Automotive and Transportation

Zero Emission Trucks Market

Zero Emission Trucks Market Size, Share, Growth & Industry Analysis, By End-Use Industry (Retail and E-commerce, Construction and Infrastructure, Logistics and Transportation), By Vehicle Type (Light-duty trucks, Medium-duty trucks), By Technology (Battery Electric Trucks, Hydrogen Fuel Cell Trucks) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : March 2024

Report ID: KR579

Zero Emission Trucks Market Size

The global Zero Emission Trucks Market size was valued at USD 6.61 billion in 2023 and is projected to reach USD 27.99 billion by 2031, growing at a CAGR of 20.05% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Tesla, Inc., Daimler AG, Volvo Group, Nikola Corporation, BYD Company Limited, Rivian Automotive, Inc., Ford Motor Company, Hyundai Motor Company, Toyota Motor Corporation, Cummins Inc. and Others.

The global zero emission trucks market is growing rapidly due to government regulations and industry demand for cleaner transportation solutions. This has led to a significant increase in the demand for trucks powered by electric batteries, hydrogen fuel cells, and other alternative energy sources.

Advancements in battery technology have improved the performance and range of zero emission trucks, making them more viable for commercial use. As a result, major automotive manufacturers and startups are investing heavily in developing and commercializing zero emission truck models across different weight classes.

Although the initial acquisition costs are high, the long-term benefits of lower operating costs, reduced maintenance expenses, and environmental sustainability are driving fleet operators and logistics companies to adopt zero emission trucks.

Moreover, partnerships and collaborations between industry players and infrastructure development initiatives are addressing challenges such as charging infrastructure availability, thereby boosting market growth. The global zero emission trucks market is expected to continue to expand and innovate in the coming years.

Analyst’s Review

The integration of autonomous driving technology with zero emission trucks is set to revolutionize the freight transportation industry. Autonomous trucks, powered by electric or hydrogen fuel cells, have the potential to optimize routes, reduce idle time, and enhance overall fleet efficiency. This integration may improve operational productivity while contributing to a more sustainable transportation ecosystem by eliminating emissions during operation.

Additionally, adopting circular economy models may have a profound impact on the zero emission trucks market. Practices such as battery recycling and remanufacturing reduce waste and resource consumption, making zero emission trucks more environmentally friendly throughout their life cycle. This approach aligns with sustainability goals and lowers production costs over time, making these trucks more accessible to a wider market segment.

Moreover, the advancement of hydrogen fuel cell technology presents a significant opportunity for long-range zero emission trucks, especially in heavy-duty and long-haul transportation. Hydrogen-powered trucks offer fast refueling times and extended ranges, addressing some of the limitations of battery-electric trucks. As the infrastructure for hydrogen refueling expands, these trucks are expected to gain traction in various logistics and transportation sectors, further driving market growth.

Market Definition

Zero-emission trucks are commercial vehicles that do not produce tailpipe emissions, thus reducing harmful pollutants and greenhouse gases. They use electric propulsion systems powered by batteries, hydrogen fuel cells, or a combination of renewable energy sources.

These trucks are commonly used for urban delivery and distribution, where air quality concerns are prominent. Furthermore, they are gaining traction in industries such as logistics, construction, and waste management, where sustainable transport solutions are prioritized.

Governments worldwide are implementing policies and incentives to accelerate the adoption of zero emission trucks. Such initiatives include establishing zero emission zones, offering financial incentives, imposing stricter emissions standards, and investing in charging or refueling infrastructure.

Regulatory frameworks and initiatives, such as California's Advanced Clean Trucks regulation and the European Union's CO2 emission standards, play a crucial role in supporting the adoption and growth of zero emission trucks globally.

Zero Emission Trucks Market Dynamics

Technological advancements, such as improved battery technology, fuel cells, and electric drivetrains, are driving the adoption of zero emission trucks. Enhanced battery energy density and efficiency increase the range and performance of electric trucks, while advancements in hydrogen fuel cells offer fast refueling times and longer ranges for heavy-duty transport.

Innovations in electric drivetrains improve efficiency and reliability, thereby reducing maintenance costs. These breakthroughs address current limitations and facilitate the progression of future innovations, which are contributing to the growth of the global zero emission trucks market.

Additionally, technological advancements and growing public awareness of environmental issues create significant opportunities for companies in the industry. As public awareness of air pollution and climate change increases, there is a rising demand for sustainable transportation solutions, including zero emission trucks.

Favorable government policies, such as subsidies, tax incentives, and regulatory mandates, further incentivize businesses to adopt zero emission trucks. Companies that invest in developing and offering these cleaner alternatives have the opportunity to capitalize on this surging demand and government support, thereby expanding their market presence.

Strategic partnerships, innovative marketing campaigns, and product differentiation based on technology and performance may enhance market expansion opportunities. However, the higher initial costs of zero emission trucks compared to traditional diesel trucks pose a major challenge to growth, especially for small and medium-sized enterprises (SMEs). While zero emission trucks offer long-term cost savings, the upfront investment can deter SMEs from transitioning(to??).

To address this, governments and industry stakeholders are aiming to provide financial incentives such as subsidies and tax credits. Promoting leasing and financing options tailored for zero emission vehicles can further help mitigate the financial burden. These measures encourage broader adoption and accelerate the transition to sustainable transport practices.

Segmentation Analysis

The global zero emission trucks market is segmented based on end-use industry, vehicle type, technology, and geography.

By End-Use Industry

Based on end-use industry, the market is segmented into retail and e-commerce, food and beverage, construction and infrastructure, and logistics and transportation. The logistics and transportation segment garnered the highest revenue of USD 2.67 billion in 2023.

The continuous growth of global trade and the e-commerce sector has increased the demand for efficient and sustainable transportation solutions, which is driving the adoption of zero emission trucks in logistics operations.

Additionally, stringent emissions regulations and environmental targets in major markets have compelled logistics companies to invest in cleaner fleets to comply with standards. Moreover, advancements in technology and infrastructure supporting electric and hydrogen-powered trucks have made these solutions more feasible and cost-effective for logistics and transportation companies.

By Vehicle Type

Based on vehicle type, the market is classified into light-duty trucks, medium-duty trucks, and heavy-duty trucks. The heavy-duty trucks segment accrued the largest market share of 56.22% in 2023.

Heavy-duty trucks play a crucial role in freight transportation for diverse industries such as logistics, construction, and mining, where larger payloads and longer distances are common requirements. The adoption of zero emission technology in heavy-duty trucks offers substantial environmental benefits, aligning with stringent emissions regulations and sustainability goals in numerous regions.

Moreover, advancements in battery and fuel cell technology have enabled manufacturers to develop high-performance zero emission solutions suitable for heavy-duty applications, thereby driving the demand for these vehicles in the global marketplace.

By Technology

Based on technology, the market is bifurcated into battery electric trucks and hydrogen fuel cell trucks. The hydrogen fuel cell trucks segment is set to register a robust CAGR of 21.17% through the forecast period.

The hydrogen fuel cell technology offers several advantages such as longer ranges, shorter refueling times, and suitability for heavy-duty applications. Advancements in hydrogen infrastructure development, including refueling stations and supply chains, are enhancing the feasibility and scalability of hydrogen fuel cell trucks.

Increasing investments and collaborations in hydrogen technology research and development are fueling innovation and cost reductions, thereby boosting the growth of hydrogen fuel cell trucks in the market.

Zero Emission Trucks Market Regional Analysis

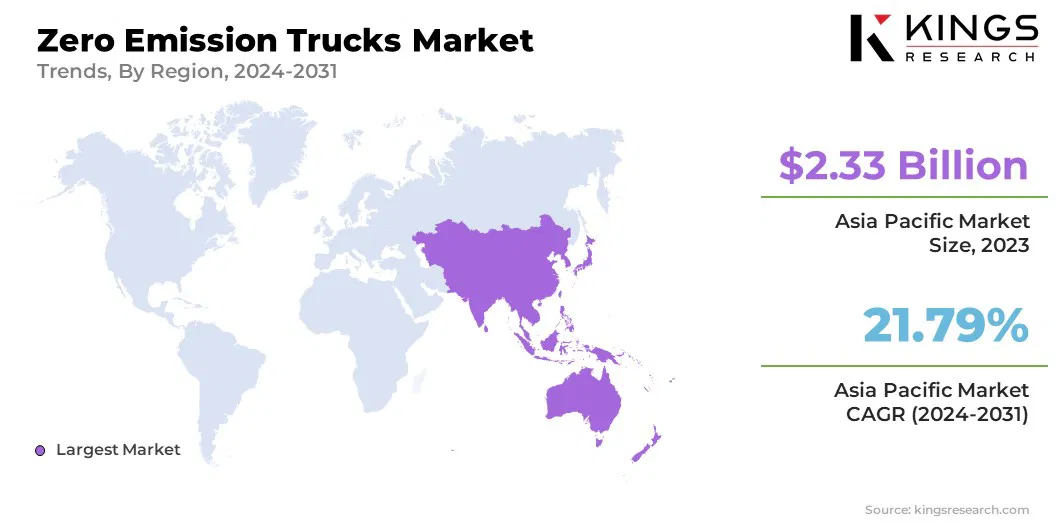

Based on region, the global zero emission trucks market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia Pacific Zero Emission Trucks Market share stood around 35.25% in 2023 in the global market, with a valuation of USD 2.33 billion. Rapid industrialization and urbanization in countries such as China and Japan have fueled the demand for efficient and sustainable transportation solutions, thereby driving the adoption of zero emission trucks in the region.

Supportive government policies, incentives, and investments in clean energy and transportation infrastructure have prompted companies to invest in zero emission technologies. The growing awareness of environmental issues and the need to reduce air pollution have accelerated the shift toward cleaner transportation options, thus further boosting market growth in Asia-Pacific.

Europe is poised to reach a significant valuation of USD 6.92 billion by 2031. Stringent emissions regulations and targets set by the European Union (EU) have propelled the shift toward cleaner transportation options, encouraging investments in zero emission technologies.

Additionally, growing public awareness of environmental issues and sustainability concerns has led to increased demand for eco-friendly transport solutions. Moreover, government incentives, subsidies, and investments in charging infrastructure are supporting the expansion of the market in Europe.

Competitive Landscape

The global zero emission trucks market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Widely adopted strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, are positively influencing the market outlook.

List of Key Companies in Zero Emission Trucks Market

- Tesla, Inc.

- Daimler AG

- Volvo Group

- Nikola Corporation

- BYD Company Limited

- Rivian Automotive, Inc.

- Ford Motor Company

- Hyundai Motor Company

- Toyota Motor Corporation

- Cummins Inc.

Key Industry Developments

- January 2024 (Product Launch): Tevva Motors launched the U.K.'s first hydrogen fuel cell-electric truck. The truck represented a significant step toward sustainable transportation, combining hydrogen fuel cells with electric drivetrains for zero emission operations. This initiative aligned with global efforts to reduce carbon emissions in the transportation sector and showcased advancements in clean energy technology within the commercial vehicle industry.

- September 2023 (Product Launch): Nikola commercialized its first hydrogen fuel cell electric truck in Coolidge, Arizona. The launch marked a significant milestone for the company as it aimed to revolutionize the transportation industry with zero emission solutions. The launch underscored Nikola's commitment to sustainable transportation and highlighted the growing momentum toward hydrogen fuel cell technology in the commercial trucking sector.

The Global Zero Emission Trucks Market is Segmented as:

By End-Use Industry

- Retail and E-commerce

- Food and Beverage

- Construction and Infrastructure

- Logistics and Transportation

By Vehicle Type

- Light-duty trucks

- Medium-duty trucks

- Heavy-duty trucks

By Technology

- Battery Electric Trucks

- Hydrogen Fuel Cell Trucks

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)