expansion of the segment is further fueled by the integration of advanced technologies such as AI, machine learning, and biometric sensors, which offer personalized fitness insights and adaptive training programs. Additionally, the rising popularity of home workouts, spurred by the global pandemic, has increased reliance on wearable fitness devices to track and optimize exercise routines outside of traditional gym environments.

Wearable Healthcare Devices Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

.jpg)

North America wearable healthcare devices market accounted for a considerable share of 34.32% and was valued at USD 8.44 billion in 2023, underscoring the region's leading position in this rapidly evolving industry. This dominance is reinforced by several factors, including the widespread adoption of advanced healthcare technologies, a high level of consumer awareness, and strong healthcare infrastructure.

The United States, in particular, has been at the forefront of wearable healthcare device adoption, propelled by a tech-savvy population and a robust ecosystem of tech companies and healthcare providers.

The region's aging population, coupled with a high prevalence of chronic diseases such as diabetes and cardiovascular conditions, has fueled the demand for wearable devices that enable continuous health monitoring and preventive care.

Additionally, favorable reimbursement policies and increasing investments in healthcare innovation have created a conducive environment for the growth of the North America market. Moreover, the region’s well-established regulatory framework, which ensures the safety and efficacy of wearable devices, fosters consumer confidence and stimulates regional market expansion.

Asia-Pacific is poised to grow at a staggering CAGR of 19.95% in the forthcoming years, reflecting the increasing adoption of wearable healthcare devices and the rapid transformation of healthcare landscape in the region. Several factors contribute to this robust growth, including the region's large and diverse population, rising healthcare awareness, and improving economic conditions.

As disposable incomes increase and access to healthcare services expands, an increasing number of consumers in Asia-Pacific are turning to wearable devices to monitor and manage their health. Countries such as China, India, and Japan are leading this trend, supported by government initiatives to promote digital health, the proliferation of smartphones and internet connectivity, and a growing middle–class population that is increasingly health-conscious.

Additionally, the region’s growing tech industry, which emphasizes innovation and affordability, is playing a crucial role in the development of wearable healthcare devices. Moreover, collaborations between local tech firms and global healthcare companies are accelerating the development and deployment of cutting-edge wearable technologies designed to meet the needs of the Asia-Pacific market.

Competitive Landscape

The global wearable healthcare devices market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Wearable Healthcare Devices Market

- Apple Inc

- Alphabet Inc

- Xiaomi

- Sony Corporation

- Samsung

- Huawei Technologies Co

- OMRON Healthcare, Inc.

- Koninklijke Philips N.V

- Withings

- Medtronic

Key Industry Development

- July 2024 (Launch): KORE, an IoT company based in Georgia specializing in scalable solutions, and mCare Digital, an Australian firm that leverages technology for independent living, announced the launch of the mCareWatch 241, a smartwatch designed for virtual patient monitoring.

The global wearable healthcare devices market is segmented as:

By Type

- Diagnostic Devices

- Therapeutic Devices

By Product

- Fitness Trackers

- Smartwatches

- Smart Clothing

- Hearables

- Others

By Application

- Sports and Fitness

- Home Healthcare

- Remote Patient Monitoring

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)