Energy and Power

Wind Tower Market

Wind Tower Market Size, Share, Growth & Industry Analysis By Type (Steel Tower, Concrete Tower, Hybrid Tower), By Deployment (Onshore, Offshore), By Application (Industrial, Commercial, Residential, Utility), and Regional Analysis 2024-2031

Pages : 120

Base Year : 2023

Release : February 2025

Report ID: KR386

Market Definition

The market involves the production and installation of wind towers, vital components of wind turbines that elevate the rotor for optimal energy capture. This market includes various types of towers, such as lattice, tubular, and hybrid structures, used in both onshore and offshore wind farms.

The market is driven by the increasing demand for renewable energy, government incentives, and advancements in turbine technology, with factors like material costs and global energy policies significantly impacting market dynamics.

Wind Tower Market Overview

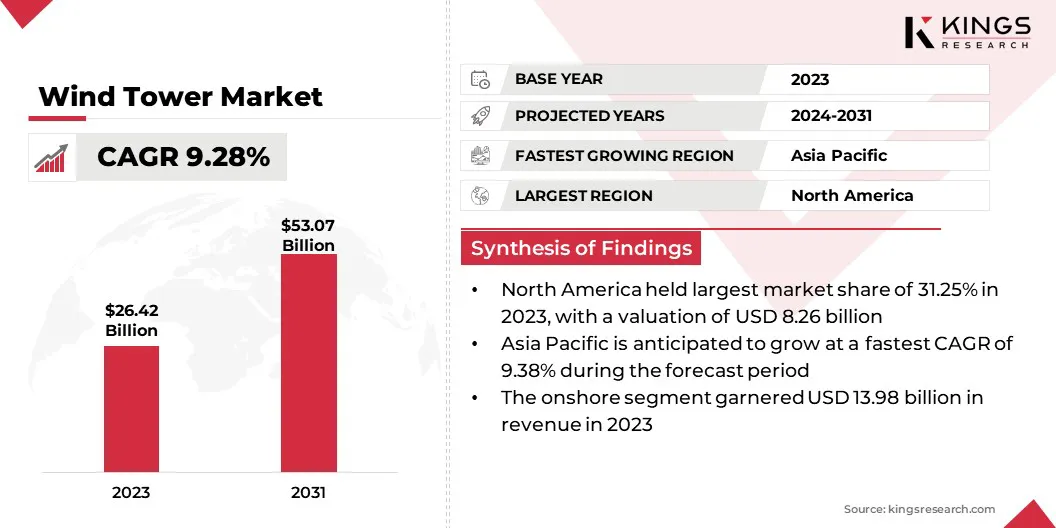

The global wind tower market size was valued at USD 26.42 billion in 2023 and is projected to grow from USD 28.52 billion in 2024 to USD 53.07 billion by 2031, exhibiting a CAGR of 9.28% during the forecast period.

The market is growing rapidly, due to the rising adoption of wind energy as a key component of the global transition to sustainable energy sources. Increased investments in wind energy infrastructure, coupled with favorable government policies and incentives, drive this growth. The shift toward larger and more efficient wind turbines boosts the demand for advanced wind tower designs, contributing further to market expansion.

Major companies operating in the wind tower industry are General Electric Company, goldwind.com, Siemens Gamesa Renewable Energy, Envision Group, Nordex SE, Suzlon Energy Limited, ENERCON Global GmbH, ACCIONA, KGW, Senvion Wind Technology Pvt. Ltd, Suzlon Energy Limited, CS WIND Corporation, DONGKUK S&C, Inoxwind, Vestas, and Arcosa Wind Towers, Inc.

Declining costs of wind energy technology, environmental concerns, and the need for energy security are driving the market. The demand for both onshore and offshore wind installations is expected to rise as countries strive to meet renewable energy targets and cut greenhouse gas (GHG) emissions, benefiting the market.

Innovations in materials and manufacturing are also improving performance and reducing costs, ensuring sustained growth in the years ahead.

- In January 2024, Vestas announced plans to establish a new offshore blade factory in northern Szczecin, Poland, on a site acquired in February 2023. This facility will complement its existing nacelle assembly factory on Ostrów Brdowski Island, which is expected to begin operations in 2025 and create 700 direct jobs. These developments aim to meet the growing demand for offshore wind energy in Europe.

Click to learn, How data-driven insights can impact your market positionKey Highlights

Click to learn, How data-driven insights can impact your market positionKey Highlights

- The wind tower market size was valued at USD 26.42 billion in 2023.

- The market is projected to grow at a CAGR of 9.28% from 2024 to 2031.

- North America held a market share of 31.25% in 2023, with a valuation of USD 8.26 billion.

- The steel tower segment garnered USD 10.48 billion in revenue in 2023.

- The utility segment is expected to reach USD 18.81 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 9.38% during the forecast period.

Market Driver

“Expansion of Offshore Wind Farms”

Offshore wind energy is growing rapidly, due to its ability to harness stronger, more consistent winds, resulting in higher energy output than onshore installations. Technological advancements, such as floating wind turbines and taller wind towers, are improving feasibility even in deeper waters.

The demand for specialized, durable offshore wind towers is set to rise significantly as nations prioritize energy security and carbon neutrality.

- In June 2024, Dogger Bank Wind Farm announced an additional USD 31.4 million investment to support coastal communities in the North and North East of England over its 35-year operational lifespan. This funding aims to enhance STEM education, expand scholarship programs, and provide community grants, building upon the USD 1.2 million already invested during the construction phase. The initiative underscores the wind farm's commitment to creating a lasting positive impact in its surrounding communities.

The continuous expansion of offshore wind projects is driving renewable energy growth, which contributes to local economic and social development. This long-term commitment highlights the broader impact of wind energy beyond power generation, which is accelerating the growth of the wind tower market.

Market Challenge

“High Initial Costs”

The high initial costs associated with manufacturing and installing wind towers, especially for offshore wind farms, present one of the most important challenges in the global wind tower market.

These significant upfront expenses, which include advanced materials, installation, and infrastructure, can deter investments, particularly in developing regions with limited access to capital. Wind energy offers long-term environmental and economic benefits; however, the capital-intensive nature of the industry can delay the transition to renewable energy, slowing overall market growth.

Governments can offer incentives, while economies of scale and technological advancements in materials and manufacturing processes can help lower costs over time, encouraging more widespread adoption of wind energy.

- The Contracts for Difference (CfD) scheme in the UK aims to encourage investment in renewable energy by providing a stable revenue stream for developers, ensuring fixed electricity prices for 15 years. It has contributed to reducing costs and risks for developers, boosting confidence and attracting investment.

Market Trend

“Rising Adoption of Modular & Prefabricated Wind Towers”

The rising adoption of modular & prefabricated wind towers is reshaping the wind energy sector by addressing key challenges like transportation, installation time, and cost. Modular wind towers are made up of pre-manufactured sections that can be transported more easily compared to traditional, massive single-piece towers.

This modularity allows for faster on-site assembly, reducing construction time and labor costs. Additionally, prefabrication in controlled environments ensures high-quality standards and reduces material waste.

- In August 2024, Siemens Gamesa launched the SG 3.2-129 wind turbine, specifically designed for medium to low wind sites in the U.S. This turbine, built on the robust 2.3 MW product series, offers a 10.3% increase in annual energy production. With a 129-meter rotor and 3.2 MW rated power, the SG 3.2-129 features geared technology, high efficiency, and reduced maintenance, making it an ideal solution for diverse wind conditions in the U.S.

Modular designs are becoming essential as the demand for taller towers increases, as they allow for the efficient construction of taller and more robust towers. These towers can be customized to suit specific wind conditions and terrain, making them ideal for remote or difficult-to-access locations. This trend not only helps lower the overall cost of wind power but also improves the feasibility of deploying wind turbines in a broader range of locations.

Wind Tower Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Steel Tower, Concrete Tower, Hybrid Tower |

|

By Deployment |

Onshore, Offshore |

|

By Application |

Industrial, Commercial, Residential, Utility |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Type (Steel Tower, Concrete Tower, Hybrid Tower): The steel tower segment earned USD 10.48 billion in 2023, driven by its strength, cost-effectiveness, and the high demand for reliable, mass-produced solutions for onshore wind installations. Steel towers are widely used, due to their efficiency in different wind conditions, as well as ease of transportation and construction.

- By Deployment (Onshore, Offshore): The onshore segment held 52.90% share of the market in 2023, driven by cost-effective installations, favorable policies, and increasing demand for renewable energy in regions with suitable land availability and wind conditions.

- By Application (Industrial, Commercial, Residential, Utility): The utility segment earned USD 9.34 billion in 2023, driven by the growing demand for large-scale renewable energy projects and government incentives promoting the transition to clean energy. Utility-scale wind farms are increasingly being deployed to meet national energy targets and reduce reliance on fossil fuels, offering significant power generation capacity.

Wind Tower Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

.webp)

The U.S. and Canada are leading the way with onshore wind projects, supported by favorable wind conditions, technological advancements, and an evolving energy infrastructure.

- On August 24, 2023, the U.S. Department of Energy released reports showing strong growth in the U.S. wind power sector. Wind power accounted for 22% of new electricity capacity in 2022, with significant investments and job creation. The Inflation Reduction Act has spurred the growth of onshore and offshore wind, with land-based wind capacity forecasted to increase by 60% by 2026, creating more than 2 million MW of additional power.

The wind tower industry in Asia Pacific is poised to grow at a CAGR of 9.38% through the projection period. This growth is driven by increasing investments in renewable energy, government support for wind energy projects, and the growing demand for clean energy solutions in countries like China, India, and Japan. The wind power market in Asia Pacific is set to expand significantly as the region continues to prioritize sustainable energy.

- In July 2024, the Global Energy Monitor reported that China continues to lead the world in renewable energy, with 159 GW of wind and 180 GW of solar capacity under construction. This significant growth positions China as a dominant force in the energy transition, with twice as much renewable capacity being built compared to the rest of the world combined. The country’s ambitious policies and large-scale investments are key drivers of this development.

Regulatory Frameworks

- The European Commission introduced the Renewable Energy Directive (RED II) to establish a legally binding framework for achieving renewable energy targets. The directive includes specific provisions for biofuels, energy storage, and energy efficiency, while aiming to increase renewable energy to 32% by 2030. It emphasizes sustainability criteria and the reduction of GHG emissions in the energy and transport sectors.

- In the U.S., the Federal Energy Regulatory Commission (FERC) regulates interstate transmission of electricity, natural gas, and oil. It oversees market practices and infrastructure related to renewable energy and ensures fair competition. The FERC also plays a key role in approving new energy projects, including wind & solar power, and establishing policies related to energy markets.

- In China, the State Council issued a regulation in 2014 focusing on the development and promotion of renewable energy, which includes wind power. It outlines steps for improving energy efficiency, promoting clean energy technologies, and establishing an organized approach to reduce carbon emissions. The document emphasizes market-oriented policies, government investments, and increasing renewable energy capacity as key drivers for long-term growth.

- In India, the Ministry of New and Renewable Energy (MNRE) is responsible for policy and regulation related to renewable energy development, including wind power. The ministry promotes the integration of renewable energy technologies, setting targets for wind capacity and supporting infrastructure development. It also facilitates financial incentives, subsidies, and green energy initiatives to meet national renewable energy goals.

Competitive Landscape

Companies should focus on innovative tower designs, including modular and hybrid structures that enhance transport and installation efficiency, to gain a competitive edge in the wind tower market.

Additionally, sustainability and cost reduction through advanced manufacturing techniques and materials can increase profitability. Firms must also stay ahead by aligning with government policies, securing renewable energy incentives, and investing in offshore wind projects.

- For instance, in January 2023, GE Vernova proposed the development of two new offshore wind facilities in New York as part of its push to expand renewable energy in the U.S. These projects aim to provide clean energy to hundreds of thousands of homes while contributing to the state’s renewable energy goals. The facilities will include cutting-edge offshore wind technology designed to generate sustainable electricity.

List of Key Companies in Wind Tower Market:

- General Electric Company

- goldwind.com

- Siemens Gamesa Renewable Energy

- Envision Group

- Nordex SE

- Suzlon Energy Limited

- ENERCON Global GmbH

- ACCIONA

- KGW

- Senvion Wind Technology Pvt. Ltd

- Suzlon Energy Limited

- CS WIND Corporation

- DONGKUK S&C

- Inoxwind

- Vestas

- Arcosa Wind Towers, Inc

Recent Developments

- In December 2024, European Energy and Novo Holdings announced a joint venture to triple the renewable energy capacity of German onshore wind parks. The collaboration aims to replace outdated turbines with modern, more efficient models, significantly increasing the combined capacity of the parks. This initiative is set to boost clean energy production and support the transition to a more sustainable energy system in Germany.

- In December 2024, BP and JERA Co., Inc. announced a partnership to create a top-tier global offshore wind business. This joint venture will combine their offshore wind portfolios, combining BP's expertise in offshore wind development with JERA’s resources and experience in the energy sector. The collaboration aims to drive growth in the offshore wind market, expand global renewable energy capacity, and support the transition to low-carbon energy sources.

- In November 2024, SP Group announced its expansion into the Thai renewable energy market through its first merger and acquisition (M&A) deal. The company acquired key assets in wind and solar power projects, strengthening its renewable energy portfolio in Thailand. This move aligns with SP Group’s strategy to accelerate the transition to clean energy in Southeast Asia, supporting the region’s sustainable development goals.

- In September 2024, Ørsted and GIP's Skyborn Renewables launched a joint venture to expand their offshore wind capacity with the South Fork Wind and Revolution Wind projects. This partnership aims to develop significant offshore wind farms off the coast of the U.S., contributing to renewable energy goals while strengthening both companies’ positions in the growing offshore wind market.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years

.webp)