Healthcare Medical Devices Biotechnology

Telemedicine Market

Telemedicine Market Size, Share, Growth & Industry Analysis, By Type (Product, Services), By Modality (Asynchronous, Synchronous, Others), By Application (Teleradiology, Telepathology, Teledermatology, Telepsychiatry, Telecardiology, Others), By End User, and Regional Analysis, 2024-2031

Pages : 210

Base Year : 2023

Release : February 2025

Report ID: KR188

Market Definition

Telemedicine is the use of digital communication technologies such as video calls, phone calls, and mobile apps to provide remote healthcare services. It allows patients to consult doctors, receive diagnoses, get prescriptions, and manage chronic conditions without needing in-person visits.

Telemedicine Market Overview

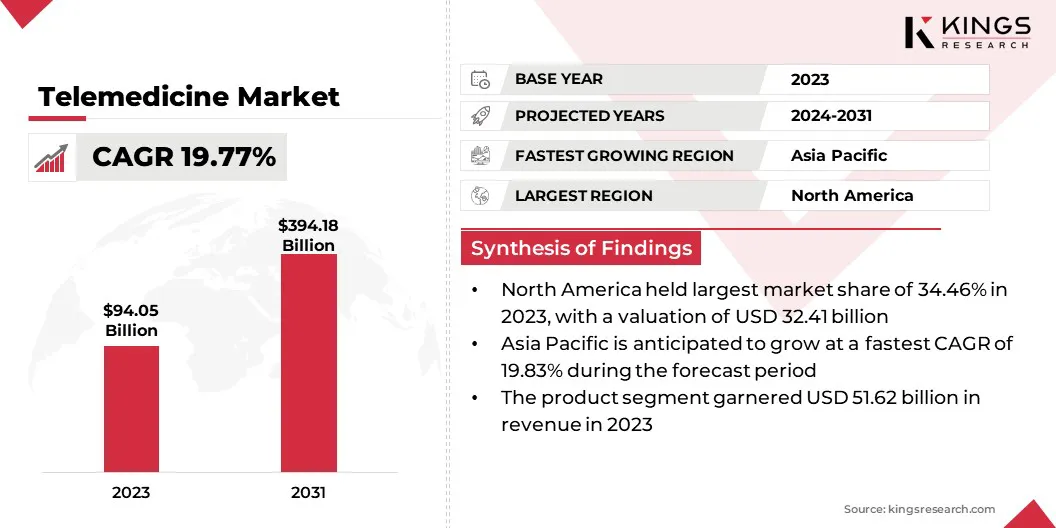

The global telemedicine market size was valued at USD 94.05 billion in 2023 and is projected to grow from USD 111.48 billion in 2024 to USD 394.18 billion by 2031, exhibiting a CAGR of 19.77% during the forecast period.

This market has registered rapid growth in recent years, driven by advancements in digital health technologies, increasing demand for remote healthcare services, and the need for cost-effective medical solutions. The COVID-19 pandemic significantly accelerated its adoption, leading to widespread acceptance among patients and healthcare providers.

Major companies operating in the telemedicine industry are Teladoc Health, Inc., American Well Corporation., Doximity, Inc., GoodRx, Inc, MDLIVE, Healthee, Hims & Hers Health, Inc., Accolade, Talkspace, Cisco Systems, Inc., Doctor On Demand by Included Health, Inc., Veradigm LLC, Zocdoc, Inc., HealthTap, Inc., and Sesame, Inc.

Key factors fueling the market include rising prevalence of chronic diseases, aging population, and improved internet & smartphone penetration. The market is expected to continue expanding as regulations evolve and technology advances, integrating artificial intelligence (AI), wearables, and real-time data analytics to enhance patient care.

- In August 2024, Pfizer launched PfizerForAll, a digital platform that simplifies healthcare access by offering same-day appointments, home delivery of medications and tests, and vaccine scheduling. It integrates with existing healthcare systems and partners to enhance patient convenience. Pfizer plans to expand the platform to cover more healthcare needs.

Key Highlights:

Key Highlights:

- The telemedicine industry size was valued at USD 94.05 billion in 2023.

- The market is projected to grow at a CAGR of 19.77% from 2024 to 2031.

- North America held a market share of 34.46% in 2023, with a valuation of USD 32.41 billion.

- The product segment garnered USD 51.62 billion in revenue in 2023.

- The asynchronous segment is expected to reach USD 152.98 billion by 2031.

- The teleradiology segment is expected to reach USD 114.86 billion by 2031.

- The healthcare facilities segment is expected to reach USD 150.18 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 19.83% during the forecast period.

Market Driver

“Rising Prevalence of Chronic Diseases and Increasing Smartphone Adoption Expand the Telemedicine Market”

The telemedicine market is registering rapid growth, driven by the increasing burden of chronic diseases and the growing penetration of smartphones & the internet. The rising prevalence of chronic conditions like diabetes, cardiovascular diseases, and respiratory disorders is creating strong demand for continuous and accessible healthcare.

Telemedicine enables remote patient monitoring and virtual consultations, allowing patients to receive timely medical attention without frequent hospital visits. This not only improves patient outcomes but also reduces healthcare costs and the strain on medical facilities.

Additionally, the widespread availability of high-speed internet and the increasing adoption of smartphones have revolutionized access to telemedicine services. This digital transformation has made healthcare more convenient and accessible, encouraging more patients and healthcare providers to integrate telemedicine into routine medical care, further driving the market.

- In December 2024, DocGo Inc. expanded its partnership with SHL Telemedicine to integrate the SmartHeart portable 12-lead ECG device into its mobile healthcare units. DocGo enables remote ECG screenings with rapid cardiologist-reviewed results by deploying SmartHeart technology in mobile health units, eliminating the need for in-clinic visits and improving patient outcomes.

Market Challenge

“Overcoming Regulatory and Data Security Challenges in Telemedicine”

The telemedicine market faces significant challenges that hinder its full potential, with regulatory complexities and data security concerns being among the most pressing issues. Telemedicine regulations vary widely across different countries and even within regions of the same country, creating a fragmented landscape that makes it difficult for healthcare providers to expand their virtual care services.

Licensing requirements often restrict doctors from providing telehealth consultations across state or national borders, while inconsistent reimbursement policies make it challenging for providers to sustain telemedicine operations financially.

A potential solution is the development of standardized telemedicine regulations, along with cross-state or international licensing agreements, to ensure seamless access to virtual healthcare services.

Another major challenge is data security and patient privacy. Telemedicine relies heavily on digital platforms for consultations, data storage, and remote monitoring, which increases the risk of cyberattacks and data breaches significantly. Many healthcare providers face difficulties in ensuring that patient data remains confidential while being transmitted over the internet.

Unauthorized access, hacking, and phishing attacks pose severe threats to patient trust and regulatory compliance. Healthcare organizations adopt stringent data protection measures such as end-to-end encryption, multi-factor authentication, and regular security audits to address these concerns.

Market Trend

“Integration of AI in Telemedicine”

The telemedicine market is evolving with key trends such as the integration of AI in virtual healthcare and the growing adoption of remote patient monitoring devices. AI-powered telemedicine solutions are enhancing diagnostics, automating administrative tasks, and improving clinical decision-making through predictive analytics.

- For instance, in October 2024, Vantiq, Telemedicine Solutions, and NTT DATA announced the launch of Wound AI, a GenAI-powered clinical decision support platform designed to transform wound care treatment. Wound AI leverages Vantiq’s real-time intelligent platform and integrates generative AI to provide precise wound care recommendations and AI-driven decision support at the point of care.

Simultaneously, the rising adoption of remote patient monitoring devices is transforming chronic disease management and post-hospitalization care. Wearable health devices, such as smartwatches and biosensors, enable real-time tracking of vital signs, allowing healthcare providers to monitor patients remotely and intervene when necessary.

This trend not only enhances patient engagement and proactive care but also helps reduce hospital readmissions, making telemedicine a vital component of modern healthcare systems.

Telemedicine Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Product (Hardware, Software, Others), Services (Tele-consulting/Tele-monitoring, Tele-education) |

|

By Modality |

Asynchronous, Synchronous, Others |

|

By Application |

Teleradiology, Telepathology, Teledermatology, Telepsychiatry, Telecardiology, Others |

|

By End User |

Healthcare Facilities, Homecare, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Product, Services): The product segment earned USD 51.62 billion in 2023, due to the increasing adoption of telemedicine hardware and software solutions.

- By Modality (Asynchronous, Synchronous, Others): The asynchronous segment held 38.88% share of the market in 2023, due to the growing demand for store-and-forward telehealth solutions that allow flexible consultations.

- By Application (Teleradiology, Telepathology, Teledermatology, and Telepsychiatry, Telecardiology, Others): The teleradiology segment is projected to reach USD 114.86 billion by 2031, owing to the rising need for remote diagnostic imaging and interpretation services.

- By End User (Healthcare Facilities, Homecare, Others): The healthcare facilities segment is projected to reach USD 150.18 billion by 2031, owing to increasing telemedicine integration in hospitals & clinics for enhanced patient care.

Telemedicine Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a substantial telemedicine market share of 34.46% in 2023, with a valuation of USD 32.41 billion. This is attributed to the well-established healthcare infrastructure, high adoption of advanced digital health technologies, and strong government support for telehealth initiatives in the region.

.webp) The presence of key market players, increasing investments in telemedicine solutions and growing demand for remote healthcare services further contribute to the region's leadership. Additionally, favorable reimbursement policies, rising geriatric population, and the widespread use of smartphones & high-speed internet continue to support market expansion.

The presence of key market players, increasing investments in telemedicine solutions and growing demand for remote healthcare services further contribute to the region's leadership. Additionally, favorable reimbursement policies, rising geriatric population, and the widespread use of smartphones & high-speed internet continue to support market expansion.

- In December 2024, the American Telemedicine Association (ATA) launched the ATA Center of Digital Excellence (CODE), a collaborative initiative aimed at accelerating the integration of digital care pathways within healthcare systems. CODE brings together leading health systems to drive best practices for patient-centered digital healthcare, equitable access, and improved clinical outcomes.

The telemedicine industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 19.83% over the forecast period. This rapid expansion is fueled by increasing healthcare digitization, government initiatives promoting telemedicine, and rising demand for healthcare in densely populated countries such as China and India.

The growing burden of chronic diseases, shortage of healthcare professionals in rural areas, and improved internet penetration are further accelerating the market growth.

Additionally, advancements in AI & mobile health solutions and the rising affordability of telemedicine services are making remote healthcare more accessible in the region. Continuous technological advancements and regulatory support in Asia Pacific are anticipated to drive the global market.

Regulatory Frameworks Also Play a Significant Role in Shaping the Market

- In the U.S., the Centers for Medicare & Medicaid Services (CMS) regulates telemedicine reimbursement under Medicare and Medicaid, ensuring accessibility and compliance. The Office for Civil Rights (OCR) under the U.S. Department of Health and Human Services (HHS) enforces the Health Insurance Portability and Accountability Act (HIPAA) to protect patient data privacy.

- In China, the primary regulatory authority overseeing telemedicine is the National Health Commission (NHC), which formulates and enforces national health policies & regulations related to healthcare services, including telemedicine practices.

- In Japan, the regulatory authority overseeing telemedicine is the Pharmaceuticals and Medical Devices Agency (PMDA), which operates under the Ministry of Health, Labour and Welfare (MHLW) and is responsible for reviewing and approving new telemedicine technologies, ensuring that they meet quality standards and patient safety requirements.

- In India, the regulatory authority overseeing telemedicine practices is the Medical Council of India (MCI), which released Telemedicine Practice Guidelines outlining the framework for doctors to provide healthcare using telemedicine services.

Competitive Landscape:

The telemedicine industry is characterized by a large number of participants, including established corporations and rising organizations. Competition in the market is driven by technological advancements, strategic partnerships, mergers and acquisitions, and continuous product innovations.

Companies are focusing on expanding their service offerings, enhancing user experience, and integrating AI, ML, and cloud-based solutions to improve telehealth efficiency.

Market participants are increasingly investing in R&D to enhance telemedicine capabilities, such as real-time data analytics, remote surgery, and personalized virtual consultations. Additionally, collaborations with healthcare institutions, insurance providers, and government agencies are expanding the accessibility of telemedicine.

Competition in the telemedicine market is expected to intensify as consumer demand for convenient and cost-effective healthcare continues to rise, leading to further advancements and market growth.

- In June 2024, VS Digital Health, in partnership with Hydreight Technologies and DSV Global, launched VSDHOne, a telemedicine platform enabling companies to quickly establish direct-to-consumer healthcare brands across the U.S.

List of Key Companies in Telemedicine Market:

- Teladoc Health, Inc.

- American Well Corporation.

- Doximity, Inc.

- GoodRx, Inc

- MDLIVE

- Healthee

- Hims & Hers Health, Inc.

- Accolade

- Talkspace

- Cisco Systems, Inc.

- Doctor On Demand by Included Health, Inc.

- Veradigm LLC

- Zocdoc, Inc.

- HealthTap, Inc.

- Sesame, Inc.

Recent Developments (Acquisitions/New Product Launch)

- In January 2025, Avel eCare announced the acquisition of Amwell Psychiatric Care (APC), a division of Amwell, to expand its telemedicine services in behavioral health. By integrating APC’s offerings, Avel aims to improve patient transitions during mental health crises and serve a broader customer base, including major U.S. health systems.

- In December 2024, Omda AS announced the acquisition of Dermicus AB, a telemedicine solutions company specializing in teledermatology and telewound care. The acquisition strengthens Omda’s position in medical imaging solutions. The Dermicus platform enables secure remote diagnosis of skin conditions and chronic wounds, significantly reducing dermatology waiting times in National Health Service regions.

- In June 2024, Fabric announced the acquisition of MeMD from Walmart Inc. The acquisition strengthens Fabric’s employer and payer solutions while advancing its behavioral health strategy.

- In April 2024, ZCG-backed Unimed announced the launch of a comprehensive telemedicine solution to enhance its technology-enabled maritime medical platform. The new service provides 24/7 global access to experienced maritime doctors and nurses, offering urgent care and mental health support to vessels globally.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)